Get the free Medicare Supplement Insurance Plans - smsteam.net

Show details

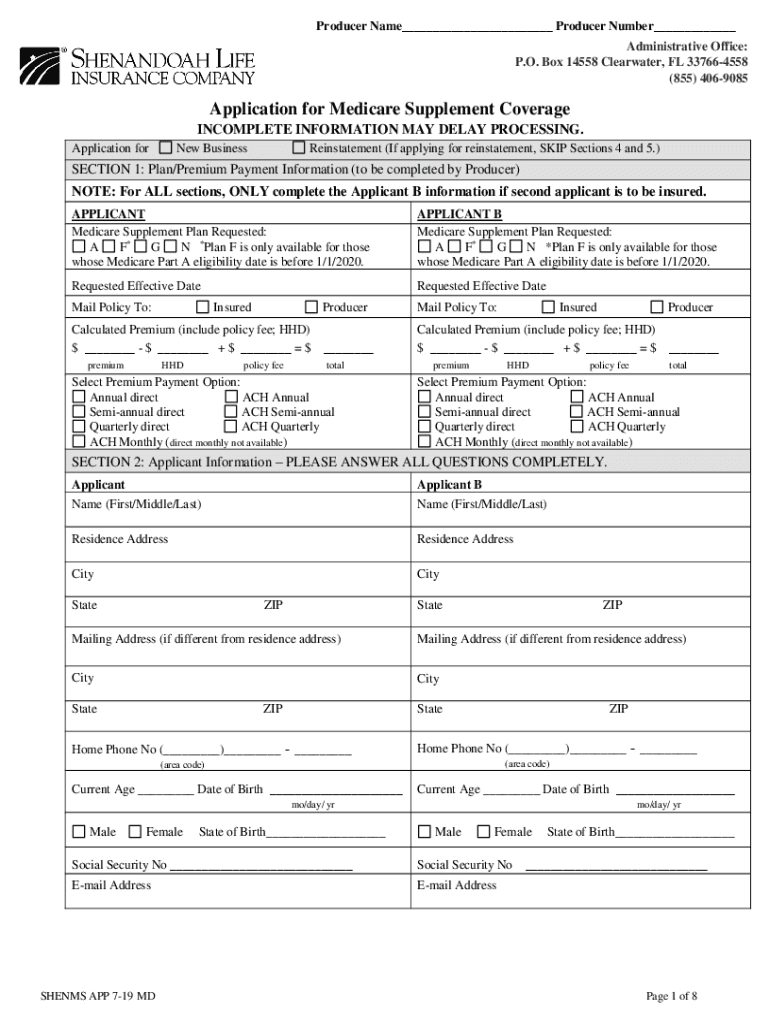

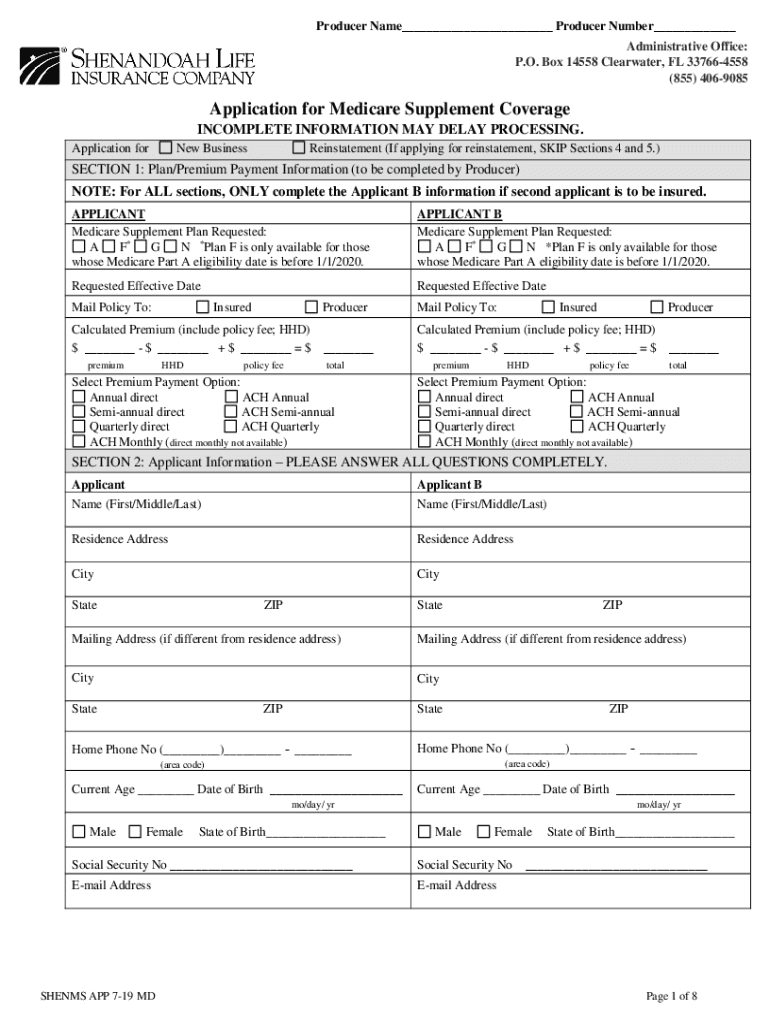

New Business Pack for Medicare Supplement InsuranceMarylandMD 0719081919Shenandoah Life Insurance Company Improve processing time by verifying the following:Determine if the Applicant is Newly Eligible

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign medicare supplement insurance plans

Edit your medicare supplement insurance plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your medicare supplement insurance plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit medicare supplement insurance plans online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit medicare supplement insurance plans. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out medicare supplement insurance plans

How to fill out medicare supplement insurance plans

01

To fill out Medicare supplement insurance plans, follow these steps:

02

Gather all necessary personal information, including your full name, address, date of birth, and Social Security number.

03

Determine which Medicare supplement insurance plan you want to enroll in. Research and compare the different plans available and choose the one that best fits your healthcare needs.

04

Contact an insurance company or private insurance agent that offers Medicare supplement insurance plans. You can find a list of approved providers on the official Medicare website.

05

Schedule an appointment to meet with the insurance agent or complete the application online. Be prepared to answer questions about your health history and previous medical conditions.

06

Provide all the required information and documentation as requested by the insurance company. This may include previous insurance information, Medicare card, and proof of age or disability.

07

Review the supplementary benefits and coverage provided by the chosen plan. Make sure you understand the costs, deductibles, and limitations associated with the plan.

08

Carefully review the application before submitting it. Double-check all the information provided to ensure accuracy and completeness.

09

Submit the completed application to the insurance company either online, by mail, or in person, as directed by the company.

10

Wait for the insurance company to review and process your application. You may receive a notification via mail or email regarding the status of your application.

11

Once approved, you will receive your Medicare supplement insurance plan documents and membership card. Keep these documents in a safe place for future reference.

12

Pay any required premiums or fees associated with the plan. Make sure to follow the payment instructions provided by the insurance company.

13

Familiarize yourself with the coverage details and benefits provided by your Medicare supplement insurance plan. Understand how to use it and what services are covered.

14

If you have any questions or need assistance, contact the insurance company, Medicare, or a Medicare counselor for further guidance.

