Get the free Streamlined Tax Exemption and - publiccounsel

Show details

Streamlined Tax Exemption and

Reinstatement for Small Nonprofits

PLUS: Upcoming workshops on Small Claims

Court and Nonprofit Formation

Form 1023EZ:

Streamlined Tax

Exemption Process for

Small NonprofitsCommunity

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign streamlined tax exemption and

Edit your streamlined tax exemption and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your streamlined tax exemption and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing streamlined tax exemption and online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit streamlined tax exemption and. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out streamlined tax exemption and

How to fill out streamlined tax exemption and:

01

Gather the necessary documents: Before starting the process, ensure you have all the required documents such as your social security number, income statements, and any relevant tax forms or receipts.

02

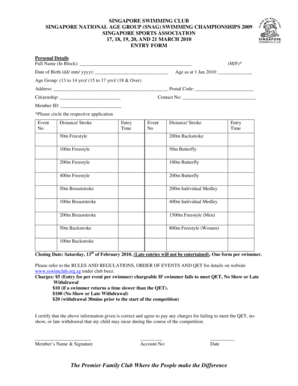

Go to the official IRS website: Visit the Internal Revenue Service (IRS) website to find the streamlined tax exemption form. Look for Form 1023-EZ, which is specifically designed for certain nonprofit organizations seeking tax exemption.

03

Understand eligibility criteria: Review the eligibility criteria for streamlined tax exemption to ensure your organization qualifies. Generally, organizations with a gross receipt of $50,000 or less and total assets of $250,000 or less are eligible to apply under this streamlined process.

04

Fill out the form: Provide accurate and up-to-date information on Form 1023-EZ. This includes details about your organization's purpose, activities, and finances. Double-check all the information before submitting the form.

05

Pay the necessary fee: The streamlined tax exemption process requires a filing fee, which is significantly lower compared to the regular Form 1023. Ensure you include the correct payment along with your application.

06

Submit the application: Once you have completed the form and gathered all the necessary documents, submit your application electronically through the IRS website. Make sure to keep a copy of the submitted application for your records.

Who needs streamlined tax exemption and:

01

Nonprofit organizations with limited resources: Streamlined tax exemption is specifically designed for smaller nonprofit organizations with fewer financial resources. If your organization meets the eligibility criteria mentioned earlier, you may consider utilizing this streamlined process.

02

New or recently formed nonprofits: If you have recently formed a nonprofit organization and meet the eligibility requirements, streamlined tax exemption can help expedite the process. It allows you to obtain tax-exempt status more quickly, enabling your organization to focus on its mission.

03

Organizations seeking retroactive tax exemption: In certain cases, organizations that missed the initial deadline for applying for tax exemption may be eligible for retroactive tax-exempt status through the streamlined process. However, specific conditions apply, so it's essential to consult the IRS guidelines and seek professional advice if needed.

Remember that tax laws and regulations can be complex, so consulting with a tax professional or attorney specializing in nonprofit law can provide valuable guidance throughout the process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify streamlined tax exemption and without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your streamlined tax exemption and into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute streamlined tax exemption and online?

pdfFiller has made it easy to fill out and sign streamlined tax exemption and. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit streamlined tax exemption and online?

The editing procedure is simple with pdfFiller. Open your streamlined tax exemption and in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

What is streamlined tax exemption and?

Streamlined tax exemption allows qualifying individuals or organizations to apply for exemption from certain taxes in a simplified and efficient manner.

Who is required to file streamlined tax exemption and?

Individuals or organizations who meet the eligibility requirements for tax exemption and wish to streamline the application process may file for streamlined tax exemption.

How to fill out streamlined tax exemption and?

To fill out streamlined tax exemption, individuals or organizations must provide all required information accurately and submit the necessary documentation as specified by the tax authorities.

What is the purpose of streamlined tax exemption and?

The purpose of streamlined tax exemption is to make the process of applying for tax exemption easier and faster for eligible individuals or organizations.

What information must be reported on streamlined tax exemption and?

The information required on streamlined tax exemption may include details about the individual or organization applying for exemption, proof of eligibility, and any supporting documents as required by the tax authorities.

Fill out your streamlined tax exemption and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Streamlined Tax Exemption And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.