IRS 14446 (zh-s) 2021 free printable template

Show details

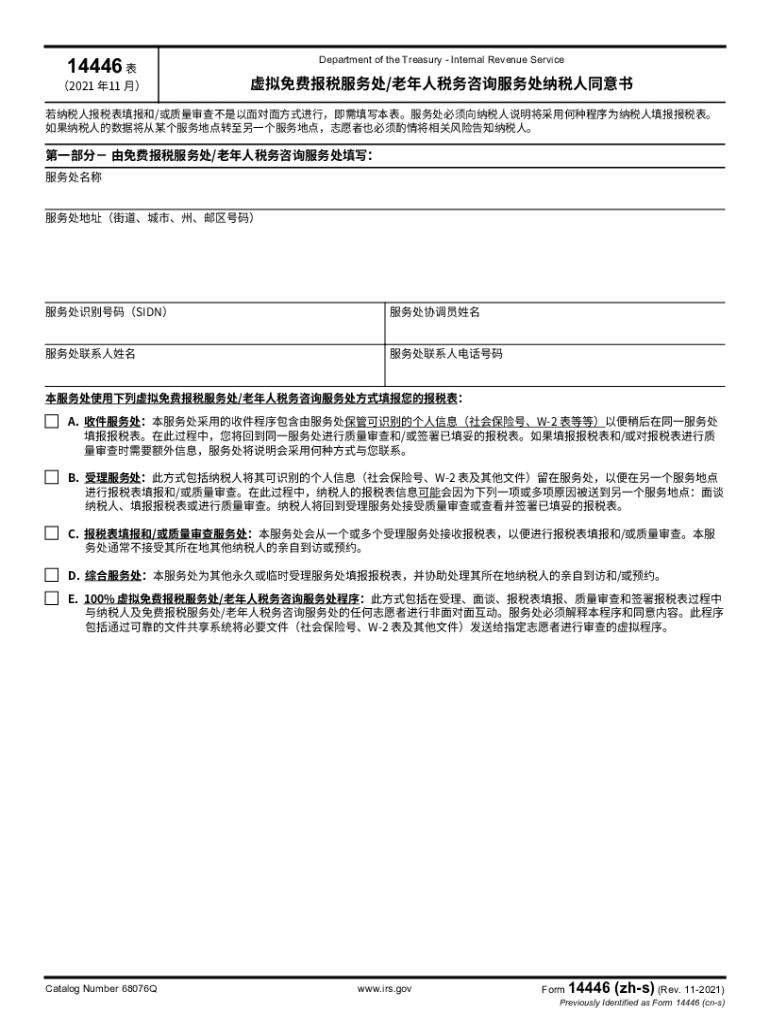

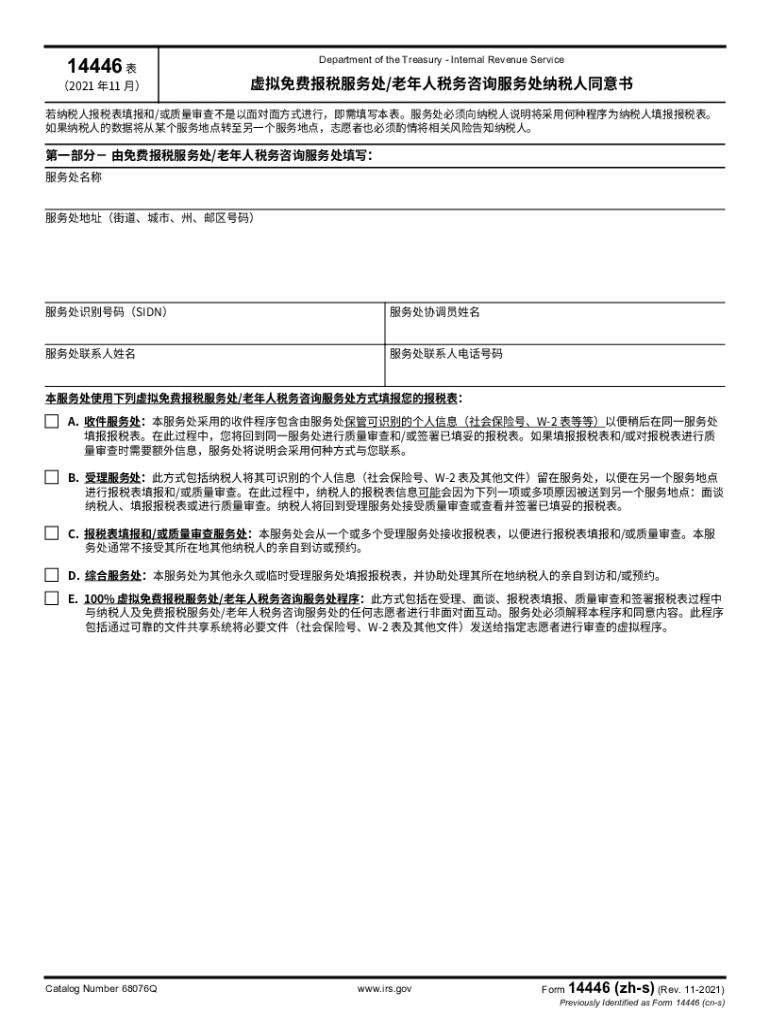

14446 2021 11 Department of the Treasury Internal Revenue Service//

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 14446 zh-s

Edit your IRS 14446 zh-s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 14446 zh-s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 14446 zh-s online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 14446 zh-s. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 14446 (zh-s) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 14446 zh-s

