Get the free Due Dates - Alabama Department of Revenue

Show details

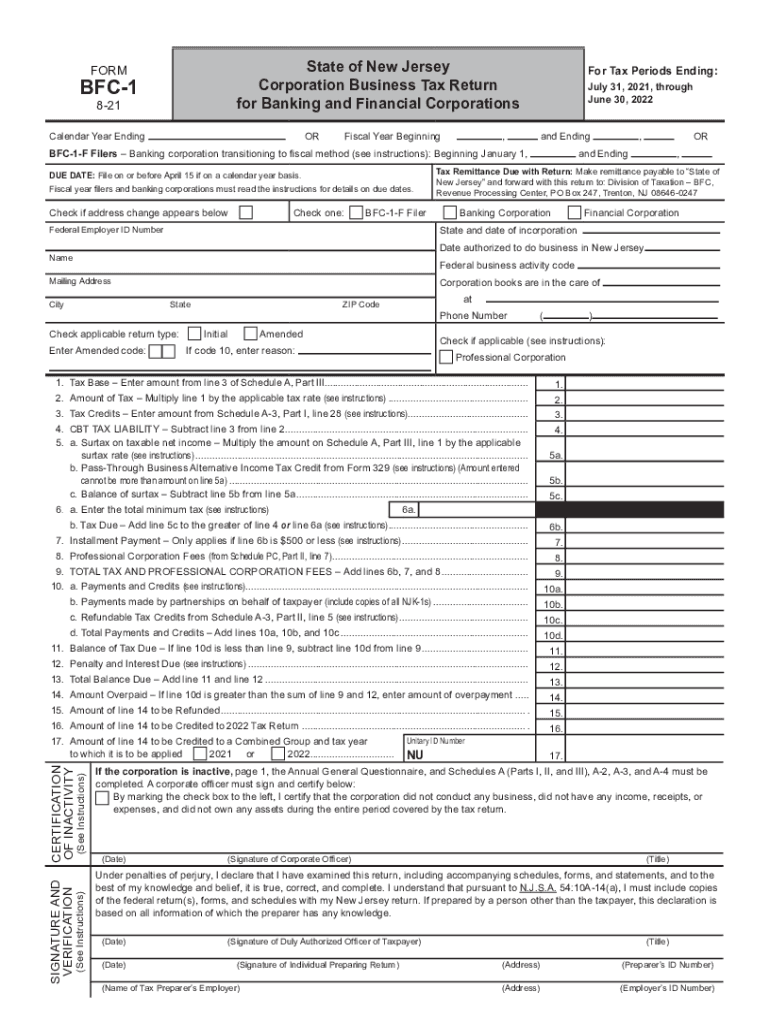

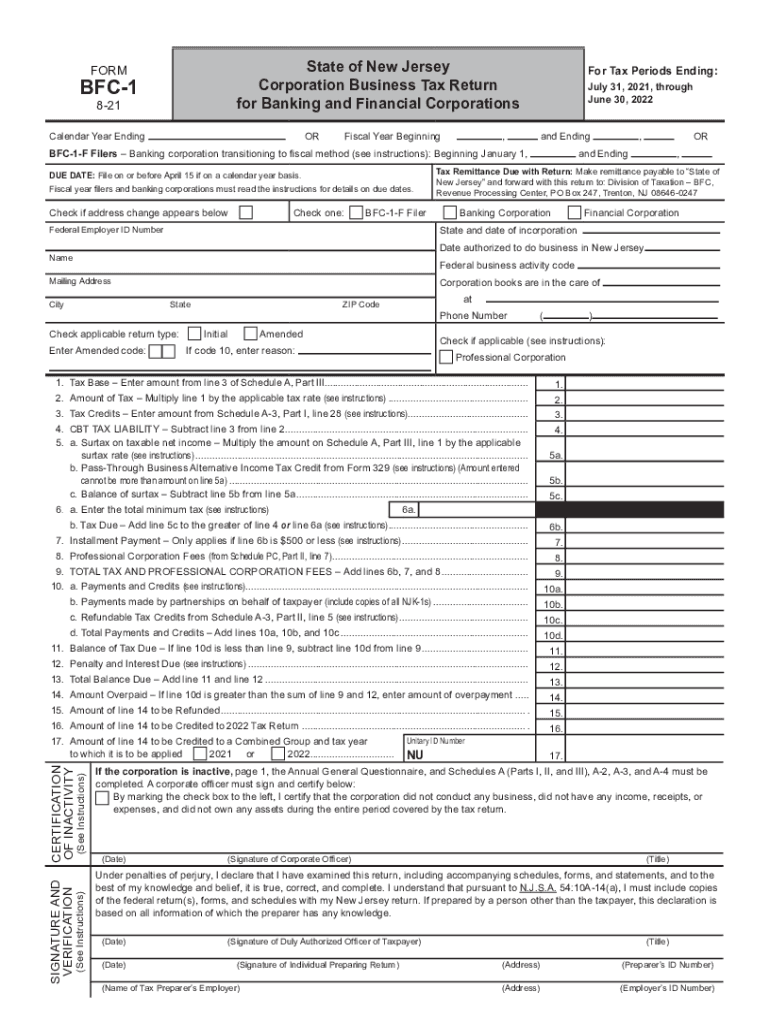

State of New Jersey Corporation Business Tax Return for Banking and Financial CorporationsFORMBFC1 821Calendar Year EndingORFiscal Year Beginning, For Tax Periods Ending: July 31, 2021, through June

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign due dates - alabama

Edit your due dates - alabama form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your due dates - alabama form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit due dates - alabama online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit due dates - alabama. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out due dates - alabama

How to fill out due dates - alabama

01

To fill out due dates in Alabama, follow these steps:

02

Gather all the necessary information and documents related to the due dates you need to fill out.

03

Determine the specific due dates you are responsible for filling out. This could include tax deadlines, payment due dates, filing deadlines, etc.

04

Make sure you have a clear understanding of the requirements and guidelines for each due date. This may involve consulting official documents, reviewing relevant laws or regulations, or seeking guidance from appropriate authorities.

05

Obtain the necessary forms or paperwork required to fill out the due dates. These forms can usually be obtained from government agencies, online platforms, or designated institutions.

06

Carefully and accurately fill out the due dates on the provided forms or paperwork. Ensure that you include all required information and adhere to any specific formatting or submission instructions.

07

Double-check your work to eliminate errors or inconsistencies. It is important to provide accurate and reliable information to avoid penalties or issues.

08

Submit the filled-out due dates forms or paperwork by the designated deadline. Make sure to follow any specified submission methods or channels.

09

Keep copies of all the submitted due dates forms or paperwork for your records. This will help you maintain a proper documentation trail and serve as proof of compliance if needed.

10

Monitor and stay updated on any changes or updates regarding the due dates. This will help you remain compliant with any new requirements or modifications that may arise.

11

Seek professional assistance if needed. If you encounter difficulties or have uncertainties in completing the due dates, it is advisable to consult with experts or professionals who specialize in this area.

Who needs due dates - alabama?

01

Various individuals, businesses, and organizations in Alabama may need to adhere to due dates. This includes:

