Get the free Mahoning County Tax Map Control Form

Show details

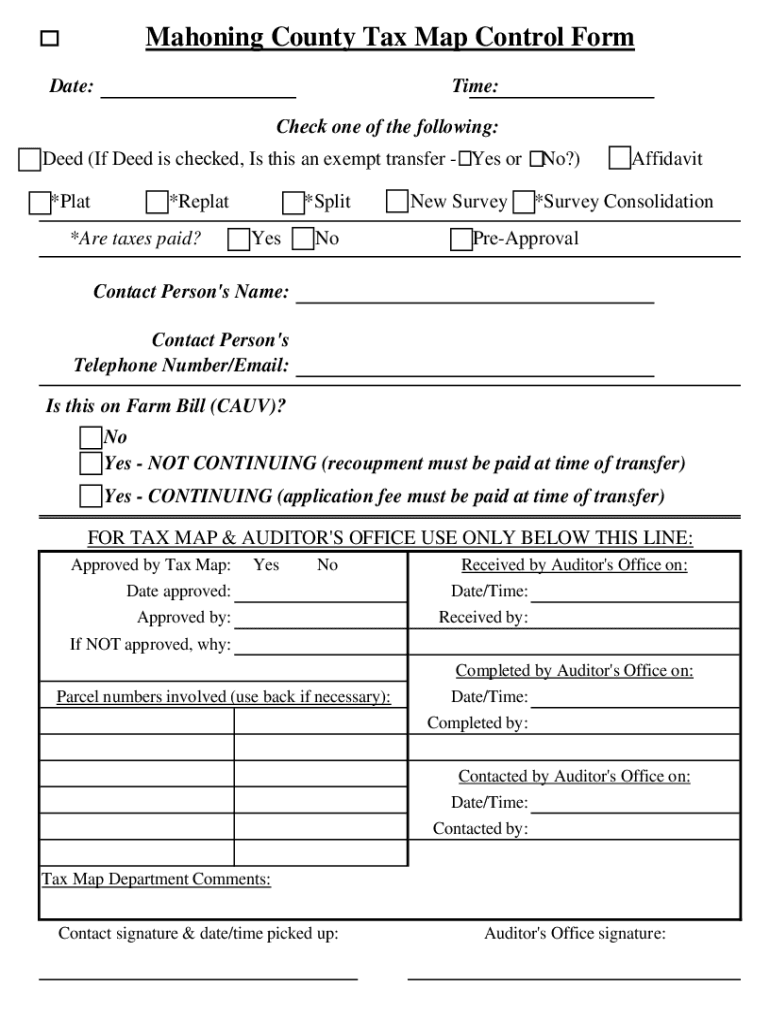

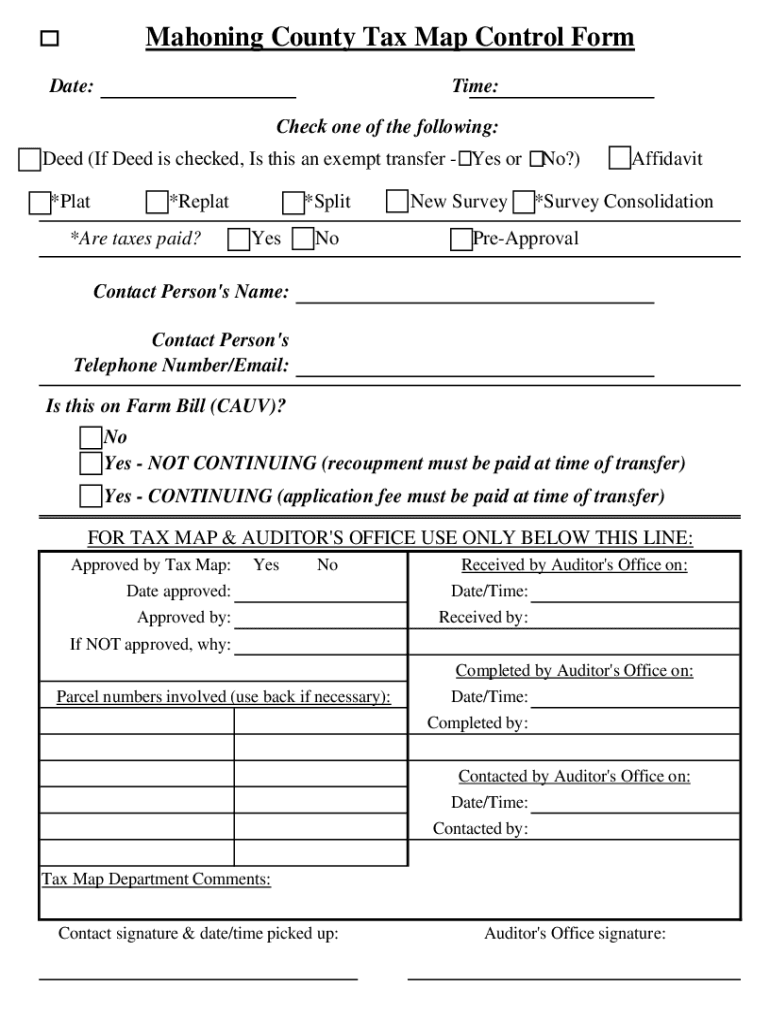

Mahoning County Tax Map Control Form Time:Date:Check one of the following: Deed (If Deed is checked, Is this an exempt transfer Yes or No?) *Plat×Repeat×Are taxes paid?*Split Tenoned SurveyAffidavit×Survey

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mahoning county tax map

Edit your mahoning county tax map form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mahoning county tax map form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mahoning county tax map online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mahoning county tax map. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mahoning county tax map

How to fill out mahoning county tax map

01

To fill out the Mahoning County tax map, follow these steps:

02

Start by obtaining a copy of the tax map form from the Mahoning County tax assessor's office.

03

Gather all the necessary information required for the tax map, such as property boundaries, parcel numbers, and any relevant legal descriptions.

04

Use accurate measurements and reference points to outline the property boundaries on the tax map.

05

Fill in the respective parcel numbers and other identification details for each property on the map.

06

Ensure that all the necessary information is correctly entered and legible on the tax map form.

07

Review the completed tax map for any errors or omissions before submitting it to the Mahoning County tax assessor's office.

08

Submit the filled-out tax map form along with any required supporting documents to the designated department or office.

09

Follow up with the tax assessor's office to ensure that the tax map is processed and updated accordingly.

Who needs mahoning county tax map?

01

Various individuals and entities may require access to the Mahoning County tax map, including:

02

- Property owners: To understand the boundaries and characteristics of their property for tax assessment purposes.

03

- Real estate professionals: To evaluate properties, determine ownership, and gather relevant data for transactions.

04

