Get the free Attachment 8 Stamp Duty Baht 20 Proxy (Form B)

Show details

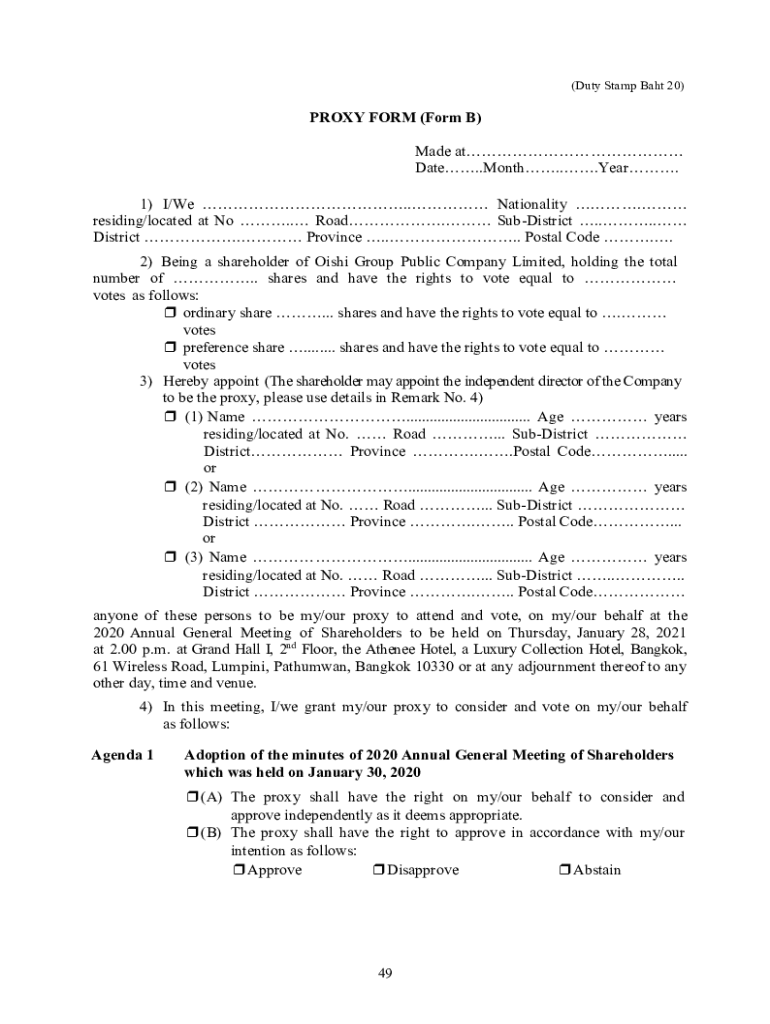

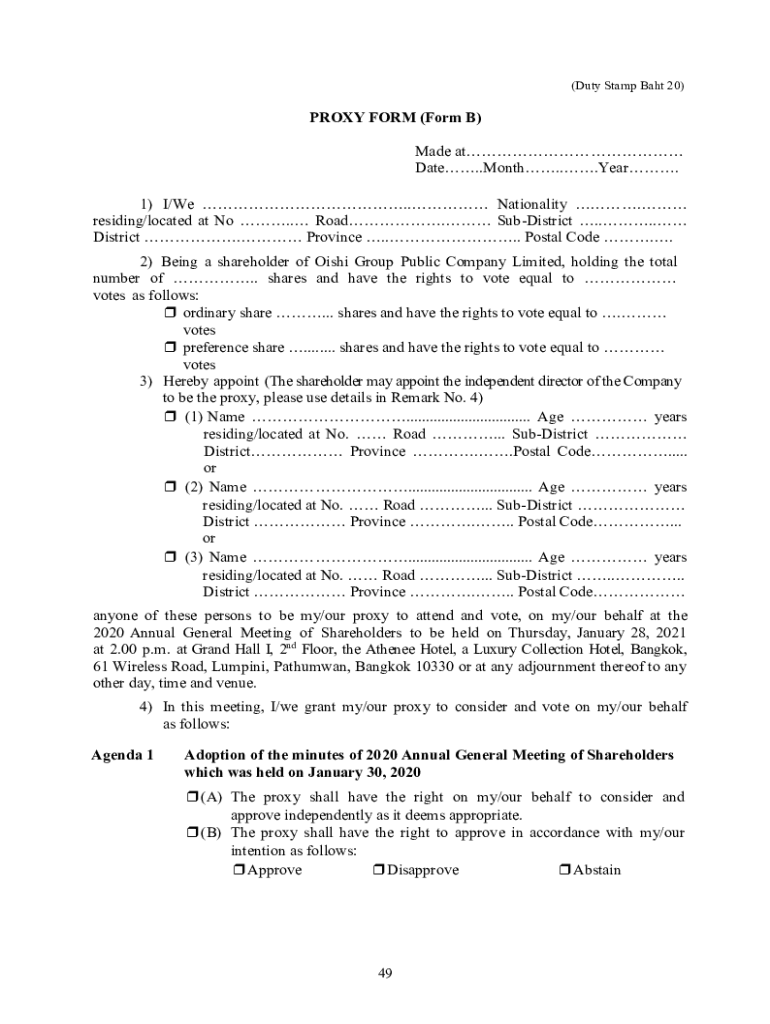

(Duty Stamp Baht 20×PROXY FORM (Form B) Made at Date. Month... Year. 1× I×We. Nationality. Residing/located at No. Road. District .... District. Province .... Postal Code. 2) Being a shareholder

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign attachment 8 stamp duty

Edit your attachment 8 stamp duty form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your attachment 8 stamp duty form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit attachment 8 stamp duty online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit attachment 8 stamp duty. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out attachment 8 stamp duty

How to fill out attachment 8 stamp duty

01

To fill out attachment 8 stamp duty, follow these steps:

02

Start by providing your personal information, such as your name, address, and contact details.

03

Enter the relevant details about the property for which you are calculating stamp duty, such as the address and purchase price.

04

Calculate the stamp duty payable using the prescribed formula or rates provided by your local authorities.

05

Enter the calculated stamp duty amount in the designated field.

06

Double-check all the information provided and make sure it is accurate and complete.

07

Sign and date the attachment 8 form to certify the accuracy of the information.

08

Attach any necessary supporting documents, such as property documents or identification proofs.

09

Submit the completed attachment 8 stamp duty form along with the necessary documents to the appropriate authority or designated office.

10

Pay any required stamp duty fees as per the instructions provided by the relevant authority.

11

Keep a copy of the filled-out attachment 8 form and the payment receipts for your records.

Who needs attachment 8 stamp duty?

01

