Get the free Financial Planner vs. Financial Advisor: What's the Difference ...

Show details

Introduction Philip O'Reilly Managing Director Money Advice+CRM Philip O 'Reilly an experienced financial planner and chartered surveyor with over 30 years industry experience has been developing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial planner vs financial

Edit your financial planner vs financial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial planner vs financial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial planner vs financial online

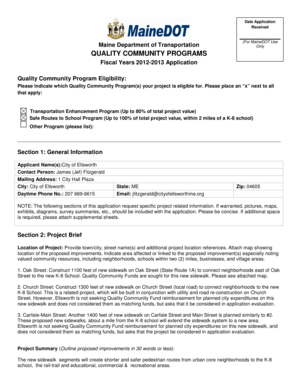

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit financial planner vs financial. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial planner vs financial

How to fill out financial planner vs financial:

01

Start by assessing your financial goals and needs. Determine what specific financial areas you require assistance with and what your long-term objectives are.

02

Research and compare different financial planners and financial tools available. Consider factors such as their expertise, experience, fees, and services they offer.

03

Consult with a financial planner if you prefer professional guidance and personalized advice. Schedule a meeting to discuss your financial situation, goals, and any concerns you may have.

04

Provide the financial planner with all the necessary information and documents they may require, such as your income details, expenses, assets, debts, and investments. Be transparent and honest to ensure they have a comprehensive understanding of your financial situation.

05

Regularly communicate and review your financial plan with the financial planner. Discuss any updates or changes to your circumstances, and ensure that your plan is aligned with your goals and risk tolerance.

06

Keep track of your financial progress and make adjustments as needed. Regularly review your investments, budget, and savings strategy.

07

Educate yourself about personal finance and financial management. Understand the basics of budgeting, saving, and investing, even if you decide to work with a financial planner.

08

Alternatively, if you feel confident managing your finances independently, consider utilizing financial tools such as budgeting apps, investment platforms, and online resources to help you stay organized and make informed decisions.

Who needs financial planner vs financial:

01

Individuals who lack the knowledge or expertise in managing their finances and want professional guidance to achieve their financial goals.

02

Those who have complex financial situations, such as multiple sources of income, significant assets, or varied investments, which require specialized knowledge and strategies.

03

People who value personalized advice and ongoing support in their financial planning journey.

04

Individuals who want to optimize their financial situation and maximize their savings, investments, and wealth accumulation.

05

Those who prefer to delegate the responsibility of financial management to an experienced professional, allowing them to focus on other aspects of their life.

06

People who face significant life changes, such as marriage, divorce, starting a family, or nearing retirement, and require expert advice to navigate these transitions.

07

Individuals who want to ensure their financial plan aligns with their long-term objectives, risk tolerance, and values.

08

Those who want to stay updated with the latest financial trends, regulations, and investment opportunities, which a financial planner can help them navigate effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is financial planner vs financial?

A financial planner is a professional who helps individuals and families create a financial plan, while financial refers to matters related to finances or money.

Who is required to file financial planner vs financial?

Financial planners are required to file financial reports for their clients, while individuals and organizations may be required to file financial statements for regulatory or reporting purposes.

How to fill out financial planner vs financial?

Financial planners must gather relevant financial information from their clients to create a comprehensive financial plan, while individuals and organizations must accurately report their financial activities and transactions.

What is the purpose of financial planner vs financial?

The purpose of a financial planner is to help clients achieve their financial goals and objectives, while the purpose of financial reporting is to provide transparency and accountability in financial matters.

What information must be reported on financial planner vs financial?

Financial planners must report on their clients' financial goals, assets, liabilities, income, and expenses, while financial reports must include detailed information on financial activities and transactions.

How can I manage my financial planner vs financial directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your financial planner vs financial and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I get financial planner vs financial?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific financial planner vs financial and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit financial planner vs financial straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing financial planner vs financial, you need to install and log in to the app.

Fill out your financial planner vs financial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Planner Vs Financial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.