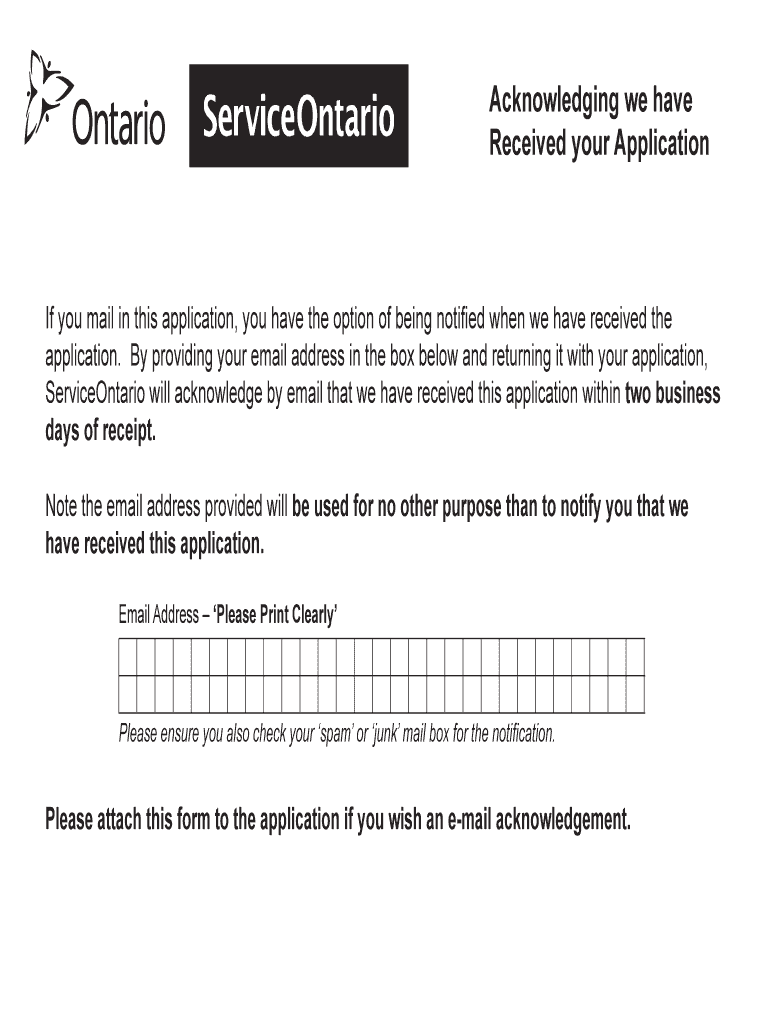

Get the free days of receipt - forms ssb gov on

Show details

This form is to be used for voluntary dissolution of a business corporation only where the corporation has not issued.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign days of receipt

Edit your days of receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your days of receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing days of receipt online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit days of receipt. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out days of receipt

How to fill out days of receipt:

01

Write the date of the receipt in the designated space. It is important to accurately record the day the transaction took place.

02

Fill in the month and year of the receipt as well. This will help to organize and track your expenses over time.

03

If applicable, indicate the specific days covered by the receipt. For example, if the receipt is for a meal or travel expense, you can note the specific days that the expense occurred.

04

Be sure to include any relevant details or descriptions of the purchased items or services. This will provide clarity and reference for future use.

05

Double-check all the information entered to ensure accuracy before submitting or filing the receipt.

Who needs days of receipt:

01

Small business owners and entrepreneurs: Keeping track of the days of receipt is crucial for accurately tracking expenses, calculating profits, and preparing tax returns.

02

Employees seeking reimbursement: If you have incurred expenses on behalf of your company or organization, submitting receipts with the days clearly mentioned helps in proper documentation and reimbursement processes.

03

Individuals managing personal finances: By recording the days of receipt, you can effectively monitor your spending habits, analyze patterns, and identify areas where you may need to make adjustments or cut down on expenses.

04

Freelancers and self-employed professionals: If you work on a project basis or provide services, documenting the days of receipt is essential for billing clients, tracking income, and maintaining financial records.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit days of receipt online?

The editing procedure is simple with pdfFiller. Open your days of receipt in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I edit days of receipt on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing days of receipt.

How do I complete days of receipt on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your days of receipt from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is days of receipt?

Days of receipt refers to the number of days it takes for a company to receive payment for goods or services.

Who is required to file days of receipt?

Any business or individual who receives payment for goods or services is required to file days of receipt.

How to fill out days of receipt?

To fill out days of receipt, you need to track the date of payment received for each transaction and calculate the number of days it took to receive payment.

What is the purpose of days of receipt?

The purpose of days of receipt is to track the efficiency of a company's accounts receivable process and monitor cash flow.

What information must be reported on days of receipt?

The information reported on days of receipt includes the date of payment received, the invoice number, and the number of days it took to receive payment.

Fill out your days of receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Days Of Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.