Get the free IT-216 - tax ny

Show details

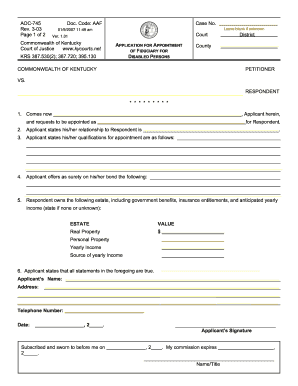

This form is used to claim the New York State child and dependent care credit for expenses incurred in 2004. It requires personal information, details about care providers, and information regarding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-216 - tax ny

Edit your it-216 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-216 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it-216 - tax ny online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit it-216 - tax ny. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-216 - tax ny

How to fill out IT-216

01

Obtain the IT-216 form from your state tax authority's website or office.

02

Provide personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the tax year for which you are filing the form.

04

Follow the instructions for each section, filling out relevant information such as income, deductions, and credits.

05

Complete any necessary calculations as outlined in the form.

06

Review your entries for accuracy and ensure all necessary documentation is attached.

07

Sign and date the form where required.

08

Submit the form by mail or electronically, depending on the submission guidelines.

Who needs IT-216?

01

Individuals or families who have made qualifying expenses for certain tax credits or deductions.

02

Taxpayers seeking to claim credits related to expenses for education or dependent care.

03

Those who have received specific communications or guidance from their state tax authority indicating the need to file the IT-216 form.

Fill

form

: Try Risk Free

People Also Ask about

Are child tax credit and child care tax credit the same?

Child and Dependent Care Tax Credit vs. The Child Tax Credit (CTC) is a separate credit that helps families reduce the overall cost of raising a child. Another difference is that the Child and Dependent Care Credit is nonrefundable, meaning that the credit can never exceed your tax liability.

How much can I deduct for child and dependent care expenses?

To claim the credit, you (and your spouse, if you're married) must have income earned from a job and you must have paid for the care so that you could work or look for work. You can claim from 20% to 35% of your care expenses up to a maximum of $3,000 for one person, or $6,000 for two or more people (tax year 2024).

What disqualifies you from a child tax credit?

Key Takeaways. There are seven qualifying tests to determine eligibility for the Child Tax Credit: age, relationship, support, dependent status, citizenship, length of residency and family income. If you aren't able to claim the Child Tax Credit for a dependent, they might be eligible for the Credit for Other Dependent

Is my income too high for a child tax credit?

You may be eligible for the full child tax credit amount if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers).

Is there a salary cap for child tax credit?

Taxpayers can claim a child tax credit (CTC) of up to $2,000 for each child under age 17 who is a US citizen or a qualifying noncitizen.* The credit is reduced by 5 percent of adjusted gross income over $200,000 for single parents ($400,000 for married couples).

Why don't I qualify for child care tax credit?

Why am I not getting the child tax credit You've entered something wrong. Your child may be too old (over 16). Your income is too high. Your income is too low. You are the custodial parent and the non-custodial parent is claiming the dependent this year.

Do I have to report child care income?

If you provide daycare services with the intention of making a profit, you're considered self-employed and responsible for reporting child care income. So, report self-employment income and expenses on Schedule C. If your net income minus expenses is $400 or more, you'll also need to: File Schedule SE.

What is the income limit for child care tax credit?

For this purpose, your income is your “adjusted gross income” shown on your Form 1040, 1040-SR, or 1040-NR. For 2021, the 50-percent amount begins to phase out if your adjusted gross income is more than $125,000, and completely phases out if your adjusted gross income is more than $438,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IT-216?

IT-216 is a tax form used in New York State for claiming a credit for taxes withheld on income earned by non-residents or part-year residents.

Who is required to file IT-216?

Individuals who earn income in New York State while being non-residents or part-year residents and wish to claim a credit for taxes withheld must file IT-216.

How to fill out IT-216?

To fill out IT-216, you need to provide your personal information, report your income earned in New York, and include details of the taxes withheld.

What is the purpose of IT-216?

The purpose of IT-216 is to allow non-residents or part-year residents to claim a credit for New York State taxes that were withheld from their income.

What information must be reported on IT-216?

You must report your name, social security number, income earned in New York, the amount of taxes withheld, and any other relevant details as specified on the form.

Fill out your it-216 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-216 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.