IN Soybean Alliance Corn Checkoff Refund Application 2019-2025 free printable template

Show details

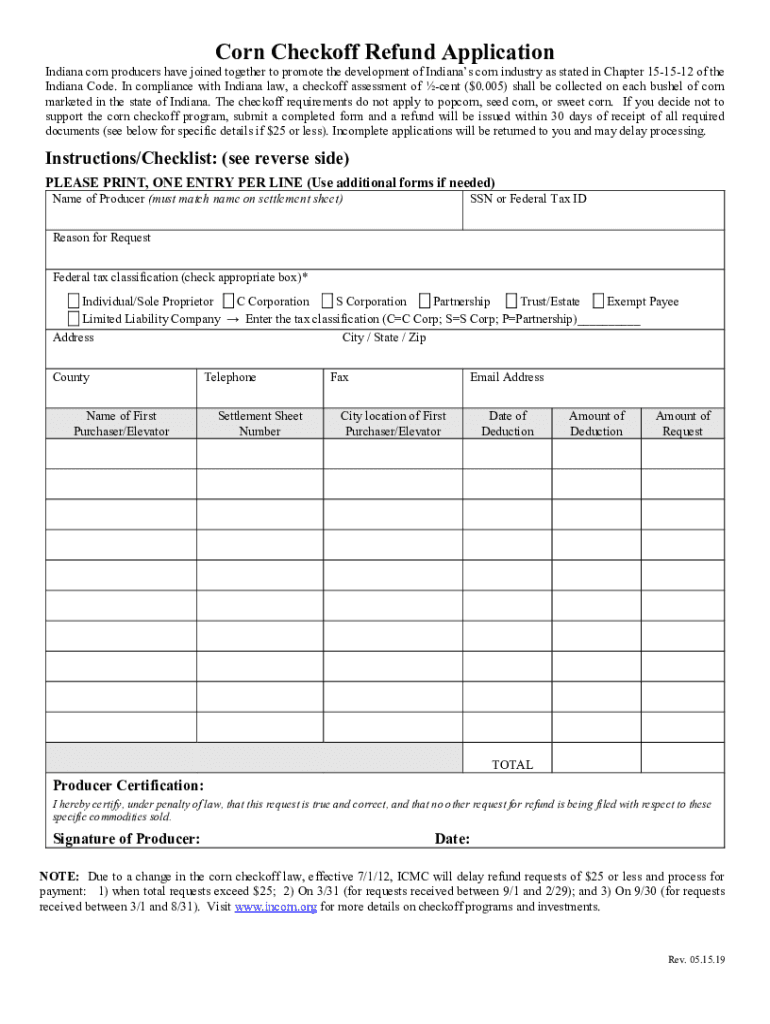

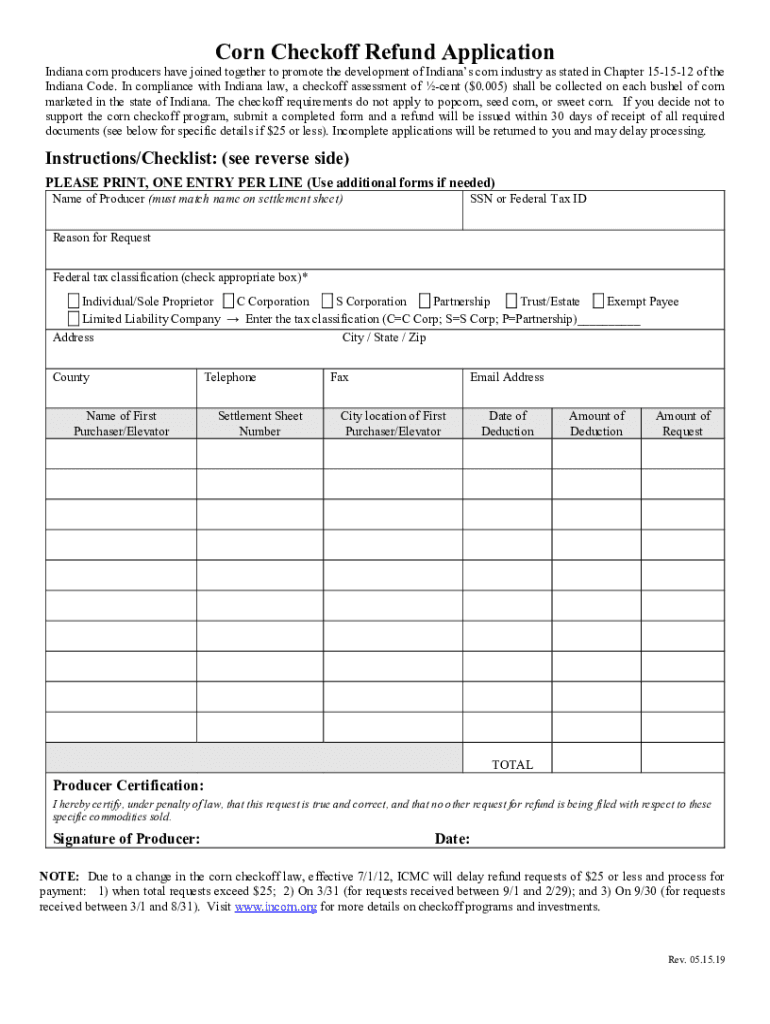

Corn Checkoff Refund Application Indiana corn producers have joined together to promote the development of Indiana scorn industry as stated in Chapter 151512 of the Indiana Code. In compliance with