Attachment 8 stamp duty is typically required by individuals or entities involved in property transactions, such as:

02

- Buyers and sellers of real estate properties

03

- Property developers

04

- Real estate agents or brokers

05

- Mortgage lenders or banks

06

- Government authorities or agencies responsible for property taxation

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute attachment 8 stamp duty online?

With pdfFiller, you may easily complete and sign attachment 8 stamp duty online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit attachment 8 stamp duty in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your attachment 8 stamp duty, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an eSignature for the attachment 8 stamp duty in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your attachment 8 stamp duty right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is attachment 8 stamp duty?

Attachment 8 stamp duty is a tax imposed on certain legal documents or transactions.

Who is required to file attachment 8 stamp duty?

Anyone involved in the specific legal documents or transactions subject to the stamp duty is required to file attachment 8.

How to fill out attachment 8 stamp duty?

To fill out attachment 8 stamp duty, you need to provide accurate information about the legal documents or transactions subject to the stamp duty.

What is the purpose of attachment 8 stamp duty?

The purpose of attachment 8 stamp duty is to generate revenue for the government and discourage certain types of legal transactions.

What information must be reported on attachment 8 stamp duty?

Information such as the nature of the legal document or transaction, the parties involved, and the value of the transaction must be reported on attachment 8 stamp duty.

Fill out your attachment 8 stamp duty online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Attachment 8 Stamp Duty is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.