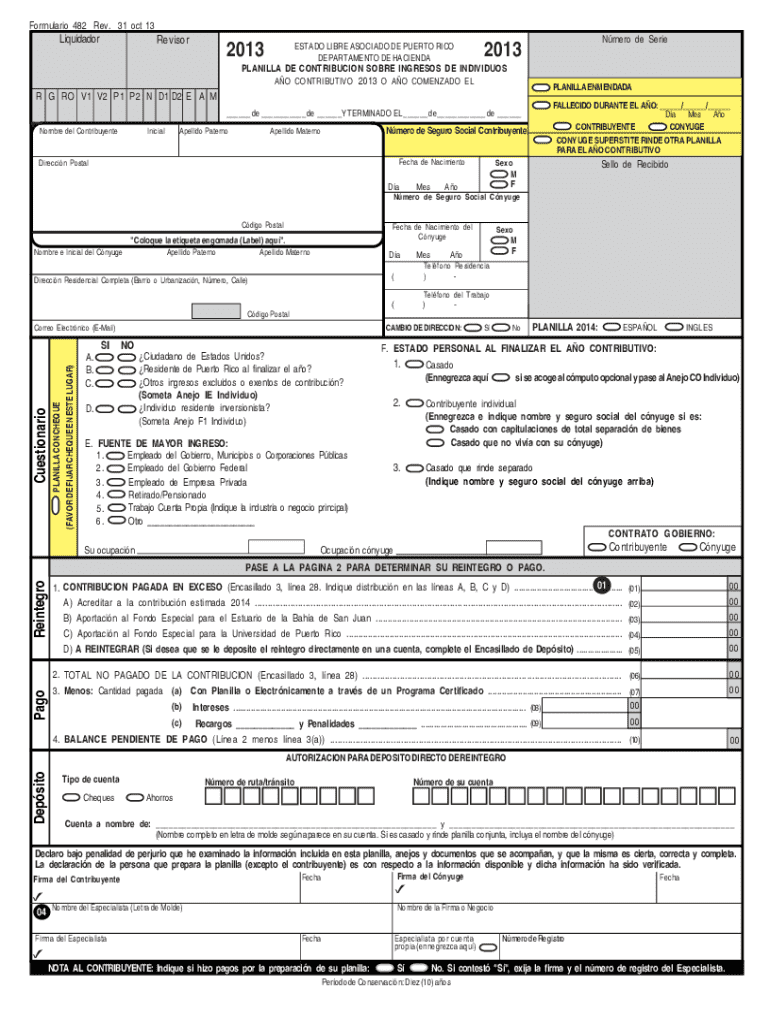

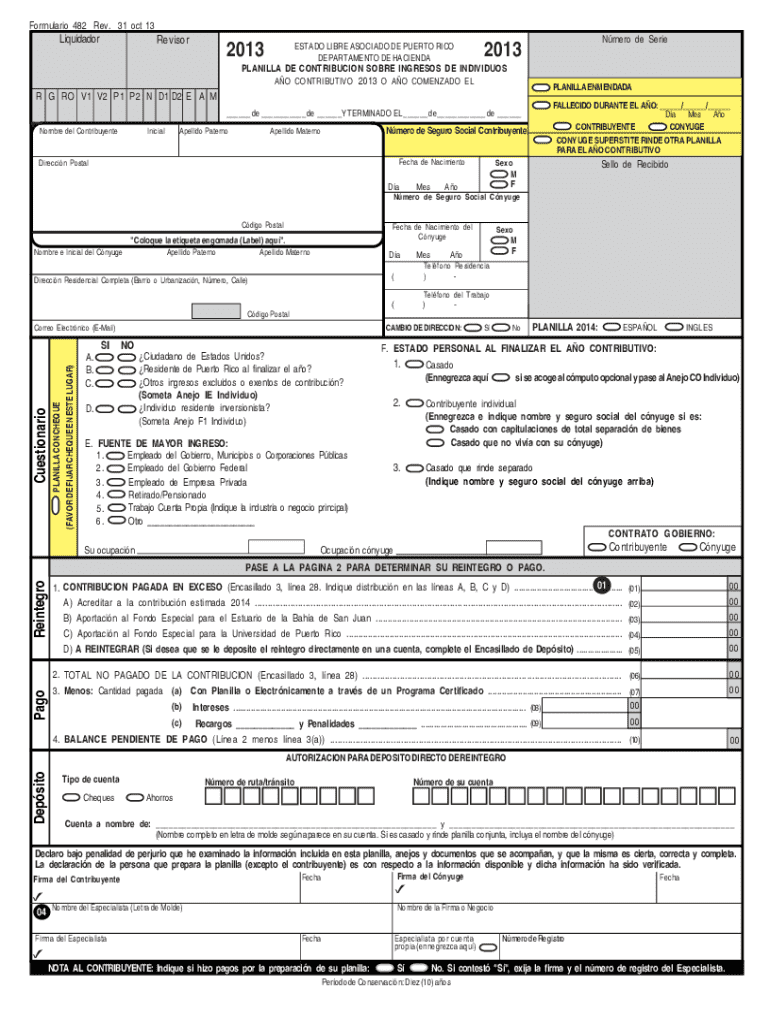

PR Formulario 482 2013 free printable template

Get, Create, Make and Sign puerto rico 482 form

Editing pr formulario 482 planilla online

Uncompromising security for your PDF editing and eSignature needs

PR Formulario 482 Form Versions

How to fill out spanish planilla contribucion sobre ingresos form

How to fill out PR Formulario 482

Who needs PR Formulario 482?

Video instructions and help with filling out and completing planilla contribucion sobre ingresos

Instructions and Help about formulario 482 planilla individuos

One of those individuals is Peter Schiff the CEO of euro pacific capital who moved his asset management firm from Newport Beach California to San Juan I spoke with him and asked him why he decided to relocate well I did it for the obvious benefit of being able to keep most of what I own I mean that's not the case here in the United States the government takes most of what I earn but if I earn money in Puerto Rico thanks to the fact that they finally reduced taxes there I get to keep a lot more of what I earn it's too bad that Puerto Rico didn't do this year's ago decades ago they wouldn't be in the economic trouble they are today they would be a shining bright spot in the United States they would have the highest per-capita income instead of the lowest well I can see the appeal on the tax front another part of the appeal is that it's apparently the closest thing to renouncing US citizenship without actually doing so because residents of Puerto Rico are considered US citizens even though they're subject to different tax laws was this a major factor in your decision sure I mean you know for a lot of Americans if you have some wealth if you have some businesses for the privilege of renouncing your citizenship the US and government imposes a very heavy tax and if you don't want to pay that exit tax if you just want to leave the country no matter where you live if you're earning money the US government wants its cut that is uniquely American most countries if their citizens travel abroad they let them go freely you know they're allowed to earn money, and they're not subject to the tax in fact now they want to even revoke your passport