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign corn checkoff refund form

Edit your indiana corn checkoff refund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corn checkoff refund application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit indiana corn checkoff refund application online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit checkoff refund application form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN Soybean Alliance Corn Checkoff Refund Application Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out checkoff refund form

How to fill out IN Soybean Alliance Corn Checkoff Refund Application

01

Obtain the IN Soybean Alliance Corn Checkoff Refund Application form from the official website or local agricultural office.

02

Fill in your personal information including name, address, and contact details at the top of the form.

03

Provide information about your farming operation, including the farm name, identification number, and the relevant corn production details.

04

Specify the refund amount you are claiming based on your corn checkoff contributions.

05

Attach necessary documentation, such as proof of payment for checkoff contributions if required.

06

Review the completed application for accuracy and completeness before submission.

07

Submit the application form through the provided method, either by mail or online, as specified in the instructions.

Who needs IN Soybean Alliance Corn Checkoff Refund Application?

01

Farmers who have paid corn checkoff fees in Indiana and are eligible for a refund may need to fill out the IN Soybean Alliance Corn Checkoff Refund Application.

Fill

corn application form

: Try Risk Free

People Also Ask about

What is Illinois corn checkoff?

Every farmer that sells a bushel of corn in Illinois pays 7/8 of a cent per bushel to the corn checkoff program. The corn checkoff uses that money to promote corn and help corn farmers. Money is spent on research, marketing, and education. The corn checkoff was created by Illinois law in 1982.

How much is the corn check off?

Since October 2012, the Nebraska corn checkoff rate has been 1/2 of a cent per bushel ($0.005/bu.)

How much is the corn checkoff?

Since October 2012, the Nebraska corn checkoff rate has been 1/2 of a cent per bushel ($0.005/bu.)

How much is the Iowa corn checkoff?

The new checkoff rate will cost a grower $1.80 per acre or 45 cents more per acre, based on a yield of 180 bushels per acre. Iowa corn promotion board recently unveiled five spending priorities: Farmer Image: Address misinformation, improve consumer understanding and engage in the food and fuel debate.

What is the checkoff rate for corn in Indiana?

Q: How does Indiana's corn checkoff program work? A: When a producer sells a load of corn in Indiana, the first purchaser automatically collects ½ cent per bushel for the checkoff program.

What is Illinois corn used for?

Illinois' agricultural commodities also provide the base for such products as animal feed, ink, paint, adhesives, clothing, soap, wax, cosmetics, medicines, furniture, paper and lumber. Each year, 274 million bushels of Illinois corn are used to produce more ethanol than any other state -- about 678 million gallons.

How do I get a refund on my corn checkoff?

If you decide not to support the corn checkoff program, submit a completed form and a refund will be issued within 30 days of receipt of all required documents (see below for specific details if $25 or less). Incomplete applications will be returned to you and may delay processing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send corn checkoff refund form to be eSigned by others?

corn checkoff refund form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for the corn checkoff refund form in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your corn checkoff refund form in seconds.

How do I complete corn checkoff refund form on an Android device?

Use the pdfFiller mobile app to complete your corn checkoff refund form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is IN Soybean Alliance Corn Checkoff Refund Application?

The IN Soybean Alliance Corn Checkoff Refund Application is a form that allows corn producers in Indiana to request a refund of checkoff fees contributed during the marketing of their corn.

Who is required to file IN Soybean Alliance Corn Checkoff Refund Application?

Corn producers in Indiana who have paid corn checkoff fees and wish to request a refund are required to file the IN Soybean Alliance Corn Checkoff Refund Application.

How to fill out IN Soybean Alliance Corn Checkoff Refund Application?

To fill out the application, producers need to provide their personal details, the amount of checkoff fees paid, and any necessary supporting documentation as specified in the application guidelines.

What is the purpose of IN Soybean Alliance Corn Checkoff Refund Application?

The purpose of the application is to facilitate the refund of checkoff fees to eligible corn producers who choose to opt-out of contributing to the marketing and promotion programs funded by those fees.

What information must be reported on IN Soybean Alliance Corn Checkoff Refund Application?

The application must include information such as the producer's name, address, the total amount of checkoff fees paid, farm identification, and any additional documentation that may be required by the Indiana Soybean Alliance.

Fill out your corn checkoff refund form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corn Checkoff Refund Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.