Get the free IRA BENEFICIARY UPDATE

Show details

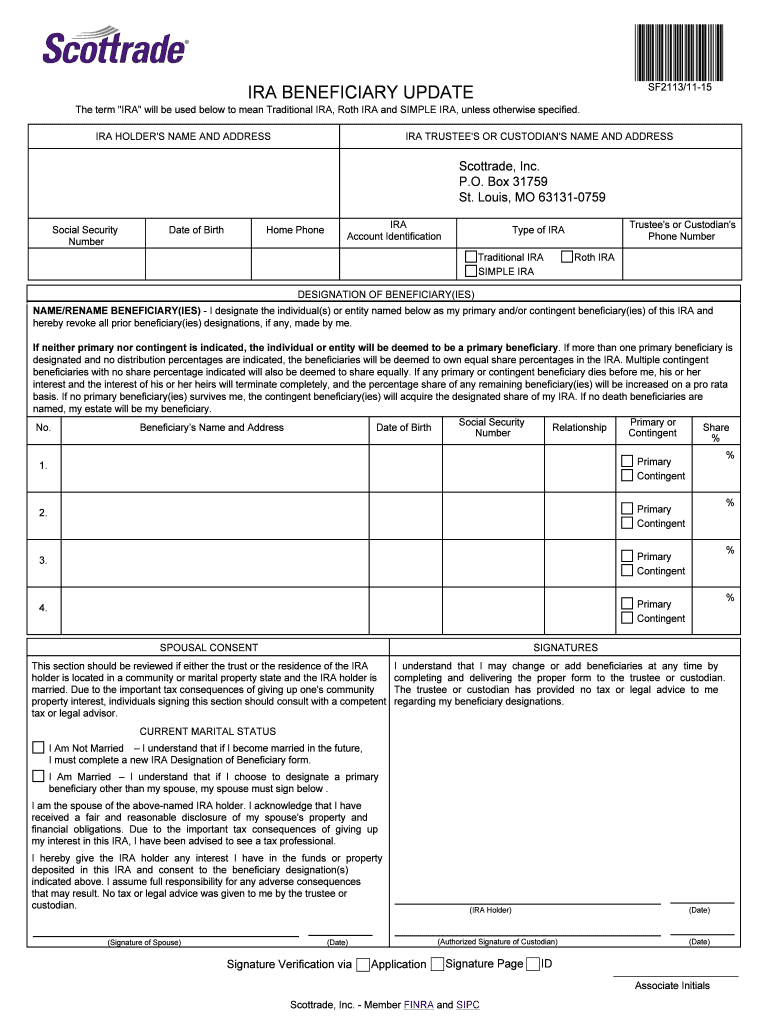

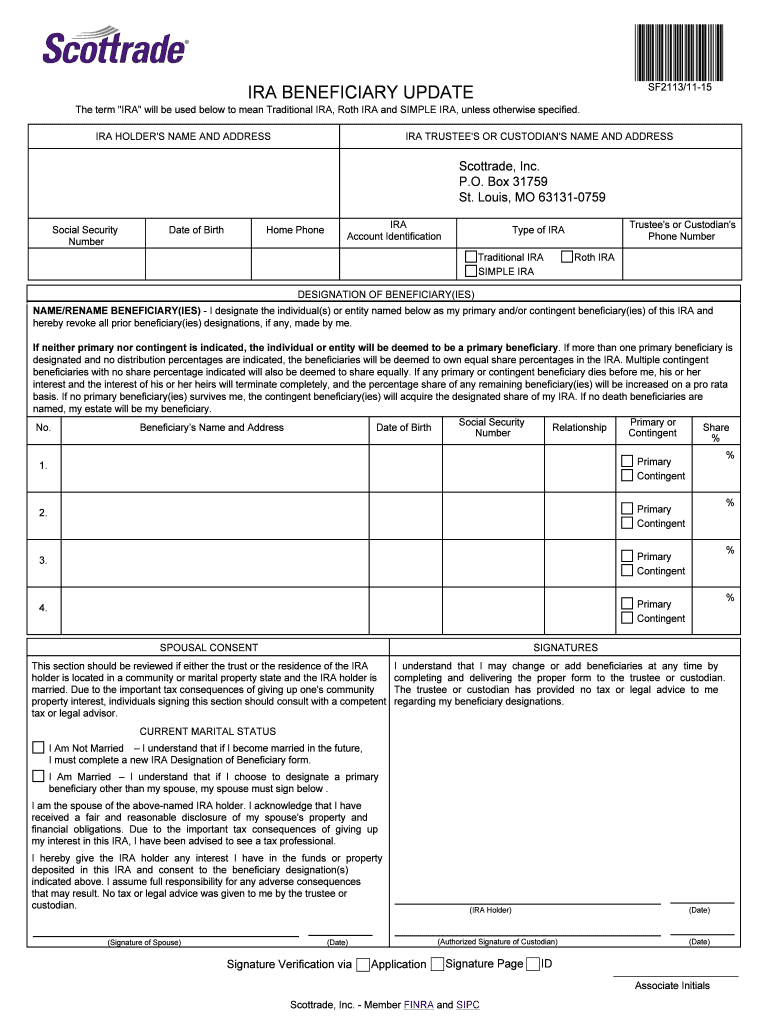

*SF2113* SF2113/1115 IRA BENEFICIARY UPDATE The term IRA will be used below to mean Traditional IRA, Roth IRA and SIMPLE IRA, unless otherwise specified. IRA HOLDER IS NAME AND ADDRESS IRA TRUSTEE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira beneficiary update

Edit your ira beneficiary update form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira beneficiary update form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ira beneficiary update online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ira beneficiary update. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira beneficiary update

Steps to fill out an IRA beneficiary update:

01

Obtain the necessary forms: Contact your IRA custodian or financial institution to request the correct forms for updating your beneficiary information. They may provide them online or send them to you via mail or email.

02

Provide your personal information: Fill in your name, address, contact details, and social security number on the designated fields of the form. This information helps identify your account and ensures the update is applied correctly.

03

Review current beneficiary information: If you have already listed beneficiaries, the form may include a section to review the existing information. Take the time to verify the accuracy of the listed beneficiaries and their respective shares.

04

Add or remove beneficiaries: If you need to add new beneficiaries or remove existing ones, clearly indicate their full names, relationship to you, and the percentage or amount of the account they should receive. If leaving a percentage, ensure the total distribution equals 100%. Be aware of any restrictions or limitations set by your IRA custodian for naming beneficiaries.

05

Specify contingent beneficiaries: Contingent beneficiaries are individuals who would receive the assets if the primary beneficiaries are unable to inherit them. Indicate your chosen contingent beneficiaries and their respective shares in case your primary beneficiaries are unable to fulfill their roles.

06

Update form and sign: After completing all the necessary information, review the form for accuracy and completeness. Ensure you have signed and dated the document as required. Missing signatures may invalidate the update.

07

Submit the form: Depending on your IRA custodian's instructions, you can submit the form electronically, by mail, or by visiting their office. Follow their guidelines to ensure your update is processed correctly.

