Get the free C.S. v. Department of the Treasury, Internal Revenue Service - dol

Show details

This document outlines the decision by the Employees’ Compensation Appeals Board regarding C.S.'s appeal for continuation of pay following an employment injury. The appeal was denied due to the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cs v department of

Edit your cs v department of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cs v department of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cs v department of online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cs v department of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cs v department of

How to fill out C.S. v. Department of the Treasury, Internal Revenue Service

01

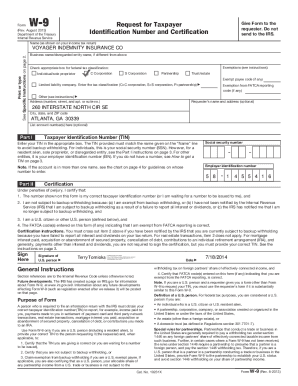

Obtain a copy of the C.S. v. Department of the Treasury, Internal Revenue Service form.

02

Read the instructions carefully to understand the requirements and sections of the form.

03

Fill in your personal information in the designated fields, including your name, address, and contact information.

04

Provide relevant details about the case or issue you are addressing in the form.

05

Sign and date the form where indicated, verifying the information is accurate.

06

Submit the completed form to the appropriate address as specified in the instructions.

Who needs C.S. v. Department of the Treasury, Internal Revenue Service?

01

Individuals or entities seeking to challenge a determination made by the IRS.

02

Taxpayers needing to contest IRS penalties or tax assessments.

03

Lawyers representing clients in disputes with the IRS.

Fill

form

: Try Risk Free

People Also Ask about

How do I speak to a live person at IRS?

For individual tax returns, call 1-800-829-1040, 7 AM - 7 PM Monday through Friday local time. The wait time to speak with a representative may be long. This option works best for less complex questions.

Will the IRS accept a check made out to Internal Revenue Service?

From the IRS link below: Checks and money orders should be made payable to "United States Treasury." Checks and money orders made payable to "Internal Revenue Service" , "U.S. Treasury" , or "Department of The Treasury" can still be accepted and processed.

Is the IRS and Internal Revenue Service the same?

Internal Revenue Service (IRS) The Internal Revenue Service (IRS) administers and enforces U.S. federal tax laws.

What does it mean to have your taxes audited by the Internal Revenue Service (IRS)?

An IRS audit is a review/examination of an organization's or individual's books, accounts and financial records to ensure information reported on their tax return is reported correctly ing to the tax laws and to verify the reported amount of tax is correct. Why am I being selected for an audit? How am I notified?

Is the Department of revenue the IRS?

The IRS is a bureau of the Department of the Treasury and one of the world's most efficient tax administrators. In fiscal year 2023, the IRS collected almost $4.7 trillion in revenue and processed more than 271.5 million tax returns.

What is the difference between the IRS and the Department of Treasury?

The Internal Revenue Service (IRS) is the largest of Treasury's bureaus. It is responsible for determining, assessing, and collecting internal revenue in the United States.

Why am I getting mail from the Department of Treasury Internal Revenue Service?

Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes any steps the taxpayer needs to take. A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return.

What is the difference between the IRS and the Internal Revenue Service?

The IRS emerged to collect money to fund the Civil War. The Internal Revenue Service is part of the U.S. Department of the Treasury and enforces and administers federal tax laws and operates within a budget approved by Congress. Internal Revenue Service. “IRS History Timeline.”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is C.S. v. Department of the Treasury, Internal Revenue Service?

C.S. v. Department of the Treasury, Internal Revenue Service is a legal case involving the Department of the Treasury and the Internal Revenue Service (IRS), typically regarding tax-related issues or disputes.

Who is required to file C.S. v. Department of the Treasury, Internal Revenue Service?

Individuals or entities that are involved in a tax dispute or are party to the legal proceedings in the case of C.S. v. Department of the Treasury, Internal Revenue Service are required to file.

How to fill out C.S. v. Department of the Treasury, Internal Revenue Service?

To fill out C.S. v. Department of the Treasury, Internal Revenue Service, parties should provide all relevant information regarding their tax situation, claims, and any supporting documentation as required by the court's guidelines.

What is the purpose of C.S. v. Department of the Treasury, Internal Revenue Service?

The purpose of C.S. v. Department of the Treasury, Internal Revenue Service is to resolve specific legal disputes related to tax liabilities, enforcement of tax laws, or interpretations of tax regulations.

What information must be reported on C.S. v. Department of the Treasury, Internal Revenue Service?

Information that must be reported includes taxpayer identification details, applicable tax years, amounts in dispute, evidence supporting claims, and any communications with the IRS relevant to the case.

Fill out your cs v department of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cs V Department Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.