if you owe more than 50000 in taxes, and you know turn this country into a giant debtors' prison, but Puerto Rico is kind of a get-out-of-jail-free card it's one of the few places or maybe the only place in the world where Americans can go and be free we can be treated like citizens of any other country if you go to Puerto Rico and earn money the US government doesn't tax you only the Puerto Rican government taxes you, and now they're not taxing you there either so Americans can experience the freedom that until recently was only available to people we're lucky enough to be born in other countries but given that it has 70 billion dollars plus an outstanding debt and one of its biggest problems is its shrinking tax base you have thousands of Puerto Ricans leaving, and they've already left mostly to Florida or Texas in search of a better economy doesn't Porto Rico need the tax revenue from wealthy people like yourself how does bringing in wealthy mainland Americans but giving them these tax breaks help Puerto Rico's economy well first they get a four percent tax, so four percent of something is better than 50 percent of nothing so the wealthy businesses that are coming to Puerto Rico are paying taxes but more than that they're hiring people they're investing their developing they are helping the economy right that's one...

People Also Ask about puerto rico formulario 482 larga

¿El IRS proporciona formularios en español?

¿Cuál es el formulario para declarar impuestos en Estados Unidos?

¿Cómo es el formulario W-2?

¿Cuál es la alternativa al Formulario 1040 para mayores de 65 años?

¿Dónde puedo encontrar más información sobre los formularios del IRS?

¿Qué anexos se utilizan con el Formulario 1040-SR?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send planilla contribucion sobre ingresos for eSignature?

How do I make edits in planilla contribucion sobre ingresos without leaving Chrome?

How do I edit planilla contribucion sobre ingresos straight from my smartphone?

What is PR Formulario 482?

Who is required to file PR Formulario 482?

How to fill out PR Formulario 482?

What is the purpose of PR Formulario 482?

What information must be reported on PR Formulario 482?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.