Get the free ON - Money Advice - Ireland

Show details

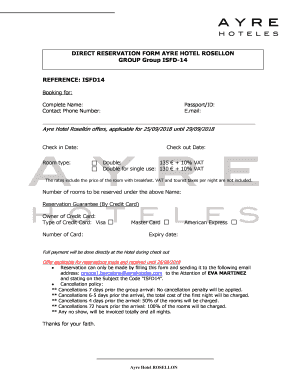

UNDERLYING FUND HAS RETURNED +630% SINCE NOVEMBER 1989 (CAR 9%) ON 25% OF INITIAL INVESTMENT DEPOSIT INTEREST OVER 12 MONTHS AVAILABLE TO INVESTMENT BCP PENSION ARF/AMRF INVESTORS SPLIT DEPOSIT ABSOLUTE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign on - money advice

Edit your on - money advice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your on - money advice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing on - money advice online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit on - money advice. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out on - money advice

How to fill out on - money advice?

01

Start by gathering all your financial information: Before seeking on - money advice, it is essential to have a clear understanding of your current financial situation. Collect all your bank statements, credit card statements, bills, income information, and any other relevant financial documents.

02

Assess your income and expenses: Take a close look at your monthly income and expenses. Identify your sources of income, such as salary, investments, or any other income streams. Next, make a comprehensive list of all your monthly expenses, including bills, rent or mortgage payments, groceries, transportation, and any other regular expenses.

03

Analyze your spending habits: Once you have a clear picture of your income and expenses, it's important to evaluate your spending habits. Are there any areas where you could potentially reduce your expenses? Are there any unnecessary or impulse purchases that can be eliminated? Identifying areas where you can cut back on spending can help improve your overall financial situation.

04

Set financial goals: Determine your short-term and long-term financial goals. Do you want to save for retirement, purchase a house, or pay off debt? Setting clear goals allows you to focus your efforts and develop a plan to achieve them.

05

Create a budget: Based on your income, expenses, and financial goals, create a realistic budget that outlines how much you can allocate towards different categories of expenses. This will help you prioritize your spending and ensure that you're not spending more than you earn.

06

Seek professional guidance: If you are unsure about how to manage your finances or need personalized advice, it is recommended to seek professional help from a financial advisor or a money management expert. They can provide tailored guidance based on your specific circumstances and assist you in making informed financial decisions.

Who needs on - money advice?

01

Individuals looking to improve their financial literacy: On - money advice can be valuable for individuals who want to enhance their knowledge and understanding of personal finance. It can help them develop better money management habits and make informed financial decisions.

02

People struggling with debt: Those dealing with significant debt may benefit from on - money advice. Experts can provide strategies to manage and reduce debt effectively, while also advising on budgeting techniques to avoid accumulating more debt.

03

Individuals planning for future goals: Whether you're saving for retirement, planning to buy a house, or starting a family, on - money advice can help you develop a solid financial plan. Professionals can guide you in making investment choices, understanding different savings options, and ensuring you're on track to achieve your future goals.

04

Those experiencing financial difficulties: If you are facing financial challenges such as unemployment, unexpected medical expenses, or a recent divorce, seeking on - money advice can provide valuable guidance during difficult times. Experts can help you create a realistic budget, explore potential financial assistance programs, and develop strategies to regain financial stability.

Remember, on - money advice is not a one-size-fits-all solution. It is crucial to tailor the advice to your individual circumstances and seek professional guidance when needed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is on - money advice?

On - money advice is a financial document that provides guidance and recommendations on managing money effectively.

Who is required to file on - money advice?

Anyone who seeks financial advice or assistance may be required to file on - money advice.

How to fill out on - money advice?

To fill out on - money advice, one must provide accurate financial information and describe their current financial situation.

What is the purpose of on - money advice?

The purpose of on - money advice is to help individuals make informed decisions about their finances and improve their financial well-being.

What information must be reported on on - money advice?

Information such as income, expenses, debts, assets, and financial goals must be reported on on - money advice.

How can I manage my on - money advice directly from Gmail?

on - money advice and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get on - money advice?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the on - money advice in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete on - money advice online?

pdfFiller has made it simple to fill out and eSign on - money advice. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Fill out your on - money advice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

On - Money Advice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.