Get the free 19RW6021Q0005 Tax Consulting Services - solicitation

Show details

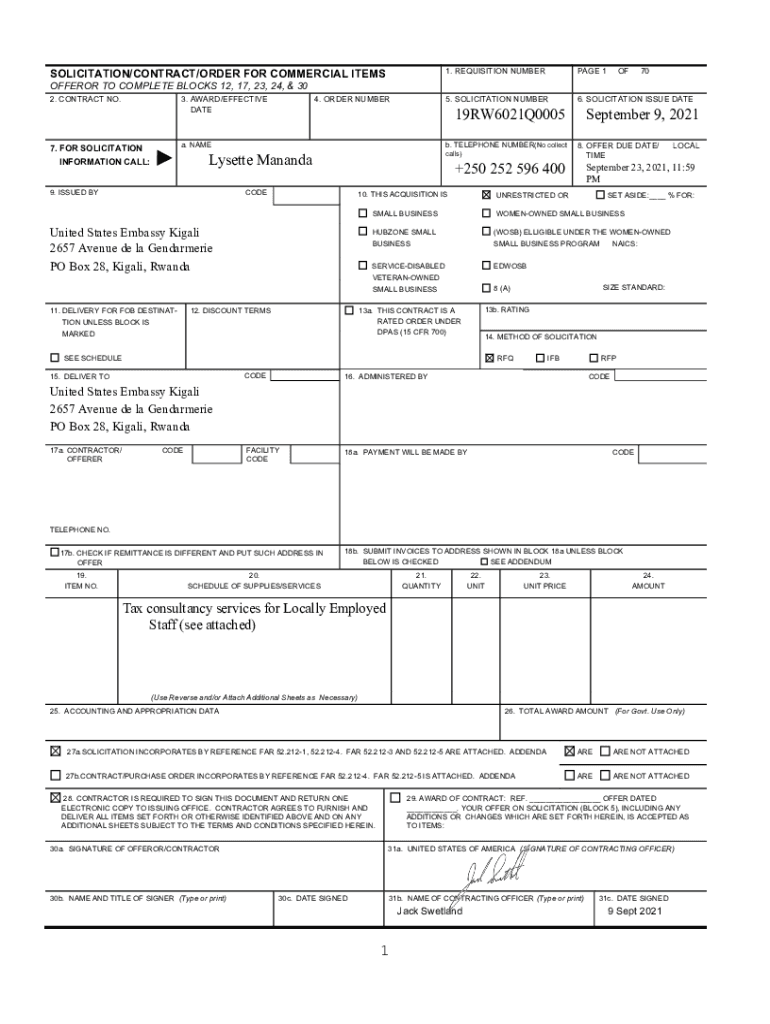

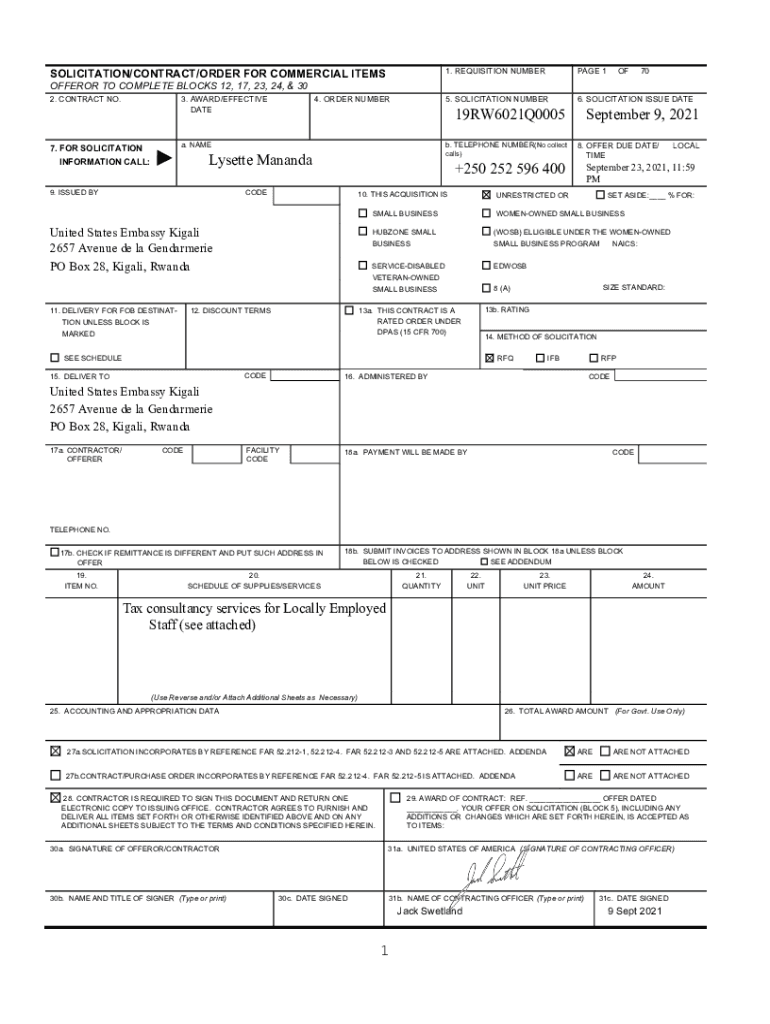

SOLICITATION×CONTRACT×ORDER FOR COMMERCIAL ITEMS1. REQUISITION NUMBERING 1OF705. SOLICITATION NUMBER6. SOLICITATION ISSUE DATEOFFEROR TO COMPLETE BLOCKS 12, 17, 23, 24, & 30 2. CONTRACT NO.3. AWARD×EFFECTIVE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 19rw6021q0005 tax consulting services

Edit your 19rw6021q0005 tax consulting services form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 19rw6021q0005 tax consulting services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 19rw6021q0005 tax consulting services online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 19rw6021q0005 tax consulting services. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 19rw6021q0005 tax consulting services

How to fill out 19rw6021q0005 tax consulting services

01

Gather all relevant financial documents such as income statements, balance sheets, and expense reports.

02

Determine the type of tax consulting service you require. This could include tax planning, tax compliance, or tax dispute resolution.

03

Understand the specific requirements and regulations associated with your industry or country.

04

Contact a tax consulting service provider or tax consultant who specializes in your specific needs.

05

Schedule a consultation with the tax consultant to discuss your situation and provide them with all the necessary information.

06

Work closely with the tax consultant to ensure accurate and complete filling out of the 19rw6021q0005 tax consulting services.

07

Review the completed form for accuracy and make any necessary corrections or updates.

08

Submit the filled-out form along with any required supporting documents to the appropriate tax authorities.

09

Keep a copy of the filled-out form and supporting documents for your records.

10

Follow up with the tax consultant or tax authority to address any further questions or concerns.

Who needs 19rw6021q0005 tax consulting services?

01

Individuals who want to ensure they are meeting their tax obligations and minimizing their tax liability.

02

Small businesses or startups that need assistance with tax planning, compliance, and other tax-related matters.

