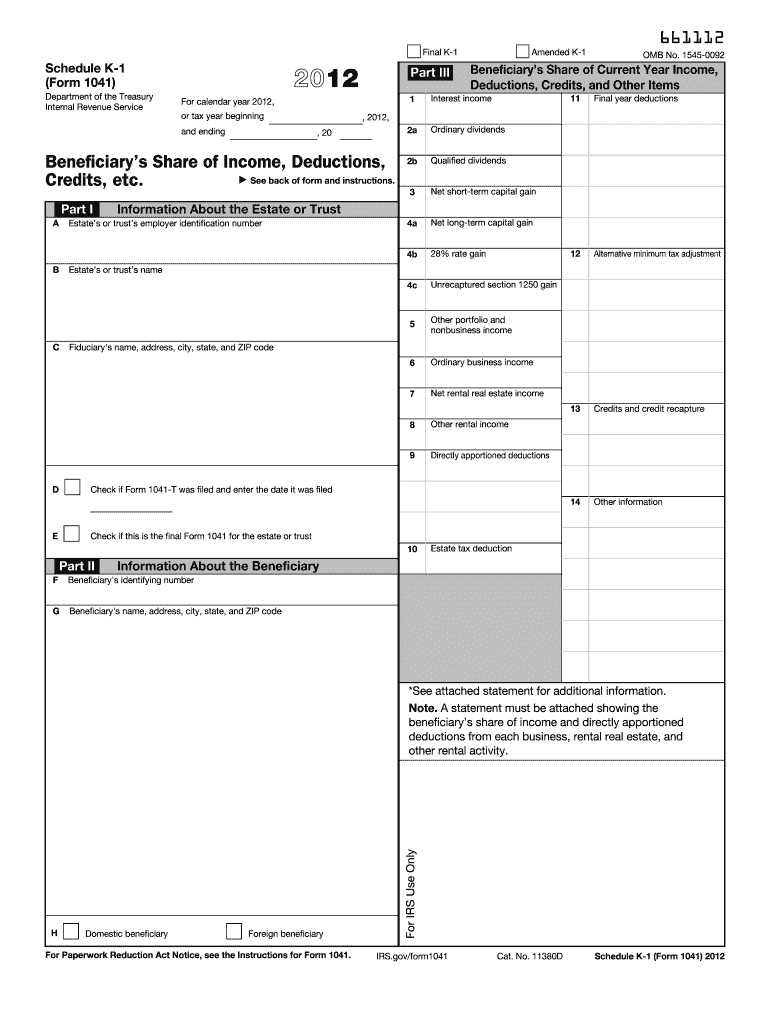

IRS 1041 - Schedule K-1 2012 free printable template

Instructions and Help about IRS 1041 - Schedule K-1

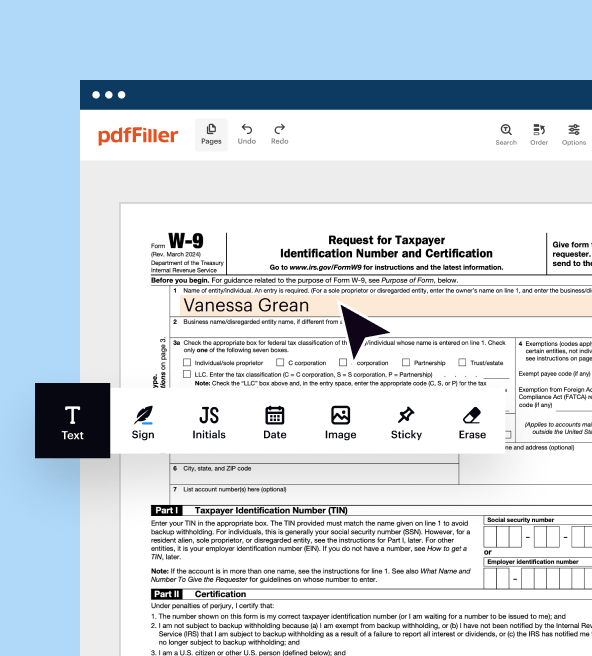

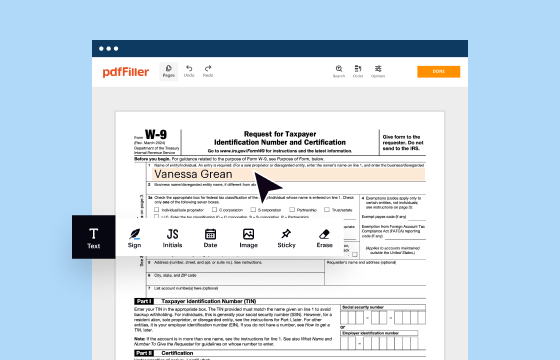

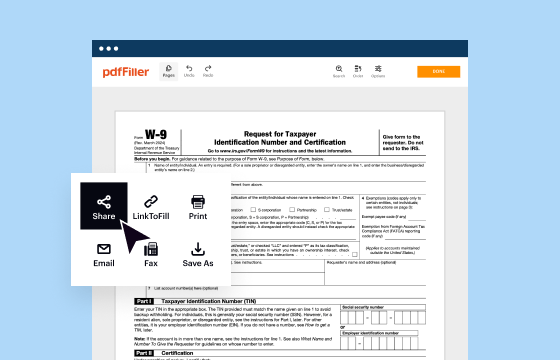

How to edit IRS 1041 - Schedule K-1

How to fill out IRS 1041 - Schedule K-1

About IRS 1041 - Schedule K-1 2012 previous version

What is IRS 1041 - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

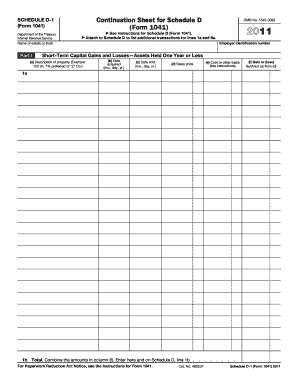

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

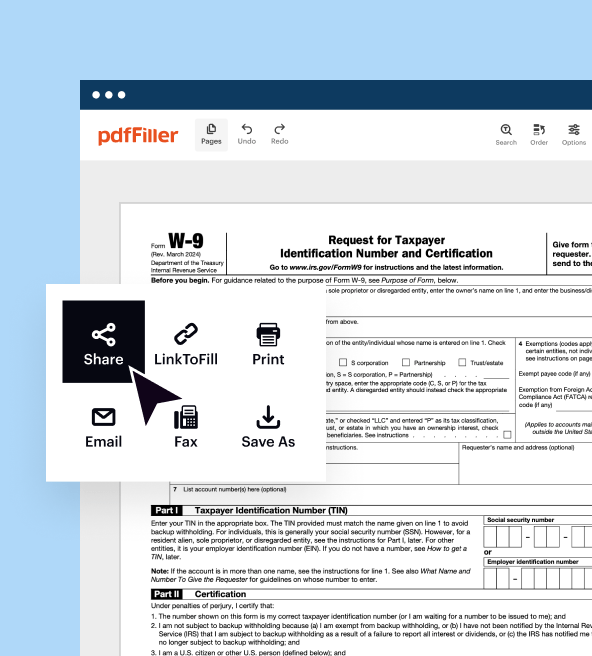

Where do I send the form?

FAQ about IRS 1041 - Schedule K-1

What should I do if I realize I made a mistake after submitting my schedule k irs forms?

If you discover an error on your schedule k irs forms after submission, you can correct it by filing an amended return. This involves completing the appropriate forms that allow you to specify the changes made, ensuring you include all required supporting information. Keep in mind to double-check the updated figures to avoid further discrepancies.

How can I verify the status of my submitted schedule k irs forms?

To check the status of your submitted schedule k irs forms, you can use the IRS online tools provided for tracking submissions. This service allows you to confirm if your forms were received and processed successfully. Make sure to have your submission details handy for accurate tracking.

