Get the free Roth IRA Distributions Code Changes 2003

Show details

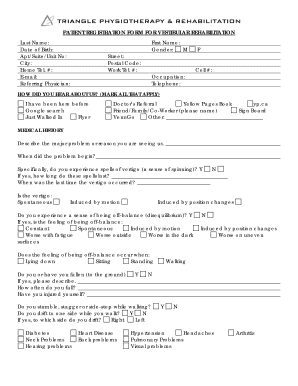

This document discusses the changes made by the IRS for reporting Roth IRA distributions through Form 1099-R for the year 2003. It outlines new reporting codes and the implications for financial institutions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign roth ira distributions code

Edit your roth ira distributions code form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your roth ira distributions code form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit roth ira distributions code online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit roth ira distributions code. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out roth ira distributions code

How to fill out Roth IRA Distributions Code Changes 2003

01

Gather all relevant tax documents, including your IRA account information.

02

Obtain the appropriate IRS form for Roth IRA distributions.

03

Identify the distribution code changes applicable to your situation from the IRS guidelines.

04

Carefully fill out the form, ensuring you accurately categorize each distribution with the correct code.

05

Review the completed form for any errors or omissions.

06

Submit the form to the IRS along with your tax return by the filing deadline.

Who needs Roth IRA Distributions Code Changes 2003?

01

Individuals with a Roth IRA who have taken distributions in 2003 or later.

02

Tax preparers or accountants assisting clients with Roth IRA distributions.

03

Anyone looking to understand the implications of changes in distribution codes for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Why did I get a 1099-R for a Roth distribution?

Form 1099-R reports distributions from an IRA. The only distribution you made from an IRA was the conversion from your traditional IRA to your Roth IRA. Therefore you receive a 1099-R for that conversion from the traditional IRA.

What is the income limit for a 2003 Roth IRA?

Your modified adjusted gross income must be less than: $160,000 Married Filing Jointly. $10,000 Married Filing Separately (and you lived with your spouse at any time during the year). $110,000 Single, Head of Household, or Married Filing Separately (and you did not live with your spouse during the year).

What is the required distribution for a Roth IRA?

You generally have to start taking withdrawals from your IRA, SIMPLE IRA, SEP IRA, or retirement plan account when you reach age 73. You're not required to take withdrawals from Roth IRAs, or from Designated Roth accounts in a 401(k) or 403(b) plan while the account owner is alive.

What is the code J for Roth IRA early distribution?

Code J indicates that there was an early distribution from a ROTH IRA. The amount may or may not be taxable depending on the amount distributed and the taxpayer's basis in ROTH IRA Contributions. This information must be entered for the software to calculate the taxable amount.

What is the 5 year rule for Roth IRAs?

However, to avoid a 10% early withdrawal penalty and owing income taxes on all or a portion of Roth IRA withdrawals, you need to follow what's called the five-year rule. Basically, any Roth IRA withdrawals must be made at least five years following the initial contribution to the account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Roth IRA Distributions Code Changes 2003?

The Roth IRA Distributions Code Changes in 2003 refer to modifications in the tax code that specify how distributions from Roth IRAs should be reported and taxed, including changes to eligibility for penalty-free withdrawals.

Who is required to file Roth IRA Distributions Code Changes 2003?

Individuals who take distributions from their Roth IRA accounts are required to report these distributions according to the changes established in 2003, particularly if they are subject to tax or penalties.

How to fill out Roth IRA Distributions Code Changes 2003?

To fill out Roth IRA Distributions Code Changes 2003, individuals must include the necessary information regarding their distribution on IRS Form 1099-R, ensuring to use the correct distribution codes as per IRS guidelines.

What is the purpose of Roth IRA Distributions Code Changes 2003?

The purpose of the Roth IRA Distributions Code Changes 2003 is to clarify and simplify the reporting of Roth IRA distributions, including defining the tax implications and conditions for penalty-free withdrawals.

What information must be reported on Roth IRA Distributions Code Changes 2003?

The information that must be reported includes the amount of the distribution, the date of distribution, the reason for the distribution, and any applicable tax implications or penalties, as indicated by the associated codes.

Fill out your roth ira distributions code online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Roth Ira Distributions Code is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.