Get the free Form 1078

Show details

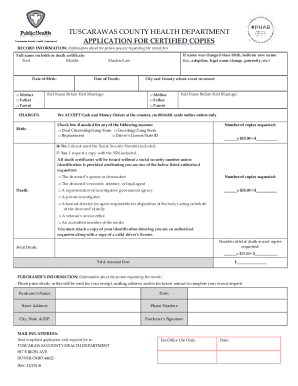

Form 1078 is used by an alien to claim residence in the United States for income tax purposes. It is essential for determining if an individual qualifies as a resident alien and therefore if their

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1078

Edit your form 1078 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1078 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 1078 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 1078. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1078

How to fill out Form 1078

01

Obtain Form 1078 from the relevant website or office.

02

Read the instructions carefully before starting the form.

03

Fill in your personal details in the top section, including your name, address, and contact information.

04

Provide any required identification numbers, such as Social Security Number or Tax Identification Number.

05

Complete the sections relating to your specific situation, making sure to answer all questions accurately.

06

Review the form for any errors or omissions.

07

Sign and date the form at the designated area.

08

Submit the completed form as per the provided instructions, whether electronically or by mail.

Who needs Form 1078?

01

Any individual or entity that needs to submit information regarding their tax situation or identity verification to the IRS.

Fill

form

: Try Risk Free

People Also Ask about

How do I fill out a W-8BEN form?

How Do I Fill Out Form W-8BEN? Part I – Identification of Beneficial Owner: Line 1: Enter your name as the beneficial owner. Line 2: Enter your country of citizenship. Line 3: Enter your permanent residence/mailing address. Line 4: Enter your mailing address, if different.

What is the IRS form to cancel all debt?

Form 1099-C. Lenders or creditors are required to issue Form 1099-C, Cancellation of Debt, if they cancel a debt owed to them of $600 or more. Generally, an individual taxpayer must include all canceled amounts (even if less than $600) on the "Other Income" line of Form 1040.

Is SSN required for W8BEN?

If you are an individual, you are generally required to enter your social security number (SSN).

What is a 1078 form?

Form 1078: Certificate of Alien Claiming Residence Definition.

What is a 1098-T tax form used for?

The 1098-T form is the Tuition Statement that your college or career school uses to report qualified tuition and related education expenses to you and the IRS. You or your parent/guardian may be able to claim these expenses as education related tax credits.

Who needs to fill the W-8BEN form?

Non-US individuals who receive certain types of income from US sources—such as interest, dividends, rents, royalties, and certain other types of income—need to fill out the W-8 BEN. The form is used to claim any applicable tax treaty benefits and to verify that the individual is not a US resident for tax purposes.

What happens if I don't fill out W-8BEN?

Failure to provide a Form W-8BEN when requested may lead to withholding at the foreign-person withholding rate of 30% or the backup withholding rate under section 3406.

How to fill out a w8ben form?

How Do I Fill Out Form W-8BEN? Part I – Identification of Beneficial Owner: Line 1: Enter your name as the beneficial owner. Line 2: Enter your country of citizenship. Line 3: Enter your permanent residence/mailing address. Line 4: Enter your mailing address, if different.

What is a 1088 form for taxes used for?

The 1088 tax form is an IRS form used to report certain transactions related to real estate. It is used to report the sale, exchange, or other dispositions of real estate property. It is also used to report the amount of mortgage interest, real estate taxes, and other related expenses paid during the tax year.

What is a 1098 form used for?

Use Form 1098, Mortgage Interest Statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or business from an individual, including a sole proprietor. Report only interest on a mortgage, defined later.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 1078?

Form 1078 is a specific form used for reporting certain information to the IRS, typically related to tax matters.

Who is required to file Form 1078?

Individuals or entities required to provide certain information under the regulations specified by the IRS must file Form 1078.

How to fill out Form 1078?

To fill out Form 1078, obtain the form from the IRS website, enter the required information accurately, and submit it by the specified deadline.

What is the purpose of Form 1078?

The purpose of Form 1078 is to gather necessary information for tax compliance and reporting purposes as required by the IRS.

What information must be reported on Form 1078?

Information that must be reported on Form 1078 typically includes taxpayer identification details, income specifics, and other relevant tax-related information.

Fill out your form 1078 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1078 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.