MN W-4MN 2022 free printable template

Show details

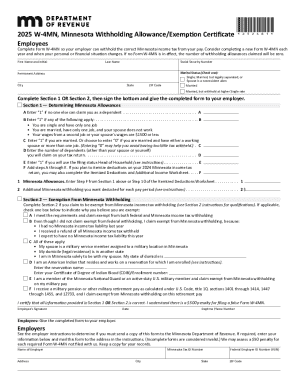

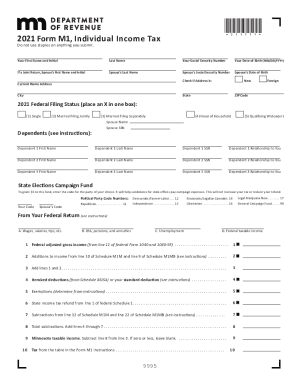

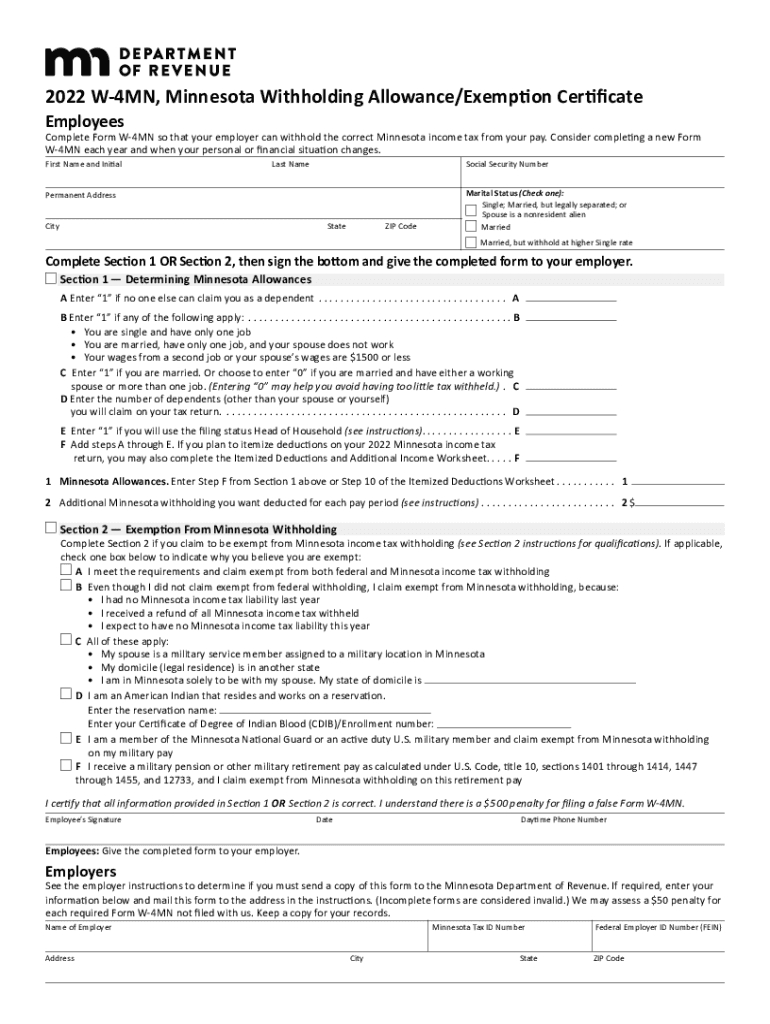

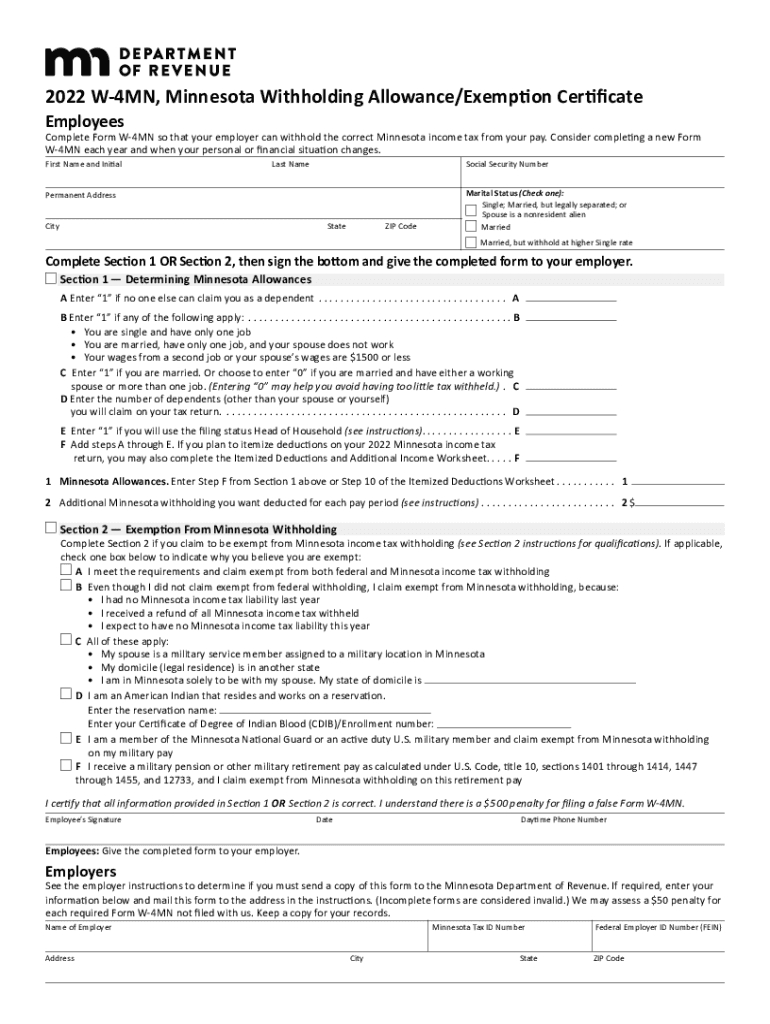

2022 W4MN, Minnesota Withholding Allowance/Exemption Certificate

EmployeesComplete Form W4MN so that your employer can withhold the correct Minnesota income tax from your pay. Consider completing

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN W-4MN

Edit your MN W-4MN form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN W-4MN form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MN W-4MN online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MN W-4MN. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN W-4MN Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN W-4MN

How to fill out MN W-4MN

01

Obtain a copy of the MN W-4MN form from the Minnesota Department of Revenue website or your employer.

02

Fill in your name and Social Security number at the top of the form.

03

Indicate your filing status (e.g., single, married, head of household) in the appropriate box.

04

Complete the section regarding allowances by referring to the instructions on the form to determine how many allowances you can claim.

05

If you want additional amounts withheld, specify that amount in the designated section.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed MN W-4MN form to your employer.

Who needs MN W-4MN?

01

Employees working in Minnesota who want to adjust their state tax withholding.

02

Individuals who have a change in their personal situation, such as getting married, having a child, or changing jobs.

03

People who want to claim more or fewer allowances to better match their tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

Can I pick up tax forms at my local post office?

A: You can pick up some of the most requested forms, instructions and publications at many IRS offices and at post offices and libraries that carry forms. 17. I don't have access to the Internet. Can I send an order for tax products through the mail?

Are 2022 mn tax forms available?

Minnesota State Income Taxes for Tax Year 2022 (January 1 - Dec. 31, 2022) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return (or you can learn how to only prepare and file a MN state return). Attention: The Minnesota tax filing and tax payment deadline is April 18, 2023.

What are the proposed Minnesota tax changes for 2022?

