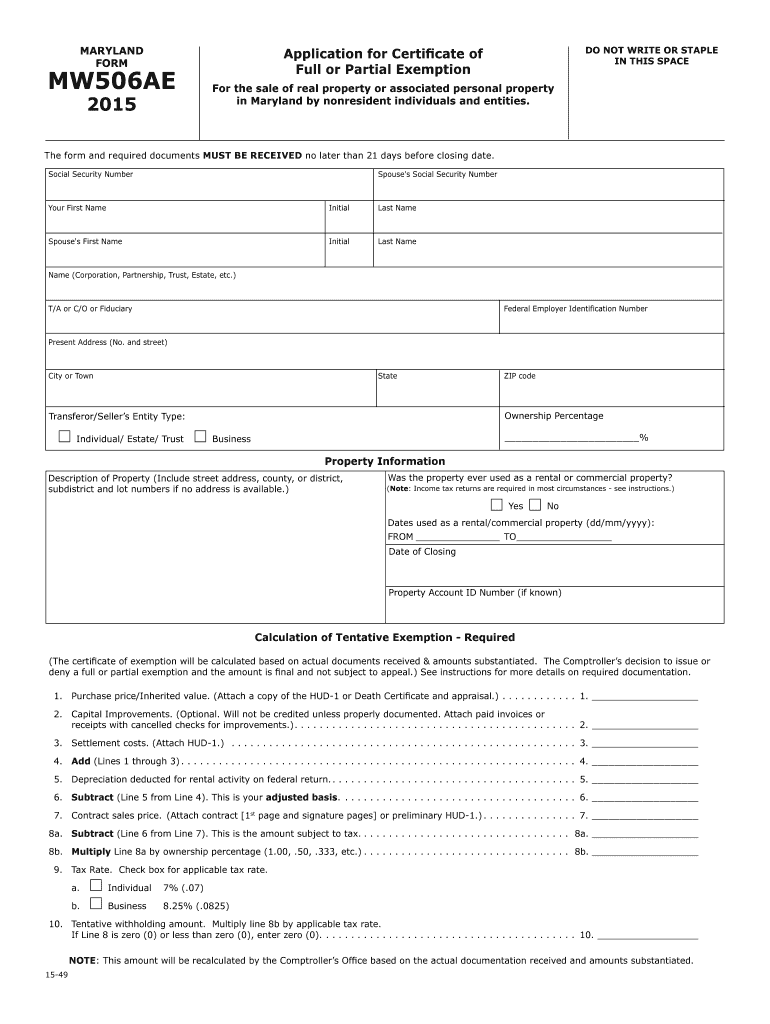

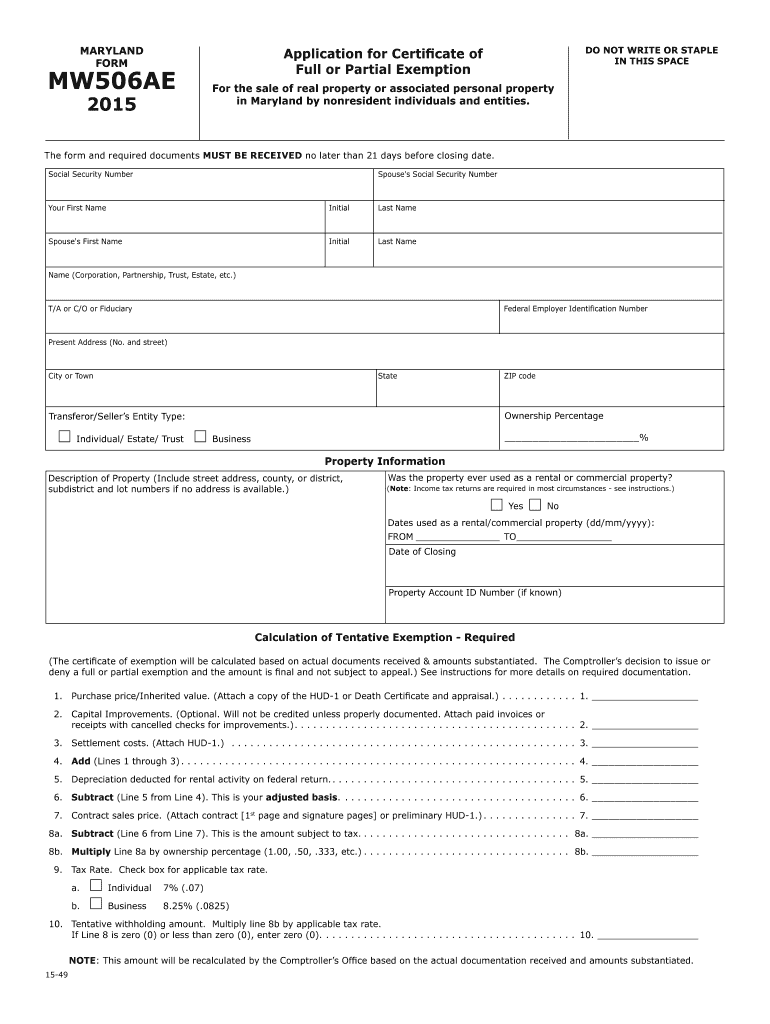

MD Comptroller MW506AE 2015 free printable template

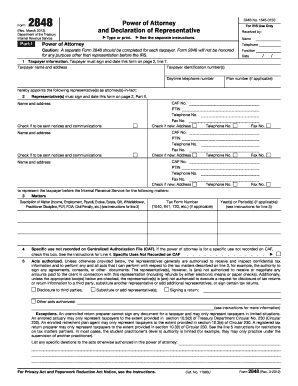

Get, Create, Make and Sign md form mw506ae 2015

How to edit md form mw506ae 2015 online

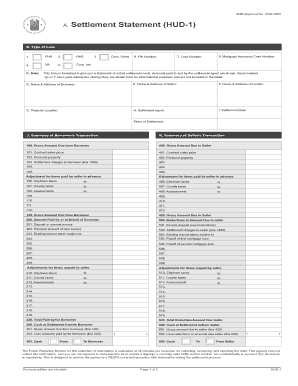

Uncompromising security for your PDF editing and eSignature needs

MD Comptroller MW506AE Form Versions

How to fill out md form mw506ae 2015

How to fill out MD Comptroller MW506AE

Who needs MD Comptroller MW506AE?

Instructions and Help about md form mw506ae 2015

You're voting on the ballot scanner is as easy as 123 step 1 mark your selections a poll worker will issue you a paper ballot take your ballot to an available voting booth be sure to use the marketing device supplied at the polling location as a first step you will need to completely fill in the Oval next to your selection avoid making any other marks on your ballot it is important that you mark your ballot properly to ensure that your votes are counted correctly make sure you mark your selection in all the races that you intend to vote selecting no more than the number of choices allowed step 2 review your selections review your selections marked on the paper ballot if you are satisfied take your ballot to the ballot scanner step 3 cast your ballot the display screen will provide instructions on how to insert your ballot into the tray the ballot scanner accepts ballots in any orientation for example you can insert the ballot upside down or backwards a scanning ballot please wait messages display during the scanning process a prompt will appear if no marks are detected