Get the free Acra LendingAE Loan Synopsis Form

Show details

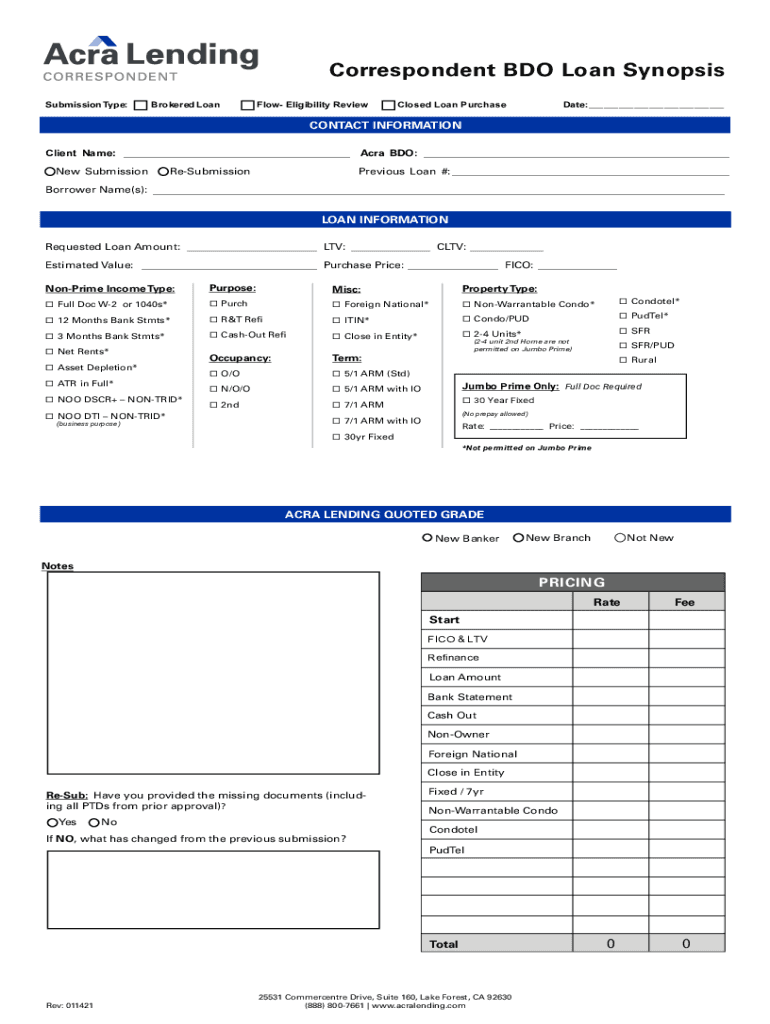

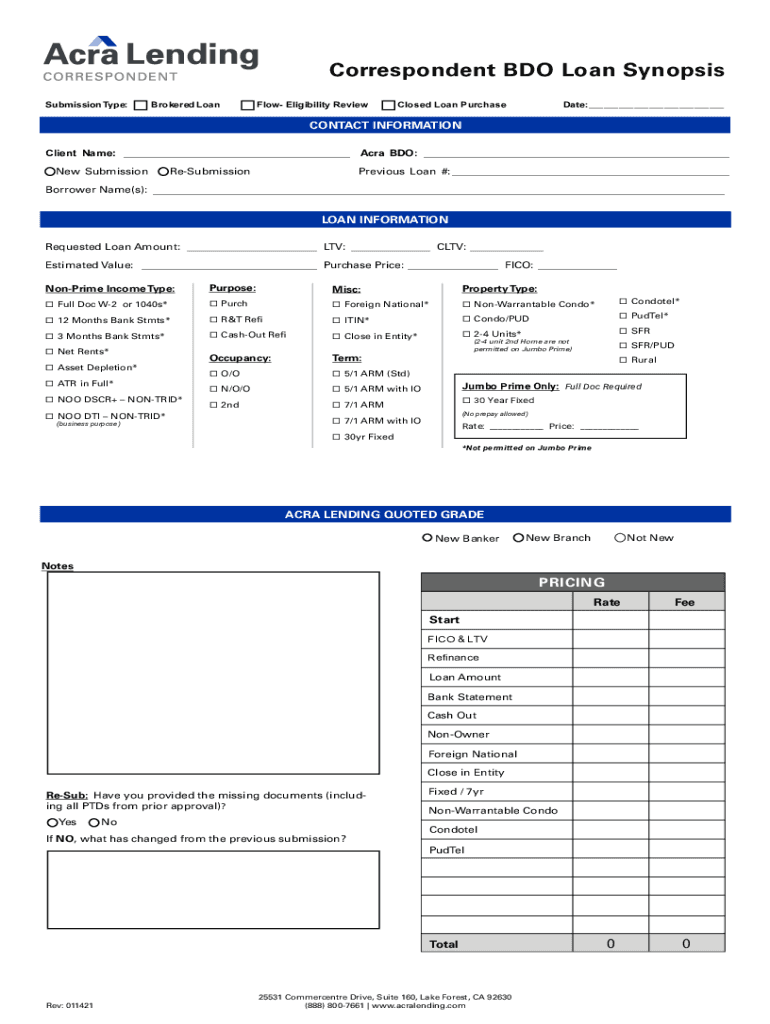

CLEAR FORMCorrespondent BDO Loan Synopsis Submission Type:Brokered Outflow Eligibility ReviewClosed Loan Purchase Date:___CONTACT INFORMATION Client Name: ___ Acre BDO: ___ New Submission ReSubmissionPrevious

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign acra lendingae loan synopsis

Edit your acra lendingae loan synopsis form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your acra lendingae loan synopsis form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing acra lendingae loan synopsis online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit acra lendingae loan synopsis. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out acra lendingae loan synopsis

How to fill out acra lendingae loan synopsis

01

To fill out the ACRA LendingAE loan synopsis, follow these steps:

02

Start by gathering all the necessary information about your loan, including the loan amount, interest rate, and repayment terms.

03

Begin the synopsis by providing a brief introduction to the loan, including the purpose of the loan and any relevant background information.

04

Include a section that outlines the key terms of the loan, such as the repayment schedule, any collateral or guarantor requirements, and any applicable fees or charges.

05

Clearly state the interest rate and any associated fees or penalties, ensuring that all terms are disclosed accurately.

06

Provide a breakdown of the loan amount, showing how it will be used or allocated.

07

Include any additional information that may be relevant to the loan, such as specific conditions or restrictions.

08

Conclude the synopsis with a summary of the main points and any next steps or actions required.

09

Proofread the synopsis for any errors or inconsistencies before finalizing it.

10

Save the completed synopsis in a suitable format, such as a PDF or Word document, for future reference or submission.

Who needs acra lendingae loan synopsis?

01

ACRA LendingAE loan synopsis is needed by individuals or businesses who are applying for a loan from ACRA LendingAE.

02

