Get the free International Fuel Tax Agreement (IFTA)Frequently AskedMotor Vehicle Fuel Tax - DOR ...

Show details

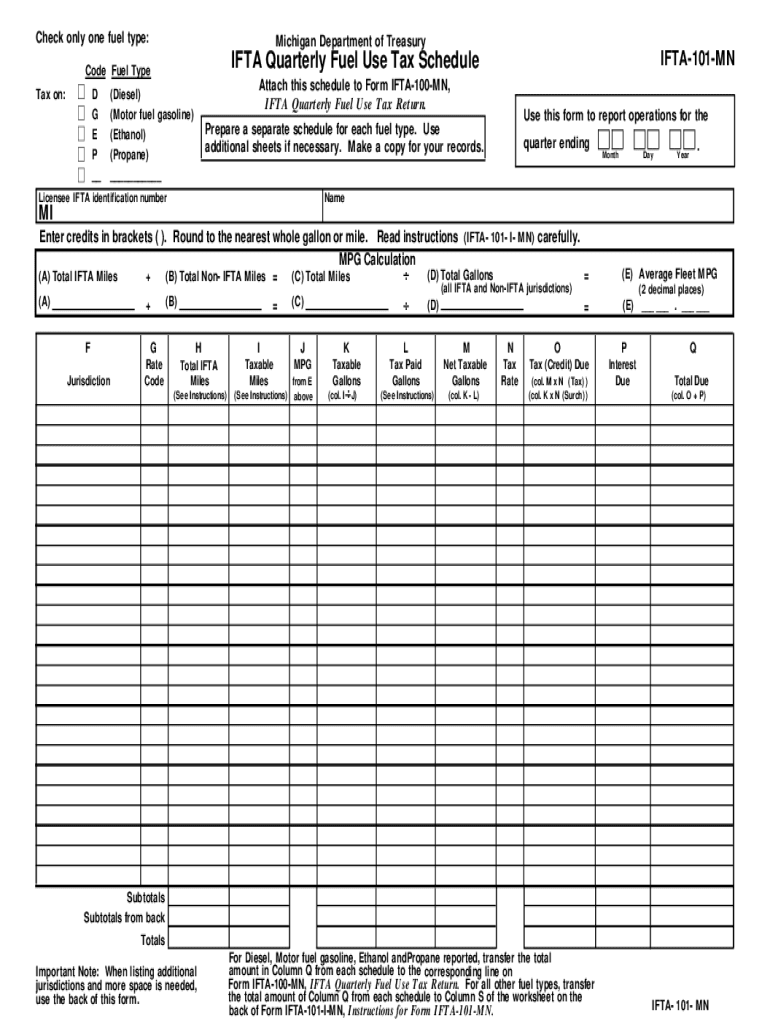

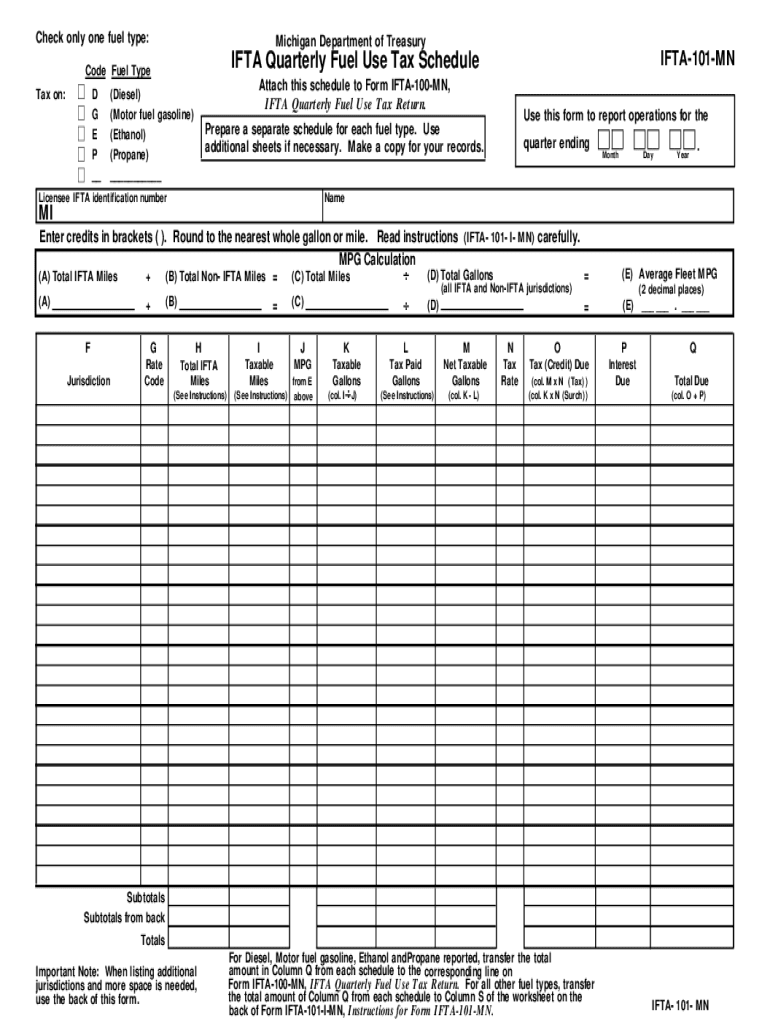

Check only one fuel type:Michigan Department of Treasury on'd G E P __IFTA101MNIFTA Quarterly Fuel Use Tax Scheduled Fuel Reattach this schedule to Form IFTA100MN, IFTA Quarterly Fuel Use Tax Return.×Diesel)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign international fuel tax agreement

Edit your international fuel tax agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your international fuel tax agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit international fuel tax agreement online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit international fuel tax agreement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out international fuel tax agreement

How to fill out international fuel tax agreement

01

Obtain an International Fuel Tax Agreement (IFTA) application form from the relevant authority or download it from their website.

02

Fill out the application form by providing the required information such as your company details, vehicle information, and fuel usage data.

03

Attach any supporting documents as requested, such as vehicle registration papers or proof of insurance.

04

Ensure all the information provided is accurate and complete.

05

Submit the filled-out application form along with any required documents to the appropriate authority.

06

Pay any necessary fees or taxes associated with the application.

07

Wait for the authority to process your application and issue the IFTA license or permit, if approved.

08

Once you receive the IFTA license, make sure to keep it in your vehicle at all times as proof of compliance with fuel tax reporting regulations.

09

Maintain accurate records of all fuel purchases and usage in order to comply with reporting requirements.

10

Regularly file your IFTA reports and pay any required fuel taxes to the appropriate jurisdictions.

11

Keep up-to-date with any changes or updates to the IFTA regulations and ensure ongoing compliance.

Who needs international fuel tax agreement?

01

Commercial motor carriers and individuals operating qualified motor vehicles across multiple jurisdictions within the International Fuel Tax Agreement (IFTA) member states need the international fuel tax agreement.

02

This includes long-haul trucking companies, fleet owners, and individual truck drivers who frequently travel across state or provincial lines.

03