2022 Tax Law Changes No major tax bill was enacted during the regular 2022 legislative session, but two law changes during the session addressed: Bonus pay for eligible COVID-19 frontline workers (go to the Frontline Worker Pay website) Unemployment taxes for businesses (go to the Unemployment Insurance website)

Where can I pick up MN tax forms?

You can get Minnesota tax forms either by mail or in person. To get forms by mail, call 651-296-3781 or 1-800-652-9094 to have forms mailed to you. You can pick up forms at our St. Paul office. Our office hours are 9:30 a.m. to 4:30 p.m., Monday - Friday. Minnesota Department of Revenue. 600 N. Robert St. St.

What is a 2022 form?

2022. Withholding Certificate for Nonperiodic Payments and. Eligible Rollover Distributions. Department of the Treasury Internal Revenue Service ▶ Give Form W-4R to the payer of your retirement payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MN W-4MN in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your MN W-4MN, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my MN W-4MN in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your MN W-4MN directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out MN W-4MN using my mobile device?

Use the pdfFiller mobile app to complete and sign MN W-4MN on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is MN W-4MN?

MN W-4MN is a Minnesota state tax form that allows employees to inform their employers of their withholding preferences for state income tax.

Who is required to file MN W-4MN?

Employees in Minnesota who want to establish or change their state income tax withholding amounts are required to file the MN W-4MN form.

How to fill out MN W-4MN?

To fill out MN W-4MN, employees should provide personal information such as name, address, Social Security number, and tax filing status. They should also indicate their withholding allowances and any additional withholding amounts if desired.

What is the purpose of MN W-4MN?

The purpose of MN W-4MN is to determine the correct amount of state income tax to withhold from an employee's paycheck, ensuring appropriate tax payments throughout the year.

What information must be reported on MN W-4MN?

The information that must be reported on MN W-4MN includes the employee's name, address, Social Security number, filing status, number of withholding allowances, and any additional withholding amount requested.

Fill out your MN W-4MN online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN W-4mn is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.