Who needs medicare supplement insurance plans?

01

Medicare supplement insurance plans are suitable for individuals who have Medicare Parts A and B and want additional coverage for out-of-pocket expenses. It is especially beneficial for those who:

02

Frequently require medical services, such as doctor visits, hospital stays, or diagnostic tests.

03

Want coverage for services and expenses not covered by Original Medicare, such as deductibles, copayments, or coinsurance.

04

Travel frequently and need coverage for medical emergencies outside their home state or country.

05

Have a chronic medical condition or require ongoing treatment that may result in high medical expenses.

06

Prefer predictable and fixed monthly costs for healthcare expenses rather than potential unexpected expenses with Original Medicare.

07

Anticipate the need for long-term care services or prescription medications not covered by Medicare.

08

It is important to assess your own healthcare needs and financial situation to determine if a Medicare supplement insurance plan is necessary and suitable for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send medicare supplement insurance plans for eSignature?

Once your medicare supplement insurance plans is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my medicare supplement insurance plans in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your medicare supplement insurance plans and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out the medicare supplement insurance plans form on my smartphone?

Use the pdfFiller mobile app to fill out and sign medicare supplement insurance plans on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is medicare supplement insurance plans?

Medicare supplement insurance plans, also known as Medigap, are health insurance policies sold by private insurance companies to help cover costs not covered by Original Medicare.

Who is required to file medicare supplement insurance plans?

Individuals who are enrolled in Original Medicare and want additional coverage for out-of-pocket costs may choose to enroll in a medicare supplement insurance plan.

How to fill out medicare supplement insurance plans?

To fill out a medicare supplement insurance plan, individuals can contact private insurance companies that offer Medigap policies and choose the plan that best fits their needs.

What is the purpose of medicare supplement insurance plans?

The purpose of medicare supplement insurance plans is to help cover costs such as copayments, coinsurance, and deductibles that are not covered by Original Medicare.

What information must be reported on medicare supplement insurance plans?

Medicare supplement insurance plans must include information about the coverage offered, premiums, benefits, and any limitations or exclusions.

Fill out your medicare supplement insurance plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Medicare Supplement Insurance Plans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.