Get the free IT-214 - tax ny

Show details

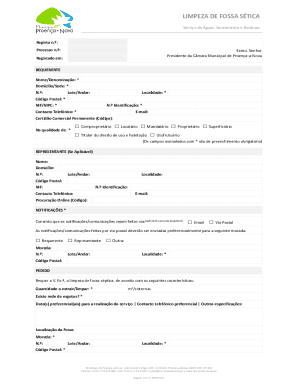

Este formulario es utilizado por los propietarios y arrendatarios en Nueva York para reclamar un crédito fiscal sobre impuestos a la propiedad real. Los solicitantes deben proporcionar información

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-214 - tax ny

Edit your it-214 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-214 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it-214 - tax ny online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit it-214 - tax ny. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-214 - tax ny

How to fill out IT-214

01

Obtain the IT-214 form from the New York State Department of Taxation and Finance website.

02

Fill in your name and address at the top of the form.

03

Enter your Social Security number in the designated box.

04

Complete the sections regarding your property information, including the address and type of property.

05

Indicate your income and filing status as required on the form.

06

Provide any additional necessary documentation that supports your claim for the credit.

07

Review the completed form for accuracy and sign it.

08

Submit the completed IT-214 form to the appropriate tax authority by the specified deadline.

Who needs IT-214?

01

Homeowners who are eligible for the school tax relief (STAR) exemption in New York State.

02

Individuals who own qualifying properties and wish to claim the IT-214 tax credit.

Fill

form

: Try Risk Free

People Also Ask about

Who is eligible for the IT 214?

To be eligible for the Real Property Tax Credit, you must meet the following criteria ing to the New York Department of Taxation and Finance: Your household gross income is $18,000 or less. You had the same New York residence for six months or more. You were a New York State resident for the entire year.

Who is eligible for the IT 214?

To be eligible for the Real Property Tax Credit, you must meet the following criteria ing to the New York Department of Taxation and Finance: Your household gross income is $18,000 or less. You had the same New York residence for six months or more. You were a New York State resident for the entire year.

Who qualifies for NYS real property tax credit?

The real property tax credit may be available to New York State residents who have household gross incomes of $18,000 or less, and pay either real property taxes or rent for their residences. The amount of the credit for each household will vary depending on income and real property taxes paid (see table to the right).

What is the IRS tax form it 214?

Complete Form IT-214, Claim for Real Property Tax Credit for Homeowners and Renters, and submit it with your New York State personal income tax return, Form IT-201. If you do not have to file a New York return, but you qualify for this credit, just complete and file Form IT-214 to claim a refund of the credit.

Who qualifies for NYS real property tax credit?

The real property tax credit may be available to New York State residents who have household gross incomes of $18,000 or less, and pay either real property taxes or rent for their residences. The amount of the credit for each household will vary depending on income and real property taxes paid (see table to the right).

Who gets the NYS property tax relief check?

The property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is $250,000 or less. Most recipients of the School Tax Relief (STAR) exemption or credit will automatically qualify and will not need to take any action in order to receive the rebate.

Who gets the NYS property tax relief check?

The property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is $250,000 or less. Most recipients of the School Tax Relief (STAR) exemption or credit will automatically qualify and will not need to take any action in order to receive the rebate.

What is the tax section 214?

Section 214 - [Effective Until 1/1/2025] Property used for religious, hospital, scientific, or charitable purposes (a) Property used exclusively for religious, hospital, scientific, or charitable purposes owned and operated by community chests, funds, foundations, limited liability companies, or corporations organized

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IT-214?

IT-214 is a New York State tax form used for claiming a property tax credit for homeowners and renters.

Who is required to file IT-214?

Individuals who meet certain income requirements and have paid rent or property taxes in New York may be required to file IT-214.

How to fill out IT-214?

To fill out IT-214, you need to provide personal information, details of your rent or property tax payments, and income information, and then submit the form along with your tax return.

What is the purpose of IT-214?

The purpose of IT-214 is to provide eligible homeowners and renters in New York State with a tax credit to help alleviate property tax burdens.

What information must be reported on IT-214?

IT-214 requires you to report your personal identification information, your household income, the amount of rent or property taxes paid, and other pertinent financial details.

Fill out your it-214 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-214 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.