or if you select more than the number of choices allow if you'd like to change your selections press return ballot on the touchscreen and your valid will be returned you may need to ask a poll worker to give you a new ballot if you prefer to cast your ballot as is select cast your ballot with mistakes on the touchscreen if your ballot is filled out properly it will automatically be accepted and the display screen will notify you once it has been cast successfully the DS 200 digital scanner is a simple to use yet cutting-edge solution for more information visit the Maryland Board of Elections website at elections Maryland gov

People Also Ask about

Are Maryland tax forms available?

What is Maryland Form mw506nrs?

What is a MW506NRS form for?

What is Maryland form MW507?

What is Maryland nonresident withholding?

What is the Maryland withholding form?

Does Maryland tax non resident income?

What is a MW508 form?

Should I claim exemption from withholding Maryland?

What is Maryland non resident withholding tax?

What is the Maryland withholding tax?

What is non resident tax withheld?

What is mw506ae?

What is Maryland Form mw506ae?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in md form mw506ae 2015 without leaving Chrome?

How do I fill out md form mw506ae 2015 using my mobile device?

How do I edit md form mw506ae 2015 on an iOS device?

What is MD Comptroller MW506AE?

Who is required to file MD Comptroller MW506AE?

How to fill out MD Comptroller MW506AE?

What is the purpose of MD Comptroller MW506AE?

What information must be reported on MD Comptroller MW506AE?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.