Get the free Tax Insights: GST/HST and QST elections for nil consideration Form will have to be f...

Show details

Tax Insights from Indirect Tax Services Issue 2014-43 GST/HST and ST elections for nil consideration: Form will have to be filed! November 5, 2014, In brief The GST/HST and ST rules allow members

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax insights gsthst and

Edit your tax insights gsthst and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax insights gsthst and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax insights gsthst and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax insights gsthst and. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax insights gsthst and

How to Fill Out Tax Insights GST/HST and:

01

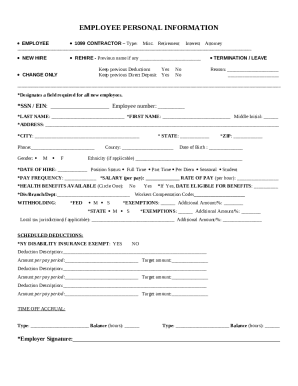

Gather all necessary documents and information: Before starting to fill out the tax insights GST/HST form, make sure you have all the relevant documents at hand. This may include sales receipts, purchase invoices, financial statements, and any other pertinent records. Additionally, ensure you have the necessary information, such as your business number and reporting period.

02

Determine the applicable tax rate: Depending on your location and the nature of your business, different tax rates may apply. Research the current GST/HST rates and determine the one that applies to your transactions. This will help you correctly calculate the amount of tax owed or refundable.

03

Start with the basics: Begin filling out the tax insights GST/HST form by providing your business information, including your legal name, business number, and reporting period. Double-check this information to avoid any mistakes.

04

Input your sales information: In this section, report your taxable sales made during the reporting period. Ensure to separate zero-rated sales, exempt sales, and sales subject to the GST/HST. This will help determine the appropriate amount of tax to apply.

05

Include your eligible input tax credits (ITCs): On the form, you can claim ITCs for the GST/HST you paid on purchases related to your business activities. Carefully calculate the total eligible amount and input it in the appropriate section. This will help reduce the total GST/HST amount payable.

06

Calculate the net tax: Subtract the total ITCs from the total GST/HST charged on your taxable sales. The result will be the net tax amount. Record this figure on the form.

07

Report any adjustments: If there are any adjustments to be made, such as rebates or changes to previously reported amounts, ensure to include them in the appropriate sections. Provide accurate details and calculations to avoid discrepancies.

08

Review and submit: Before submitting the tax insights GST/HST form, take the time to review all the information you have provided. Check for any errors or omissions, as these can lead to penalties or delays in processing. Once satisfied, submit the form as per the instructions provided.

Who needs tax insights GST/HST and:

01

Business owners and self-employed individuals: If you operate a business or work as a self-employed individual in Canada, you may be required to report and remit GST/HST through the tax insights GST/HST form. This applies to various industries, including retail, services, and manufacturing.

02

Registered charities and non-profit organizations: Certain exceptions and exemptions may apply for registered charities and non-profit organizations, depending on the nature of their activities. However, they may still need to complete the tax insights GST/HST form to fulfill their reporting obligations.

03

Individuals selling goods or services online: With the rise of e-commerce platforms, many individuals are engaged in online selling. If your online sales meet the threshold set by the Canada Revenue Agency, you may need to register for GST/HST and report it through the tax insights GST/HST form.

Note: It is essential to consult with a tax professional or refer to the official guidelines provided by the Canada Revenue Agency to ensure compliance with the latest regulations and requirements related to tax insights GST/HST and its filing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax insights gsthst and?

Tax insights gsthst is a tool or report that provides detailed analysis and interpretation of GST/HST tax data to help businesses make informed decisions.

Who is required to file tax insights gsthst and?

Businesses that are registered for GST/HST and want to have a better understanding of their tax data are required to file tax insights gsthst.

How to fill out tax insights gsthst and?

Tax insights gsthst can be filled out by using specialized software or by hiring a tax professional who can analyze and interpret the data for you.

What is the purpose of tax insights gsthst and?

The purpose of tax insights gsthst is to help businesses understand their tax data better, identify trends, and make informed decisions regarding their GST/HST obligations.

What information must be reported on tax insights gsthst and?

Tax insights gsthst must include details such as taxable sales, input tax credits, GST/HST collected and remitted, and any adjustments made to the tax data.

Can I create an electronic signature for the tax insights gsthst and in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your tax insights gsthst and and you'll be done in minutes.

Can I create an electronic signature for signing my tax insights gsthst and in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your tax insights gsthst and and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I fill out tax insights gsthst and on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your tax insights gsthst and by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your tax insights gsthst and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Insights Gsthst And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.