Get the free IT-209 - tax ny

Show details

Este formulario permite a los padres no custodiales reclamar el crédito de ingresos ganados del estado de Nueva York. Este crédito puede ser solicitado como parte de una declaración de impuestos

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-209 - tax ny

Edit your it-209 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-209 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it-209 - tax ny online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

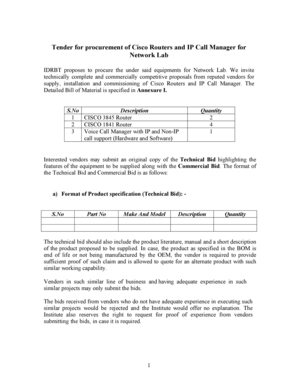

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit it-209 - tax ny. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-209 - tax ny

How to fill out IT-209

01

Gather all required documentation, such as income statements and tax forms.

02

Obtain the IT-209 form from the New York State Department of Taxation and Finance website.

03

Fill in your personal information, including your name, address, and Social Security number.

04

Report your income details as requested on the form, ensuring accuracy.

05

Complete any applicable sections based on your eligibility for credits or deductions.

06

Double-check your calculations and review the filled-out form for any errors.

07

Sign and date the form before submitting it, either electronically or by mail.

Who needs IT-209?

01

Individuals who have received a New York State tax credit refund.

02

New residents or those who have changed their residency status during the tax year.

03

Taxpayers who wish to claim a refundable credit available on their tax return.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies you for the EIC?

Key Takeaways. If you earned less than $66,819 (if Married Filing Jointly) or $59,899 (if filing as Single, Qualifying Surviving Spouse or Head of Household) in tax year 2024, you may qualify for the Earned Income Credit (EIC). These amounts increased from $63,398 and $56,838, respectively, for 2023.

What is the salary cap for the earned income credit?

EITC income limits for 2024 Number of childrenMaximum earned income tax creditMax income: Single or head of household filers 0 $632 $18,591 1 $4,213 $49,084 2 $6,960 $55,768 3 or more $7,830 $59,899 6 days ago

Who is eligible for the EIC credit?

You have to be 25 or older but under 65 to qualify for the EIC. You also have to have lived in the United States for more than half of the year and can't be a dependent of another person. In 2024, you can earn up to $18,591 ($25,511 if married and filing a joint) with no qualifying children.

What is a IT 209 form?

Requirements for New York EIC New York has two separate forms relating to EIC. Form IT-215 is for claiming Earned Income Credit, which is used in most situations. Form IT-209 is used for claiming Earned Income Credit when the taxpayer is the noncustodial parent.

Who is not eligible for EIC?

Your filing status cannot be “married filing separately.” • Generally, you must be a U.S. citizen or resident alien all year. You cannot be a qualifying child of another person. You cannot file Form 2555 or Form 2555-EZ (related to foreign earned income). Your income cannot exceed certain limitations.

Which of the following disqualifies an individual from the earned income credit?

Disqualifying income can prevent someone from receiving the earned income credit (EITC). Disqualifying income includes investment income, such as taxable and tax-exempt interest, dividends, pensions, and annuities, net income from rents and royalties, net capital gains, and net passive income.

Who is eligible for New York State earned income credit?

If you earned income in 2022 from investments, such as rental property or stocks, the amount must be $10,300 or less to qualify for the EITC. If you have no children, you must be age 19 or older. If you are: Single, you must earn less than $16,480.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IT-209?

IT-209 is a form used by certain taxpayers in New York to report and calculate the Empire State Child Credit.

Who is required to file IT-209?

Taxpayers who have qualifying children and wish to claim the Empire State Child Credit need to file IT-209.

How to fill out IT-209?

To fill out IT-209, taxpayers must provide personal information, details about qualifying children, and any relevant income information.

What is the purpose of IT-209?

The purpose of IT-209 is to allow eligible taxpayers to claim a credit for dependent children, reducing their state tax liability.

What information must be reported on IT-209?

IT-209 requires taxpayers to report their name, Social Security number, the names and Social Security numbers of qualifying children, and income details.

Fill out your it-209 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-209 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.