IL BCA 13.15 2003 free printable template

Show details

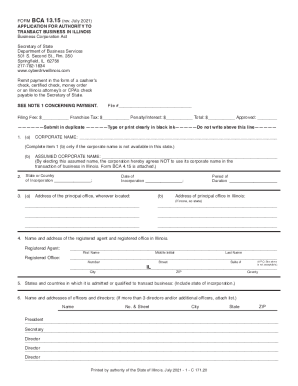

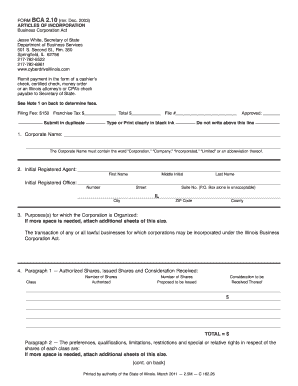

Print FORM BCA 13. 15 rev. Dec. 2003 APPLICATION FOR AUTHORITY TO TRANSACT BUSINESS IN ILLINOIS Business Corporation Act Reset Jesse White Secretary of State Department of Business Services Springfield IL 62756 Telephone 217 782-1834 www. cyberdriveillinois. com Remit payment in the form of a cashier s check certified check money order or an Illinois attorney s or CPA s check payable to the Secretary of State. SEE NOTE 1 CONCERNING PAYMENT File Filing Fee Franchise Tax Penalty/Interest Total...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL BCA 1315

Edit your IL BCA 1315 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL BCA 1315 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL BCA 1315 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IL BCA 1315. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL BCA 13.15 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL BCA 1315

How to fill out IL BCA 13.15

01

Obtain the IL BCA 13.15 form from the Illinois Secretary of State's website or your local office.

02

Fill in the name of the corporation as registered with the Secretary of State.

03

Provide the corporation's file number and principal office address.

04

Indicate the type of report you are submitting and the applicable period covered by the report.

05

Complete all required fields regarding the corporation's business purpose and activities.

06

List the names and addresses of the current officers and directors of the corporation.

07

Include the signature of an authorized officer, along with the date of signing.

08

Review the completed form for accuracy and completeness.

09

Submit the form along with any required fees to the appropriate Illinois Secretary of State office or via the online submission portal.

Who needs IL BCA 13.15?

01

Corporations registered in Illinois that are required to file annual reports.

02

Businesses seeking to maintain good standing with the Illinois Secretary of State.

03

Companies making changes in their business structure or management that need to update their official records.

Fill

form

: Try Risk Free

People Also Ask about

Where do I mail my Illinois annual report?

Personal checks are accepted. Make all forms of payment payable to "Secretary of State." Mail the fee and completed Annual Report to: Secretary of State Department of Business Services Limited Liability Division, 501 S. 2nd Street, Room 351, Springfield, IL 62756.

What are the exemption amounts for franchise taxes in Illinois?

For tax years beginning January 1, 2022, it is $2,425 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,425 or less, your exemption allowance is $2,425. If income is greater than $2,425, your exemption allowance is 0. For the 2021 tax year, it is $2,375 per exemption.

Do LLCs pay franchise tax in Illinois?

While the filing of the annual report comes with an annual registration fee, no actual Franchise tax applies to an LLC or partnership (unless treated as a corporation for tax purposes).

Who has to pay Illinois franchise tax?

Background: Each domestic and foreign Illinois Corporation is required to pay franchise tax at the time of filing its first report of issued shares (articles of Incorporation or application for authority) for the privilege of exercising its franchises in the State of Illinois.

How do I fill out a corporate annual report in Illinois?

Here's a complete list of everything you'll need to include, verify, and/or update on the Illinois Annual Report: Business file number. Business name. Registered agent name and address. Business address. State or country of formation. Date of formation or registration in the state.

Do you have to pay yearly for LLC in Illinois?

After you form an LLC in Illinois, you must file an Annual Report and pay a $75 fee every year. You need to file your Annual Report in order to keep your Illinois LLC in compliance and in good standing with the Illinois Secretary of State.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IL BCA 1315 directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your IL BCA 1315 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send IL BCA 1315 to be eSigned by others?

When you're ready to share your IL BCA 1315, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit IL BCA 1315 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share IL BCA 1315 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is IL BCA 13.15?

IL BCA 13.15 is a form used in Illinois for the annual report of certain business entities, particularly those registered under the Illinois Business Corporation Act.

Who is required to file IL BCA 13.15?

All domestic and foreign corporations that are authorized to do business in Illinois are required to file IL BCA 13.15 annually.

How to fill out IL BCA 13.15?

To fill out IL BCA 13.15, you need to provide the corporation's name, address, names of the officers and directors, and other required information. Fill in any additional sections as specified by the form instructions.

What is the purpose of IL BCA 13.15?

The purpose of IL BCA 13.15 is to maintain updated information about a corporation's structure, management, and to ensure compliance with state requirements.

What information must be reported on IL BCA 13.15?

IL BCA 13.15 requires reporting of the corporation's name, principal office address, names and addresses of officers and directors, and any other information required by the Illinois Secretary of State.

Fill out your IL BCA 1315 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL BCA 1315 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.