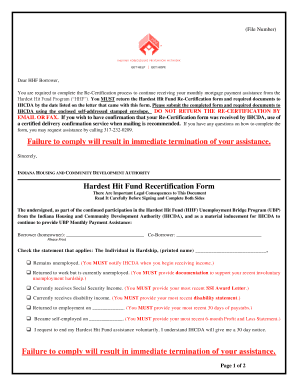

Get the free Under s ction 501(c ), 527 , or 4947( a)(1) of the Internal Reve n ue Code

Show details

Short Form OMB No. 15451150 Return of Organization Exempt From Income Tax Under s action 501(c), 527, or 4947(a)(1) of the Internal Eve n UE Coder except black In q benefit trust or private foundation)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign under s ction 501c

Edit your under s ction 501c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your under s ction 501c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit under s ction 501c online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit under s ction 501c. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out under s ction 501c

How to fill out under section 501c:

01

Determine eligibility: Before filling out under section 501c, it is important to make sure that you meet the eligibility criteria. Section 501c is specifically for organizations that are organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, or educational purposes, or to foster national or international amateur sports competition.

02

Choose the appropriate form: To apply for tax-exempt status under section 501c, you need to complete and file Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. This form will require detailed information about your organization, its activities, and finances.

03

Gather necessary information: Before you start filling out Form 1023, you will need to gather relevant information about your organization. This includes details about its mission and activities, its financial records, governance structure, and any compensation arrangements for officers or directors.

04

Complete Form 1023: Begin by carefully reading the instructions provided with Form 1023. Follow the instructions step by step and provide accurate and complete information. The form will ask for information about your organization's name, address, purpose, financials, and other required details. It is crucial to be thorough and accurate in your responses.

05

Attach supporting documents: Along with Form 1023, you will need to include various supporting documents to support your application. These may include copies of your organization's articles of incorporation, bylaws, financial statements, and any other relevant documents. Make sure to include all required attachments as specified in the instructions.

06

Review and submit: Once you have completed Form 1023 and gathered all the necessary documents, review your application thoroughly for any errors or omissions. It may be a good idea to seek professional assistance or legal advice at this stage to ensure accuracy. When you are confident that everything is complete and accurate, submit the form and supporting documents to the Internal Revenue Service (IRS) as instructed in the form's instructions.

Who needs under section 501c:

01

Nonprofit Organizations: Nonprofit organizations, such as charities, religious organizations, educational institutions, and scientific research organizations, often seek tax-exempt status under section 501c to avoid paying federal income tax on the donations and income they receive. This helps organizations allocate more resources towards their mission and activities.

02

Donors and Supporters: Individuals or entities interested in supporting charitable causes or contributing to nonprofit organizations also benefit from organizations being recognized as tax-exempt under section 501c. Donations made to these organizations may be tax-deductible for the donors, encouraging philanthropy and supporting the growth of these organizations.

03

Communities and Society: Section 501c organizations play a vital role in benefiting communities and society at large. They provide various services, support social causes, conduct research, educate, and foster positive change. By seeking tax-exempt status under section 501c, these organizations can maximize their impact on the communities they serve, as they can focus more of their resources on their mission rather than on taxes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is under section 501c?

Section 501c refers to a specific tax-exempt status for nonprofit organizations under the Internal Revenue Code.

Who is required to file under section 501c?

Nonprofit organizations seeking tax-exempt status must file under section 501c.

How to fill out under section 501c?

To apply for tax-exempt status under section 501c, organizations must submit Form 1023 or Form 1023-EZ to the IRS.

What is the purpose of under section 501c?

The purpose of section 501c is to grant tax-exempt status to qualifying nonprofit organizations so they can receive donations and operate without paying federal income tax.

What information must be reported on under section 501c?

Organizations filing under section 501c must report their mission statement, activities, finances, and governance structure to the IRS.

How can I send under s ction 501c to be eSigned by others?

When your under s ction 501c is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute under s ction 501c online?

With pdfFiller, you may easily complete and sign under s ction 501c online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for the under s ction 501c in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your under s ction 501c in seconds.

Fill out your under s ction 501c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Under S Ction 501c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.