Get the free Accounting For Bonds Payable - principlesofaccounting.com

Show details

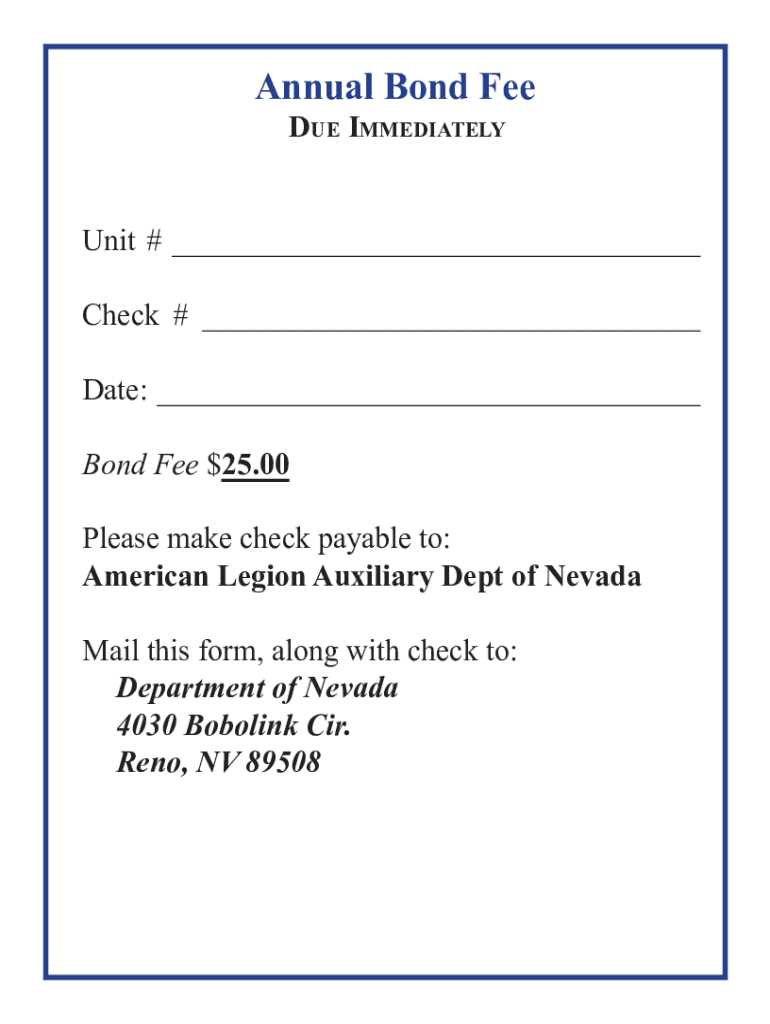

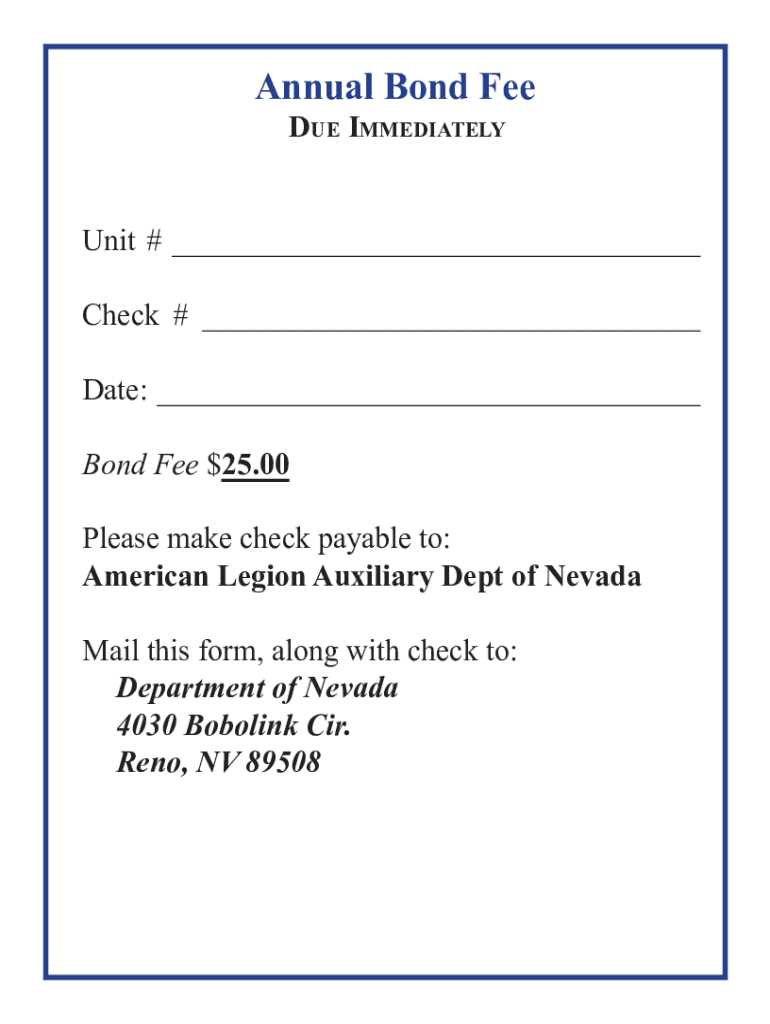

Annual Bond Fee Due ImmeDIatelyUnit # ___ Check # ___ Date: ___ Bond Fee $25.00 Please make check payable to: American Legion Auxiliary Dept of Nevada Mail this form, along with check to: Department

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounting for bonds payable

Edit your accounting for bonds payable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounting for bonds payable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accounting for bonds payable online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit accounting for bonds payable. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounting for bonds payable

How to fill out accounting for bonds payable

01

Determine the principal amount of the bond, which is the amount borrowed from investors.

02

Calculate the interest rate on the bond, which is the annual interest rate paid to investors.

03

Determine the term of the bond, which is the length of time until the bond matures.

04

Calculate the bond issue price, which is the present value of the future cash flows associated with the bond.

05

Record the bond issuance, debiting cash for the amount received from investors and crediting bonds payable for the principal amount of the bond.

06

Record the periodic interest expense, debiting interest expense for the interest paid to investors and crediting cash for the cash payment.

07

Record the periodic bond amortization, debiting interest expense for the amortized portion of the bond premium or crediting interest expense for the amortized portion of the bond discount.

08

Record the bond maturity, debiting bonds payable and interest expense for the remaining principal and interest owed to investors and crediting cash for the payment.

Who needs accounting for bonds payable?

01

Companies that issue bonds to raise capital.

02

Investors who purchase bonds as an investment.

03

Financial analysts who analyze a company's financial statements.

04

Credit rating agencies that assess a company's creditworthiness.

05

Government regulators who monitor compliance with accounting standards.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send accounting for bonds payable for eSignature?

accounting for bonds payable is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I get accounting for bonds payable?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the accounting for bonds payable in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit accounting for bonds payable straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing accounting for bonds payable right away.

What is accounting for bonds payable?

Accounting for bonds payable involves recording the issuance, interest expense, and eventual repayment of bonds issued by a company.

Who is required to file accounting for bonds payable?

Companies that issue bonds as a form of borrowing capital are required to file accounting for bonds payable.

How to fill out accounting for bonds payable?

To fill out accounting for bonds payable, companies must record the initial bond issuance, interest payments, and eventual repayment of the principal amount.

What is the purpose of accounting for bonds payable?

The purpose of accounting for bonds payable is to accurately track the company's obligations related to bond issuance and to provide stakeholders with information on the company's financial position.

What information must be reported on accounting for bonds payable?

Information such as bond issuance date, principal amount issued, interest rate, interest expense, and repayment schedule must be reported on accounting for bonds payable.

Fill out your accounting for bonds payable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounting For Bonds Payable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.