It is also required by financial institutions or lenders who need a detailed summary of the proposed loan for evaluation and decision-making purposes.

03

In addition, professionals in the field of finance or lending, such as loan officers or credit analysts, may require the loan synopsis to assess the viability of the loan and its potential risks.

04

Overall, anyone involved in the loan application and approval process, whether as a borrower or a decision-maker, can benefit from having an accurate and comprehensive ACRA LendingAE loan synopsis.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in acra lendingae loan synopsis without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your acra lendingae loan synopsis, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the acra lendingae loan synopsis in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your acra lendingae loan synopsis in seconds.

How do I edit acra lendingae loan synopsis on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign acra lendingae loan synopsis. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is acra lendingae loan synopsis?

The ACRA Lenddingae loan synopsis is a document that provides a summary of a loan taken out by a business.

Who is required to file acra lendingae loan synopsis?

Businesses or entities that have taken out a loan are required to file the ACRA Lendingae loan synopsis.

How to fill out acra lendingae loan synopsis?

To fill out the ACRA Lendingae loan synopsis, provide details about the loan amount, lender, terms, and any collateral involved.

What is the purpose of acra lendingae loan synopsis?

The purpose of the ACRA Lendingae loan synopsis is to disclose information about loans taken by businesses for transparency and compliance purposes.

What information must be reported on acra lendingae loan synopsis?

Information such as loan amount, lender's details, terms of the loan, repayment schedule, and any collateral provided must be reported on the ACRA Lendingae loan synopsis.

Fill out your acra lendingae loan synopsis online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Acra Lendingae Loan Synopsis is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.