Get the free Family Assets for Independence Modifications and ...

Show details

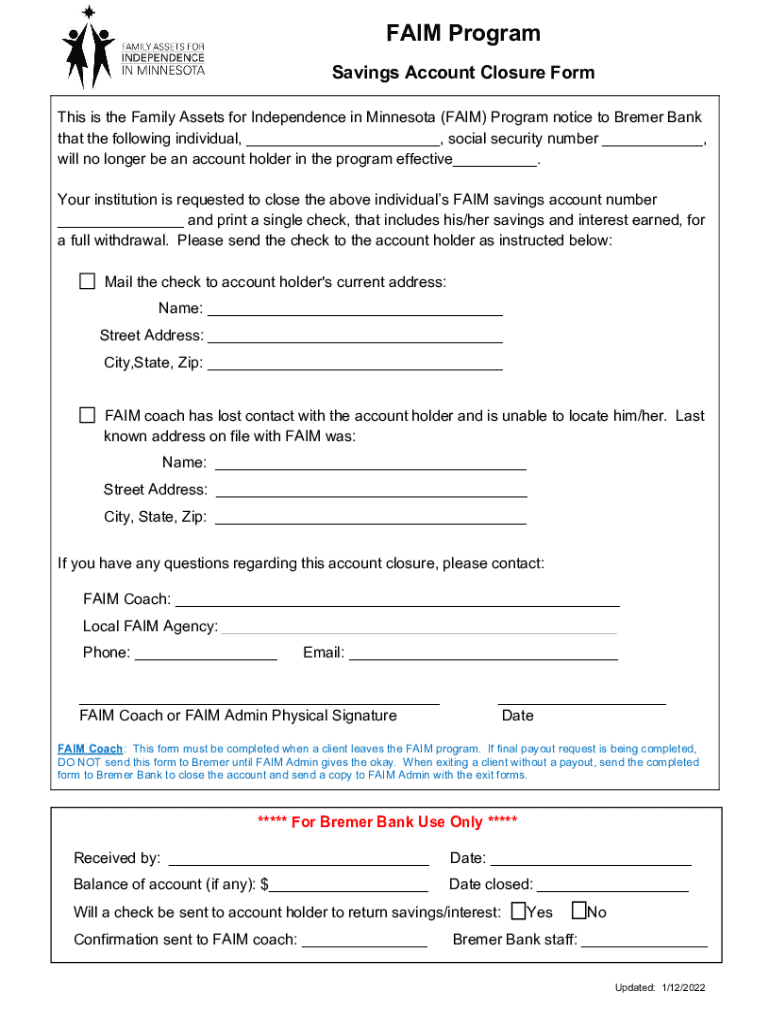

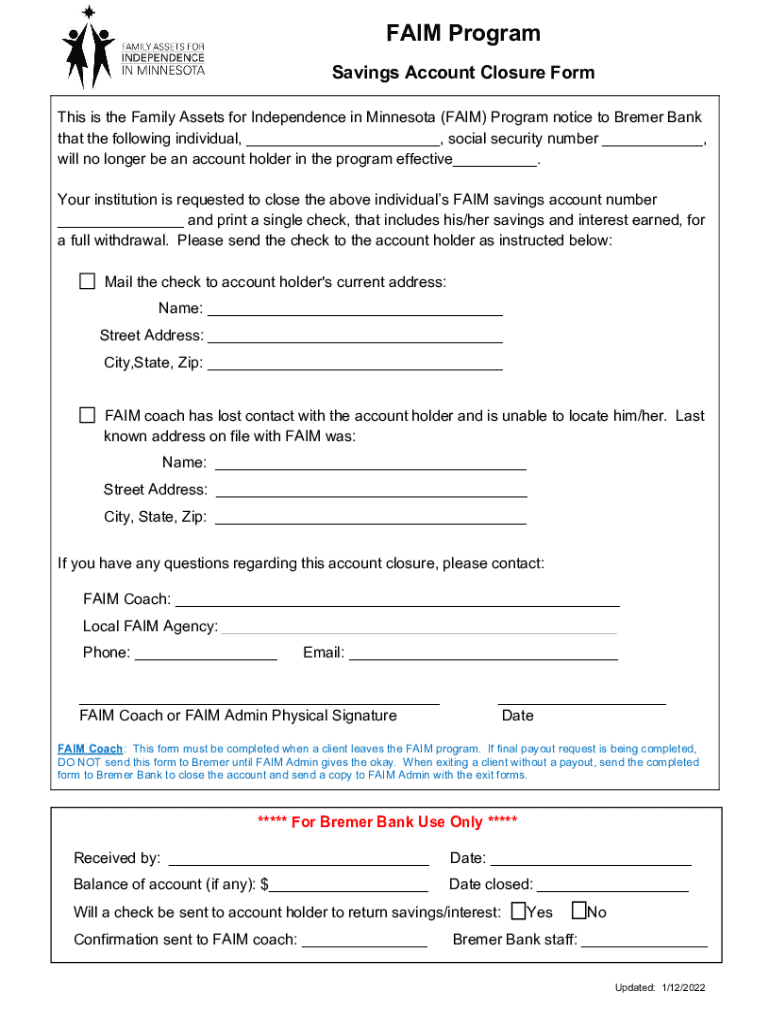

FARM Program Savings Account Closure Form This is the Family Assets for Independence in Minnesota (FARM) Program notice to Bremen Bank that the following individual, ___, social security number ___,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign family assets for independence

Edit your family assets for independence form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your family assets for independence form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit family assets for independence online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit family assets for independence. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out family assets for independence

How to fill out family assets for independence

01

Step 1: Gather all necessary documentation and information regarding your family assets. This includes bank statements, investment portfolios, real estate deeds, vehicle titles, and any other relevant documents.

02

Step 2: Make a comprehensive list of all your family assets, including their current market value. This should include cash, savings accounts, stocks, bonds, mutual funds, retirement accounts, properties, vehicles, jewelry, and any other valuable possessions.

03

Step 3: Determine the ownership structure and division of the family assets. Identify who owns each asset and whether they are marital or separate property.

04

Step 4: Assess any liabilities or debts associated with the family assets. This could include mortgages, loans, credit card debts, or any other outstanding financial obligations.

05

Step 5: Calculate the net worth of the family assets by subtracting the total liabilities from the total asset value.

06

Step 6: Consider the future financial needs and goals of each family member when determining how to allocate the family assets. This may involve creating trust funds, setting up college funds for children, or ensuring sufficient retirement savings.

07

Step 7: Consult with financial advisors, accountants, or attorneys if necessary to ensure the proper valuation and distribution of family assets for independence.

08

Step 8: Update and review your family asset records regularly to reflect any changes, such as acquisitions, sales, or changes in ownership.

09

Step 9: Keep copies of all important documents and store them in a secure location, such as a safety deposit box or a fireproof safe.

10

Step 10: Communicate with your family members about the family assets and the importance of financial independence. Encourage open and honest discussions about financial matters and educate your loved ones about responsible asset management.

