Get the free INDIVIDUAL INCOME PROTECTION PLAN ... - Money Advice

Show details

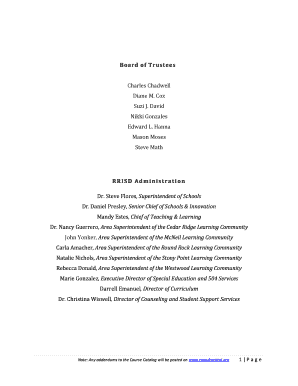

GENERAL INDIVIDUAL INCOME PROTECTION PLAN application form Agency Name: Agency Number: OFFICE USE: Client: Contract: Please complete this application in BLOCK CAPITALS and tick any relevant boxes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign individual income protection plan

Edit your individual income protection plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual income protection plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing individual income protection plan online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit individual income protection plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out individual income protection plan

How to fill out an individual income protection plan:

01

Gather necessary information: Start by collecting all your personal information, such as your full name, address, date of birth, and contact details. You will also need your social security number and any other identification documents required by the insurance provider.

02

Assess your needs: Think about what type and level of income protection you require. Consider your monthly expenses, any outstanding debts, and any dependents who rely on your income. This will help you determine the appropriate coverage amount for your plan.

03

Research and compare providers: Take the time to research different insurance providers that offer individual income protection plans. Compare their premiums, coverage options, policy terms, and reputation in the industry. Look for reviews or testimonials from existing policyholders to get an idea of their experiences with the provider.

04

Contact insurance providers: Once you have identified a few potential providers, reach out to them to discuss your individual income protection plan. Ask about the application process, required documentation, and any additional information they may need from you. This will also give you an opportunity to ask any questions you have about the policy.

05

Complete the application form: Fill out the application form provided by the chosen insurance provider. Pay close attention to each question and answer accurately and honestly. Double-check all information before submitting to avoid any potential delays or issues with your application.

06

Provide supporting documentation: Along with the application form, you may need to provide supporting documentation such as proof of income, bank statements, or medical records. Make sure to prepare these documents in advance to avoid any delays in the application process.

07

Review the policy terms: Once your application is approved, carefully review the terms and conditions of the individual income protection plan. Understand the coverage limits, waiting periods, exclusions, and any other important details. If you have any concerns or questions, reach out to your insurance provider for clarification.

Who needs an individual income protection plan:

01

Self-employed individuals: Freelancers, contractors, and business owners who rely on a steady income from their own work. Since these individuals do not have employer-provided benefits, having an individual income protection plan can help protect their income in case of illness or injury.

02

Professionals with limited sick leave: Some employees may have limited sick leave or disability benefits offered by their employers. Having an individual income protection plan can provide them with additional coverage and peace of mind in case their sick leave is exhausted.

03

Individuals without a safety net: People without significant savings or financial support from family members may need an individual income protection plan to ensure they have a source of income if they become unable to work due to illness or injury.

04

Breadwinners with dependents: Individuals who are the primary earners for their families and have dependents relying on their income. Losing their ability to work due to a disability can have severe financial consequences for themselves and their loved ones. An individual income protection plan can help mitigate this risk.

05

Those in high-risk professions: People working in physically demanding or high-risk occupations, such as construction workers or firefighters, may face a higher risk of injury or disability. Having an individual income protection plan can provide them with financial protection in case of such unfortunate events.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is individual income protection plan?

Individual income protection plan is a type of insurance policy that provides financial protection to individuals in case of loss of income due to illness, injury, or disability.

Who is required to file individual income protection plan?

Individuals who want to protect their income in case of unforeseen circumstances such as illness, injury or disability are required to file individual income protection plan.

How to fill out individual income protection plan?

Individuals can fill out an individual income protection plan by providing personal and financial information to an insurance provider, selecting coverage options, and paying premiums.

What is the purpose of individual income protection plan?

The purpose of an individual income protection plan is to provide financial security to individuals by replacing lost income in case of illness, injury, or disability.

What information must be reported on individual income protection plan?

Individual income protection plan must include personal information, medical history, occupation, income details, coverage amount, and beneficiary information.

How can I send individual income protection plan to be eSigned by others?

To distribute your individual income protection plan, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the individual income protection plan in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your individual income protection plan in minutes.

Can I edit individual income protection plan on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share individual income protection plan from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your individual income protection plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Income Protection Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.