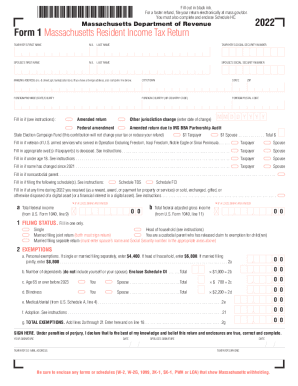

MA DoR Form 1-ES 2022 free printable template

Get, Create, Make and Sign ma revenue estimated income tax form

Editing estimated income tax online

Uncompromising security for your PDF editing and eSignature needs

MA DoR Form 1-ES Form Versions

How to fill out massachusetts 1 es form

How to fill out MA DoR Form 1-ES

Who needs MA DoR Form 1-ES?

Video instructions and help with filling out and completing massachusetts estimated income tax

Instructions and Help about ma 1 es form

Hi I'm April and here is your tax fact ever hear the term quarterly is bandied about by your accountant and maybe some of your friends and wonder what it is do you think there's something that you have to do that you're not aware of well Quarterlies are just estimated tax payments that you make throughout the year yes every quarter hence the name that help you prepay the tax if you're going to owe too much at the end of the year the IRS generally wants you to pay the tax ahead of time, or they might penalize you for federal tax returns if you owe the government more than a thousand dollars you may be charged interest in penalties to prevent that from happening you just need to pay at least 100 percent and in some cases 105 percent of your prior year's tax bill then it won't matter how much you owe at the end of the year you could a hundred thousand dollars and not pay any interest in penalties but check with your tax preparer who can help you calculate what's called your safe harbor amount, so there are several situations where you could end up having to pay Quarterly's one of those quarterly events would be being self-employed selling a stock a sizable gain having high interest or dividend income and sometimes if you have multiple jobs you may not have enough tax withholding, but before you decide to pay Quarterly's yourself you may already have an opportunity to have the federal taxes withheld from your employer so a simple way to do that would just be to refile your w-4 at work and have more taxes withheld again a tax preparer can help you calculate how much more you should withhold if you don't have an employer who can take care of the additional and holding tax then you want to pay the quarterly estimates using the IRS Form 1040a BS which you can download from the IRS website is pretty easy finally you'll want to know when to make the quarterly payments they're due by April 15th June 15th September 15th of the same year with the fourth quarter payment due January 15th of the following year so there you have it an explanation of what Quarterlies are and how to pay them and when they're due I'm April and this has been your friendly tax fact brought to you from Ambrosia counting

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the MA DoR Form 1-ES electronically in Chrome?

How can I fill out MA DoR Form 1-ES on an iOS device?

How do I complete MA DoR Form 1-ES on an Android device?

What is MA DoR Form 1-ES?

Who is required to file MA DoR Form 1-ES?

How to fill out MA DoR Form 1-ES?

What is the purpose of MA DoR Form 1-ES?

What information must be reported on MA DoR Form 1-ES?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.