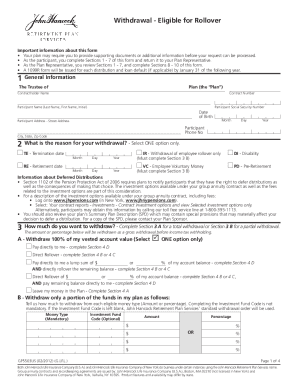

UK HMRC Form C1 Confirmation 2021-2025 free printable template

Show details

Confirmation

Uses this form when applying for confirmation in Scotland and the deceased died on or after 1 January 2022.

Your name and addressYour reference HM Revenue and Customs reference (where

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign c1 confirmation form

Edit your uk scotland confirmation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your c1 confirmation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit uk c1 scotland confirmation pdf online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form c1 scotland confirmation. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC Form C1 Confirmation Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form scotland confirmation

How to fill out UK HMRC Form C1 Confirmation

01

Obtain the UK HMRC Form C1 Confirmation from the official HMRC website or your local tax office.

02

Fill in your personal details, including your name, address, National Insurance number, and other required identification.

03

Provide details of the tax year or period for which you are confirming information.

04

State the reason for submitting the form, such as a change in circumstances or rectifying previous information.

05

Review the filled-out form for accuracy and completeness.

06

Sign and date the form at the designated area.

07

Send the completed form to the appropriate HMRC address specified in the form's instructions.

Who needs UK HMRC Form C1 Confirmation?

01

Individuals who need to confirm their tax information with HMRC.

02

Taxpayers who have received a request from HMRC to provide additional information.

03

Those who are correcting previously submitted tax details.

04

Anyone who has changed their circumstances affecting their tax status.

Fill

united kingdom revenue customs

: Try Risk Free

People Also Ask about c1 confirmation pdf

What is HMRC declaration form?

Use this form to tell HM Revenue and Customs (HMRC) how you have disposed of goods entered into the UK under the following customs procedures: • Inward Processing (IP) using an authorisation by declaration If you do not complete this form and send it to HMRC you'll have to pay any duty and import VAT due on the goods.

What is a HMRC declaration?

FORM TO BE COMPLETED IN BLOCK CAPITALS. ALL SECTIONS MUST BE COMPLETED. From 4 April 2022, licensing authorities must carry out certain checks on applications from individuals, companies and any type of partnership to make sure they are aware of their tax responsibilities or have completed a tax check.

What is a C160 form?

You will be sent a customs declaration form (C88 or C160) which you must complete and return to the Border Force at the Postal Depot before your package can be delivered.

What is the UK equivalent of the IRS?

HM Revenue & Customs - GOV.UK.

What is the customs declaration form for USA to UK?

The C108 form is used by visitors to the United Kingdom to declare personal belongings to Customs, and to claim any applicable duty or tax-free relief.

What is the US equivalent of HMRC?

The HMRC is the British equivalent of the Internal Revenue Service (IRS) in the United States.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete c1 confirmation printable online?

pdfFiller has made filling out and eSigning c1 scotland confirmation easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How can I edit c1 confirmation download on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing c1 confirmation template.

Can I edit c1 confirmation fillable on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign c1 confirmation online. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is UK HMRC Form C1 Confirmation?

UK HMRC Form C1 Confirmation is a form that confirms a company's compliance with its tax obligations and provides HM Revenue and Customs with relevant information regarding its tax status.

Who is required to file UK HMRC Form C1 Confirmation?

Companies that are registered in the UK and have tax obligations, such as those required to complete corporation tax returns, are required to file UK HMRC Form C1 Confirmation.

How to fill out UK HMRC Form C1 Confirmation?

To fill out UK HMRC Form C1 Confirmation, a company must provide accurate details about its financials, confirm its compliance with tax laws, and include any necessary documentation as specified by HMRC.

What is the purpose of UK HMRC Form C1 Confirmation?

The purpose of UK HMRC Form C1 Confirmation is to confirm a company's tax status and compliance with tax regulations, ensuring that HMRC has current and accurate information about the company.

What information must be reported on UK HMRC Form C1 Confirmation?

Information that must be reported on UK HMRC Form C1 Confirmation includes the company's name, registration number, financial details, tax compliance status, and any other pertinent information required by HMRC.

Fill out your uk c1 scotland confirmation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Example Of Completed c1 Form is not the form you're looking for?Search for another form here.

Keywords relevant to confirmation c1

Related to c1 confirmation sample

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.