02

- Taxpayers who are required to submit tax returns or make tax payments within specified deadlines.

03

- Business owners and entrepreneurs who need to comply with deadlines for business filings, such as registration renewals, tax filings, or licensing applications.

04

- Individuals or entities involved in legal matters, where specific due dates for court filings, document submissions, or responses are mandated.

05

- Students or educational institutions who must meet deadlines for applications, registrations, or submission of academic documentation.

06

- Government agencies or employees responsible for fulfilling obligations or providing reports within set due dates.

07

- Professionals such as accountants, financial advisors, or consultants who assist clients in managing and adhering to various due dates.

08

- Contractors, suppliers, or individuals involved in construction projects who must meet deadlines for project deliverables, payments, or permit applications.

09

- Any individual or entity responsible for fulfilling contractual obligations that include specific due dates.

10

These are just a few examples, and due dates can vary widely depending on the context and specific requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute due dates - alabama online?

Completing and signing due dates - alabama online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make changes in due dates - alabama?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your due dates - alabama to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out the due dates - alabama form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign due dates - alabama and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is due dates - alabama?

Alabama due dates refer to the specific deadlines for filing various types of taxes or reports with the state of Alabama.

Who is required to file due dates - alabama?

Businesses and individuals who have tax obligations in Alabama are required to file due dates.

How to fill out due dates - alabama?

Due dates in Alabama can be filled out either online through the Alabama Department of Revenue's website or by mailing in paper forms.

What is the purpose of due dates - alabama?

The purpose of due dates in Alabama is to ensure that individuals and businesses fulfill their tax obligations in a timely manner.

What information must be reported on due dates - alabama?

The specific information required to be reported on due dates in Alabama depends on the type of tax or report being filed.

Fill out your due dates - alabama online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Due Dates - Alabama is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.