Who needs an IRA beneficiary update?

An IRA beneficiary update is beneficial for anyone who holds an individual retirement account (IRA) and wishes to make changes to their designated beneficiaries. It is essential to regularly review and update your beneficiaries to ensure your assets are distributed according to your wishes and any life changes, such as marriage, divorce, birth, or death. By keeping your beneficiary information up to date, you can safeguard your legacy and provide for your loved ones in the event of your passing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ira beneficiary update?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific ira beneficiary update and other forms. Find the template you need and change it using powerful tools.

How do I execute ira beneficiary update online?

Completing and signing ira beneficiary update online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit ira beneficiary update straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing ira beneficiary update, you can start right away.

What is ira beneficiary update?

An IRA beneficiary update is a form that allows the account holder to designate or update the beneficiaries who will inherit the funds in their Individual Retirement Account (IRA) upon their passing.

Who is required to file ira beneficiary update?

Any individual who has an IRA account and wishes to designate or update beneficiaries must file an IRA beneficiary update form.

How to fill out ira beneficiary update?

To fill out an IRA beneficiary update, the account holder must provide their personal information, the names of the beneficiaries, their relationship to the account holder, and the percentage of the account balance they will inherit.

What is the purpose of ira beneficiary update?

The purpose of an IRA beneficiary update is to ensure that the account holder's assets are distributed according to their wishes upon their passing, and to avoid potential conflicts or legal issues among beneficiaries.

What information must be reported on ira beneficiary update?

The IRA beneficiary update form must include the account holder's personal information, the beneficiaries' names, their relationship to the account holder, and the percentage of the account balance they will inherit.

Fill out your ira beneficiary update online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Beneficiary Update is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.