03

Medium to large-sized companies that require specialized tax consulting services for complex tax issues or multinational operations.

04

Organizations or individuals facing a tax dispute or audit and require expert assistance in resolving the issue.

05

Professionals such as lawyers or accountants who may benefit from specialized tax consulting services to better serve their clients.

06

Anyone seeking professional guidance and advice on tax matters to ensure compliance and avoid penalties or legal issues.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 19rw6021q0005 tax consulting services to be eSigned by others?

Once your 19rw6021q0005 tax consulting services is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit 19rw6021q0005 tax consulting services online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your 19rw6021q0005 tax consulting services to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How can I edit 19rw6021q0005 tax consulting services on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit 19rw6021q0005 tax consulting services.

What is 19rw6021q0005 tax consulting services?

19rw6021q0005 tax consulting services involve providing expert advice and guidance on tax-related matters to individuals or businesses.

Who is required to file 19rw6021q0005 tax consulting services?

Anyone who is seeking professional help or advice on tax matters may choose to file 19rw6021q0005 tax consulting services.

How to fill out 19rw6021q0005 tax consulting services?

To fill out 19rw6021q0005 tax consulting services, one should provide accurate information about their tax situation and seek help from a tax consultant if needed.

What is the purpose of 19rw6021q0005 tax consulting services?

The purpose of 19rw6021q0005 tax consulting services is to assist individuals or businesses in managing their tax liabilities more effectively.

What information must be reported on 19rw6021q0005 tax consulting services?

Information such as income, expenses, deductions, credits, and other relevant tax-related data must be reported on 19rw6021q0005 tax consulting services.

Fill out your 19rw6021q0005 tax consulting services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

19Rw6021Q0005 Tax Consulting Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.