- Land surveyors: To reference and verify property boundaries and locations.

05

- Government agencies: For urban planning, zoning, and land development purposes.

06

- Legal professionals: To support legal cases related to property boundaries, inheritances, disputes, and more.

07

- Tax assessors and appraisers: To assess property values and determine tax rates.

08

- Researchers and analysts: To study trends, assess property markets, and conduct demographic analyses.

09

- General public: For informational purposes and to gain insights into property ownership and spatial data.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mahoning county tax map?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the mahoning county tax map. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for the mahoning county tax map in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your mahoning county tax map in seconds.

How do I edit mahoning county tax map on an Android device?

You can make any changes to PDF files, such as mahoning county tax map, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is mahoning county tax map?

The Mahoning County tax map is a visual representation of property boundaries, ownership, and assessment information within Mahoning County.

Who is required to file mahoning county tax map?

Property owners within Mahoning County are required to file the tax map.

How to fill out mahoning county tax map?

To fill out the Mahoning County tax map, property owners need to provide accurate information about their property boundaries, ownership details, and assessment values.

What is the purpose of mahoning county tax map?

The purpose of the Mahoning County tax map is to help in assessing property taxes accurately and to maintain updated records of property ownership within the county.

What information must be reported on mahoning county tax map?

Information such as property boundaries, ownership details, and assessment values must be reported on the Mahoning County tax map.

Fill out your mahoning county tax map online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mahoning County Tax Map is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.