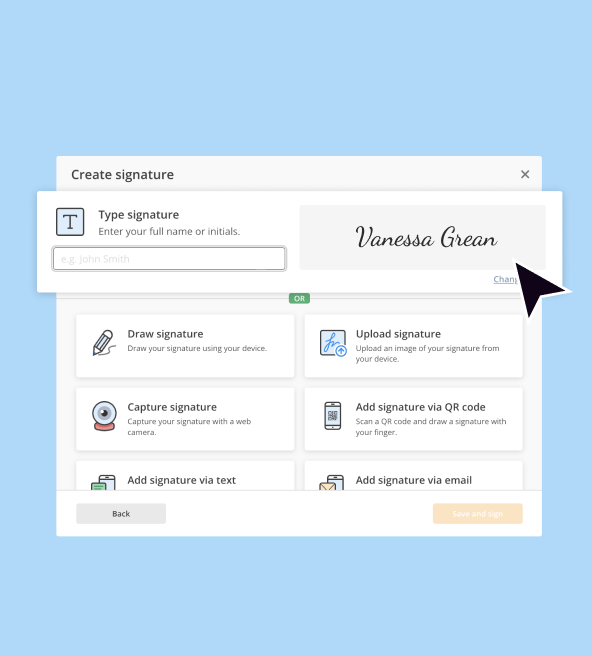

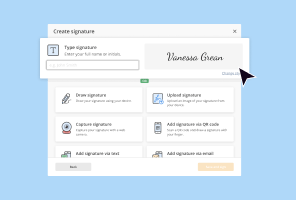

What should I consider regarding e-signatures when submitting schedule k irs forms?

When using e-signatures for your schedule k irs forms, ensure that the platform you’re using is compliant with IRS regulations. E-signatures can be an acceptable option, but it's crucial to maintain proper records of consent and authenticate all signatories involved in the filing.

Are there any common mistakes to avoid when filing schedule k irs forms?

Common mistakes when filing schedule k irs forms include misreporting income, failing to include all necessary information, and incorrect calculations. To avoid these errors, carefully review all entries and consider using accounting software that can help minimize discrepancies.

What should I do if I receive an IRS notice regarding my schedule k irs forms?

Upon receiving an IRS notice related to your schedule k irs forms, read the document carefully to understand the issue. Gather the necessary documentation to respond and ensure you meet any deadlines specified in the notice. It may also be beneficial to consult a tax professional for guidance on resolving the matter.

See what our users say