How to fill out IRS 14446 (zh-s)

01

Obtain the IRS Form 14446 from the IRS website or your tax professional.

02

Fill out your personal information including your name, address, and Social Security number.

03

Indicate the specific tax years or periods for which you are seeking relief.

04

Provide reason(s) for your request, detailing any hardships or circumstances.

05

Sign and date the form at the bottom where indicated.

06

Submit the completed form as directed in the IRS instructions, either by mail or e-filing.

Who needs IRS 14446 (zh-s)?

01

Individuals who have experienced significant hardships or circumstances that have affected their ability to comply with tax obligations.

02

Taxpayers seeking relief for penalties due to failing to file or pay taxes on time.

03

People who need assistance with IRS tax compliance issues due to specific life events such as a natural disaster or death in the family.

Fill

form

: Try Risk Free

People Also Ask about

Is form 9325 required?

Form 9325 is not required, but some taxpayers may request this form to prove their returns have been e-filed and accepted by the IRS. Some preparers print this report automatically for every return and extension for their own recordkeeping purposes as well as to provide a copy to the taxpayer.

Who can talk to IRS on my behalf?

Who You Can Authorize. You can authorize your tax preparer, a friend, a family member, or any other person you choose to receive oral disclosure during a conversation with the IRS.

Can the IRS or other taxing authority discuss the return with the preparer?

Don't stress the IRS. This lets the IRS discuss your return with the person you designate, even if they're not a tax professional. Things the IRS can discuss with the third party designee on your tax return include the processing of your current tax return and the status of tax refunds.

What does form 8821 allow?

Form 8821 authorizes the IRS to disclose your confidential tax information to the person you appoint. This form is provided for your convenience and its use is voluntary. The information is used by the IRS to determine what confidential tax information your appointee can inspect and/or receive.

Do you want to allow another person to discuss this return with the IRS?

You can allow the IRS to discuss your tax return information with a third party by completing the Third Party Designee section of your tax return, often referred to as "Checkbox Authority." This will allow the IRS to discuss the processing of your current tax return, including the status of tax refunds, with the person

Does a tax extension require a signature?

It doesn't require a date or signature. You don't have to give a reason for requesting an extension. All you have to provide is: In Part I: Your name, address, Social Security number, and, if applicable, your spouse's Social Security number.

What is Virtual Vita?

Virtual VITA is an alternate filing model offered by various VITA programs throughout the United States when the traditional face-to-face tax preparation isn't available. It involved a tax preparation process without the taxpayer physically present during the majority of the process.

What is the taxpayer consent form?

This form is required when any part of the tax return preparation process is completed without in-person interaction between the taxpayer and the VITA/TCE volunteer. The site must explain to the taxpayer the process used to prepare the taxpayer's return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 14446 zh-s to be eSigned by others?

Once you are ready to share your IRS 14446 zh-s, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make edits in IRS 14446 zh-s without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing IRS 14446 zh-s and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I complete IRS 14446 zh-s on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your IRS 14446 zh-s from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is IRS 14446 (zh-s)?

IRS Form 14446 (zh-s) is a tax form used by certain individuals or entities to communicate specific information required by the Internal Revenue Service regarding tax obligations and compliance.

Who is required to file IRS 14446 (zh-s)?

Individuals or entities that meet specific criteria set forth by the IRS, typically related to income levels, tax status, or certain deductions, are required to file IRS Form 14446 (zh-s).

How to fill out IRS 14446 (zh-s)?

To fill out IRS Form 14446 (zh-s), taxpayers should gather necessary financial information, follow the step-by-step instructions provided with the form, and ensure all required fields are completed accurately before submitting.

What is the purpose of IRS 14446 (zh-s)?

The purpose of IRS Form 14446 (zh-s) is to ensure compliance with federal tax laws by providing specific information needed for accurate processing of an individual's or entity's tax situation.

What information must be reported on IRS 14446 (zh-s)?

IRS Form 14446 (zh-s) requires reporting of personal identification information, income details, deductions, tax credits, and any other relevant financial information that affects tax liability.

Fill out your IRS 14446 zh-s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 14446 Zh-S is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.