Get the free SITK3912012P65491FAC20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248.xml. Comprobante Fi...

Show details

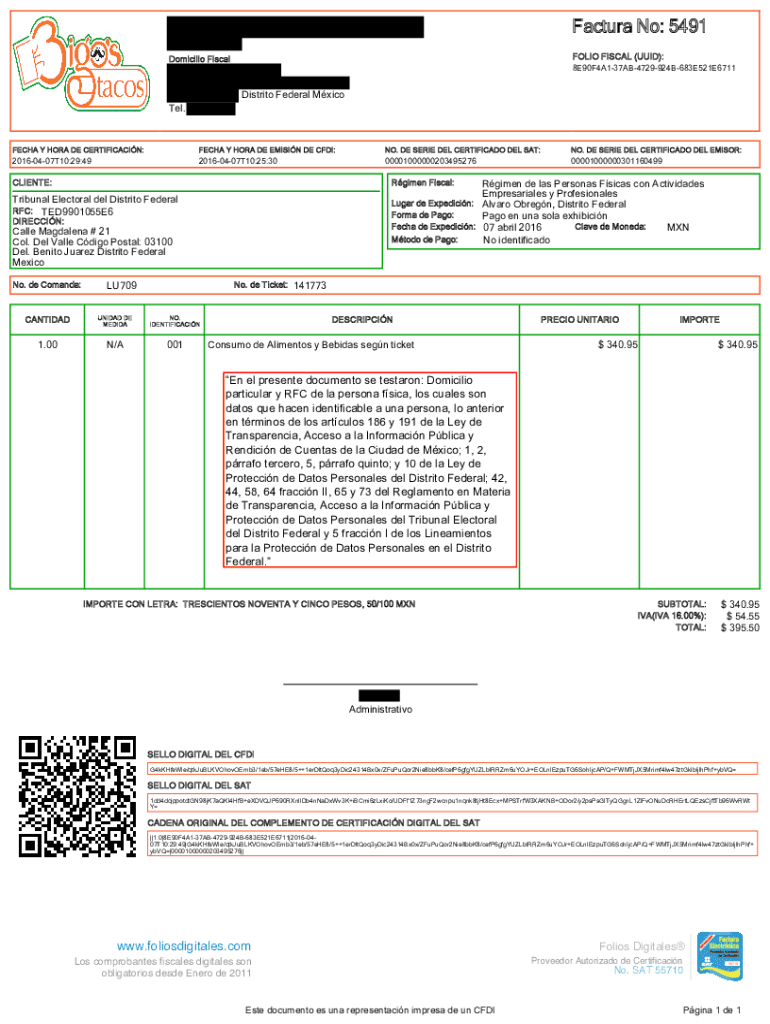

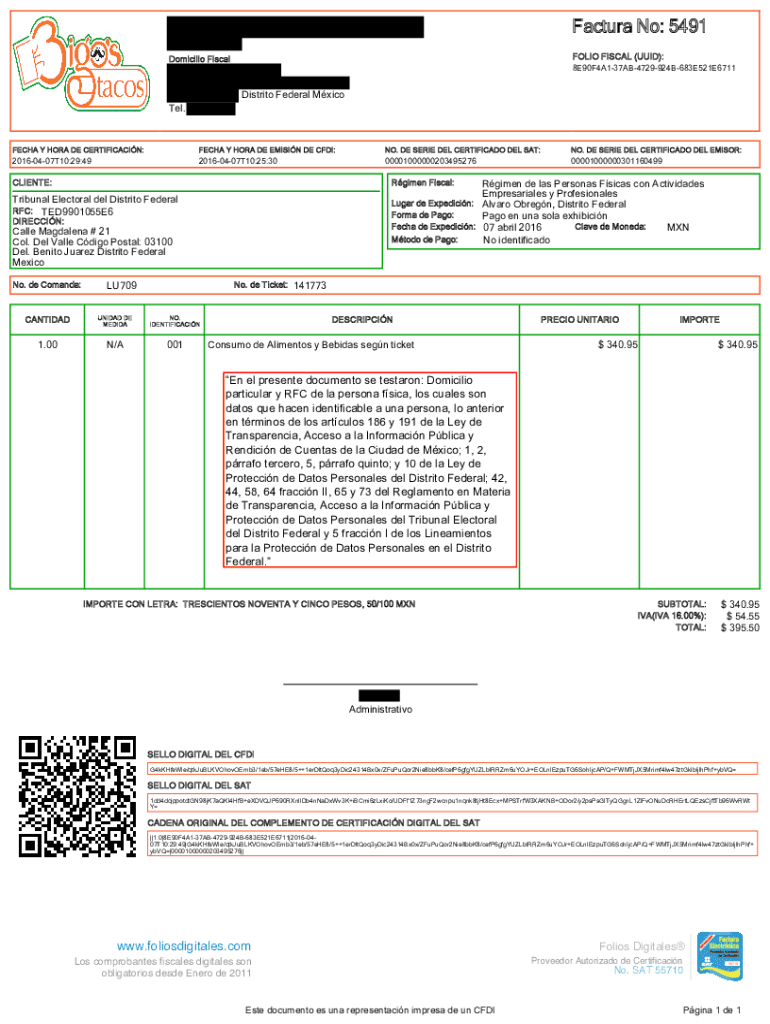

Facture No: 5491 FOLIO FISCAL (UUID):Domicile Fiscal8E90F4A137AB4729924B683E521E6711Distrito Federal Mexico Tel. FEC HA Y HORA DE CERTIFICATION:FEC HA Y HORA DE EM ISIN DEC FDI:NO. DE SERIES DEL CERTIFICATE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fi

Edit your sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fi form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fi form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fi online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fi. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fi

How to fill out sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fiscal digital

01

To fill out sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fiscal digital, follow these steps:

02

Open the XML document with a compatible software or editor.

03

Review the fields and sections in the document.

04

Enter the required information in the corresponding fields.

05

Make sure to provide accurate and up-to-date data.

06

Verify that all mandatory fields are filled.

07

Save the changes and generate the digital fiscal receipt.

Who needs sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fiscal digital?

01

The sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fiscal digital is needed by businesses and individuals who are required to issue official invoices or receipts for their sales or services in compliance with fiscal regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fi?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fi and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make changes in sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fi?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fi to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I sign the sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fi electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fiscal digital?

The sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fiscal digital is an electronic invoice issued in Mexico for tax purposes.

Who is required to file sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fiscal digital?

Businesses and individuals engaged in commercial activities in Mexico are required to file sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fiscal digital.

How to fill out sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fiscal digital?

To fill out the sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fiscal digital, you need to include specific information such as the issuer's details, recipient's details, item description, quantity, unit price, and total amount.

What is the purpose of sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fiscal digital?

The purpose of sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fiscal digital is to document and facilitate tax compliance for transactions conducted in Mexico.

What information must be reported on sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fiscal digital?

The sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fiscal digital must include information such as the issuer's tax identification number, date of issuance, description of goods or services, and total amount.

Fill out your sitk3912012p65491fac20160407f07b9d1a-562d-4d8b-bb30-8aaf4498a248xml comprobante fi online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sitk3912012P65491Fac20160407F07B9D1A-562d-4D8B-bb30-8Aaf4498A248Xml Comprobante Fi is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.