The purpose of the IFTA is to simplify the fuel tax reporting and payment process for motor carriers by allowing them to consolidate their fuel tax obligations into a single quarterly report and payment, rather than dealing with separate tax filings in each jurisdiction they operate in.

04

By participating in the IFTA, motor carriers can avoid the administrative burden and potential penalties associated with filing multiple fuel tax reports and payments.

05

It also ensures fair and equitable distribution of fuel tax revenues among the jurisdictions based on the actual miles traveled and fuel consumed in each state or province.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send international fuel tax agreement for eSignature?

When you're ready to share your international fuel tax agreement, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit international fuel tax agreement online?

The editing procedure is simple with pdfFiller. Open your international fuel tax agreement in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit international fuel tax agreement on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign international fuel tax agreement. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is international fuel tax agreement?

The International Fuel Tax Agreement (IFTA) is an agreement between the lower 48 states of the United States and the Canadian provinces, to simplify the reporting of fuel taxes by interstate motor carriers.

Who is required to file international fuel tax agreement?

Interstate motor carriers who operate in multiple jurisdictions and use qualified motor vehicles are required to file the International Fuel Tax Agreement.

How to fill out international fuel tax agreement?

To fill out the International Fuel Tax Agreement, carriers need to report the total miles traveled and fuel purchased in each member jurisdiction, which can be done online through the IFTA website.

What is the purpose of international fuel tax agreement?

The purpose of the International Fuel Tax Agreement is to streamline the reporting and payment of fuel taxes for interstate motor carriers, by allowing them to file a single tax return instead of multiple returns for each jurisdiction.

What information must be reported on international fuel tax agreement?

The information that must be reported on the International Fuel Tax Agreement includes total miles traveled, total gallons of fuel purchased, and fuel tax paid in each member jurisdiction.

Fill out your international fuel tax agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

International Fuel Tax Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.