Get the free Revised Labor Student Payroll Record sk 8-11.doc - olin msu

Show details

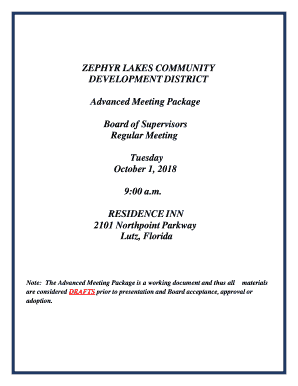

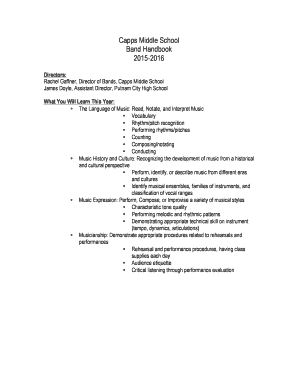

MSU Student Health Services Bi Weekly Payroll Record Student Labor Employee Name Number Department Pay Begin Date Pay End Date **All time must be recorded to the nearest tenth of an hour** Please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revised labor student payroll

Edit your revised labor student payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revised labor student payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit revised labor student payroll online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit revised labor student payroll. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revised labor student payroll

01

Gather necessary information: To fill out the revised labor student payroll, you will need to gather all the relevant information required for the form. This includes the student's personal details, such as their name, student ID, and contact information. Additionally, you may need the student's supervisor's name, department, and contact details.

02

Enter student details: Start by accurately entering the student's personal information into the designated fields on the payroll form. Double-check the information to ensure it is correct and up-to-date.

03

Specify employment details: Provide the necessary details regarding the student's employment. This may include the start and end dates of their employment period, the number of hours they are expected to work per week, their wage or hourly rate, and any applicable overtime rates.

04

Indicate pay period: Select the appropriate pay period for which the payroll is being filled out. This could be weekly, bi-weekly, or monthly, depending on your organization's pay schedule.

05

Calculate and enter hours worked: Determine the number of hours the student has worked during the designated pay period and enter this information into the payroll form. Ensure that you accurately record both regular and overtime hours, if applicable.

06

Calculate earnings: Multiply the hours worked by the student's wage or hourly rate to calculate their total earnings for the pay period. Depending on the specific payroll form, you may need to enter different types of earnings separately, such as regular pay, overtime pay, or any additional bonuses or incentives.

07

Deductions and taxes: Deduct any mandatory withholdings from the student's earnings, such as income tax, Social Security, and Medicare contributions. Also, deduct any voluntary deductions, such as health insurance premiums or retirement plan contributions, if applicable.

08

Review and double-check: Review the completed payroll form to ensure all the information and calculations are accurate. Double-check all the entries for any errors or omissions before submitting the form.

Who needs revised labor student payroll?

01

Organizations employing student workers: Any organization or institution that hires student workers, such as universities, colleges, businesses, or non-profit organizations, may require a revised labor student payroll. This form helps in keeping track of student employees' working hours, compensation, and important payroll information.

02

Department supervisors: The supervisors or managers of the student workers are often responsible for filling out the revised labor student payroll. They need this document to accurately record and document the working hours and earnings of their student employees for payroll purposes.

03

Payroll or HR department: The payroll or human resources (HR) department of an organization needs the revised labor student payroll to process payroll accurately and ensure that the student workers are paid correctly and promptly. They utilize the information provided in the form to calculate payroll taxes, benefits, and other deductions accurately.

In summary, filling out the revised labor student payroll involves gathering essential information, entering student and employment details, calculating hours worked and earnings, deducting taxes and deductions, and verifying the form for accuracy. This payroll form is needed by organizations employing student workers, department supervisors, and the payroll or HR department.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is revised labor student payroll?

Revised labor student payroll refers to the updated payroll information for student employees.

Who is required to file revised labor student payroll?

Employers who have student employees are required to file revised labor student payroll.

How to fill out revised labor student payroll?

Revised labor student payroll can be filled out by entering updated payroll information for student employees.

What is the purpose of revised labor student payroll?

The purpose of revised labor student payroll is to ensure accurate and up-to-date payroll information for student employees.

What information must be reported on revised labor student payroll?

Revised labor student payroll must include updated hours worked, wages earned, and any deductions for student employees.

How do I modify my revised labor student payroll in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your revised labor student payroll as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I get revised labor student payroll?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific revised labor student payroll and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make changes in revised labor student payroll?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your revised labor student payroll to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Fill out your revised labor student payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revised Labor Student Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.