Who needs family assets for independence?

01

Anyone who wants to attain financial independence and security can benefit from having family assets. This includes individuals, couples, and families who are looking to build wealth, protect their assets, and plan for the future.

02

Family assets for independence can be particularly beneficial for those going through life transitions, such as marriage, divorce, starting a family, or retirement. It allows individuals to have a clear overview of their financial situation and make informed decisions to achieve their financial goals.

03

Additionally, family assets for independence are important for estate planning purposes. It ensures that your assets are properly managed and distributed according to your wishes, providing peace of mind for you and your loved ones.

04

Overall, family assets for independence are essential for anyone who wants to take control of their financial future and ensure the well-being of their family.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete family assets for independence online?

pdfFiller has made filling out and eSigning family assets for independence easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make edits in family assets for independence without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your family assets for independence, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my family assets for independence in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your family assets for independence and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is family assets for independence?

Family assets for independence refers to the documentation and information submitted to assess a family's financial situation and eligibility for assistance.

Who is required to file family assets for independence?

The head of the household or the primary caregiver is typically required to file family assets for independence.

How to fill out family assets for independence?

Family assets for independence can typically be filled out online or through a paper form by providing accurate and up-to-date financial information.

What is the purpose of family assets for independence?

The purpose of family assets for independence is to determine the need for financial assistance and support for families in need.

What information must be reported on family assets for independence?

Information such as income, expenses, savings, investments, and debts must be reported on family assets for independence.

Fill out your family assets for independence online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Family Assets For Independence is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.