Get the free 2014 ESTATE AND TRUST INCOME TAX RETURN CHECKLIST - aicpa

Show details

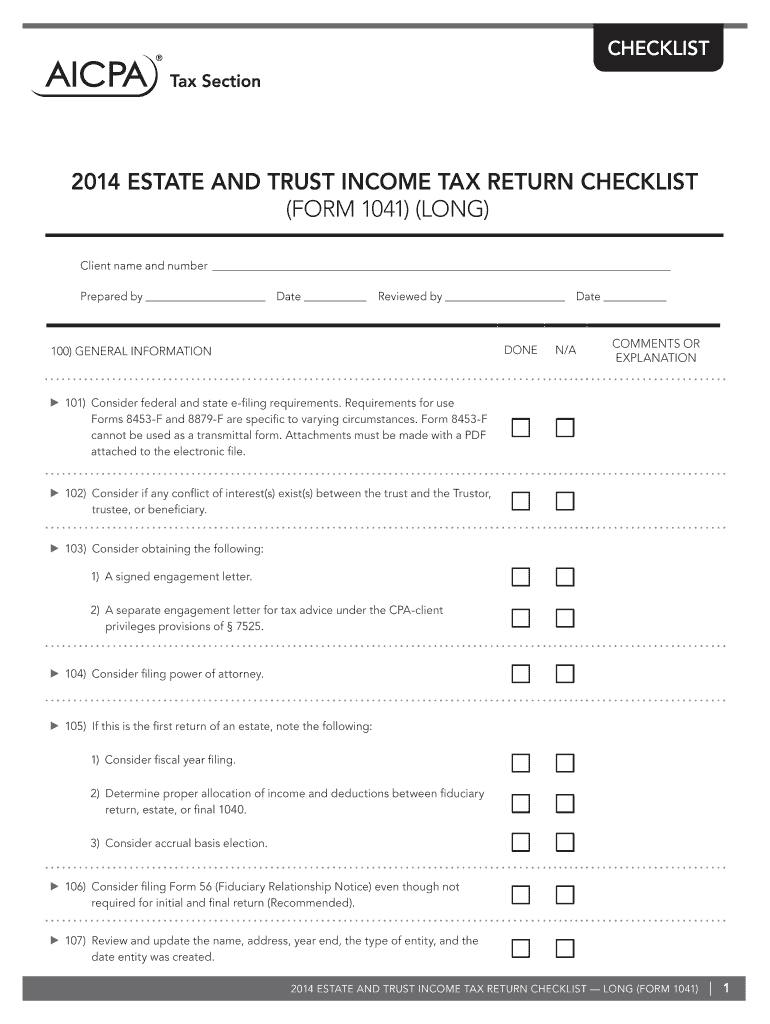

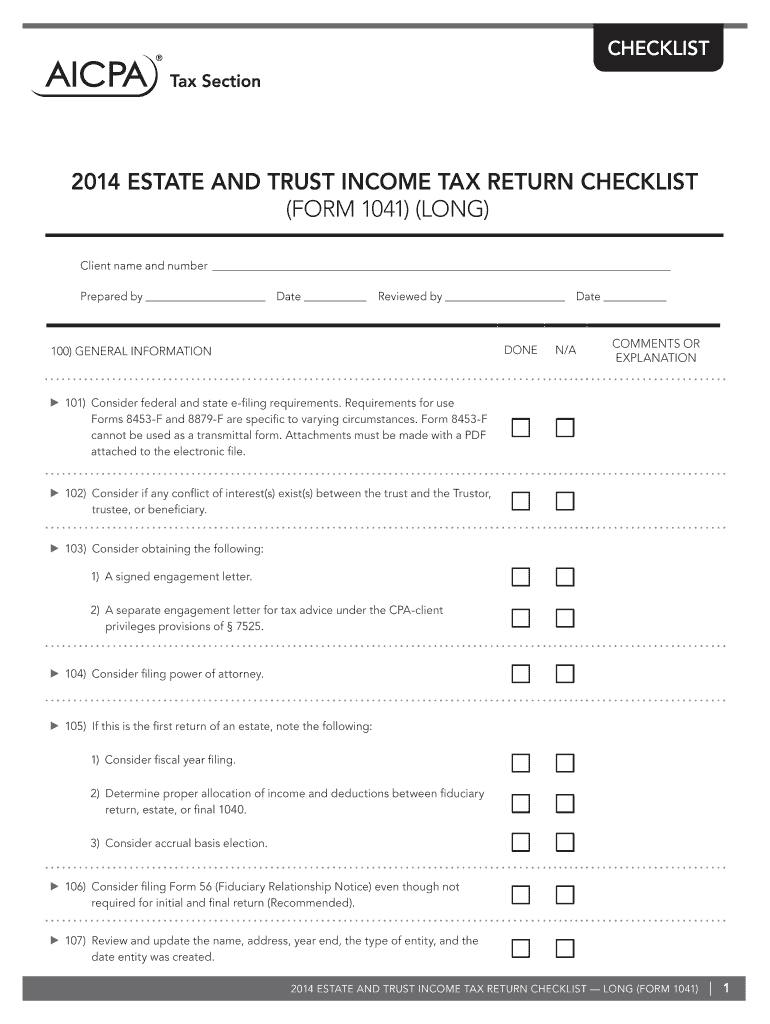

CHECKLIST 2014 ESTATE AND TRUST INCOME TAX RETURN CHECKLIST (FORM 1041) (LONG) Client name and number Prepared by Date Reviewed by DONE 100) GENERAL INFORMATION Date N/A COMMENTS OR EXPLANATION 101)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2014 estate and trust

Edit your 2014 estate and trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2014 estate and trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2014 estate and trust online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2014 estate and trust. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2014 estate and trust

How to fill out 2014 estate and trust:

01

Gather all necessary documents: Before starting the process, make sure you have all the required documents handy. These may include the decedent's will, asset information, tax identification numbers, and any relevant financial statements.

02

Determine the assets: Assess the decedent's assets and determine which ones are part of the estate and should be included in the trust. This may include property, bank accounts, investments, and any other valuable possessions.

03

Appoint a trustee: Select a trustworthy individual or institution to act as the trustee of the estate and trust. They will be responsible for managing the assets, ensuring they are distributed as per the instructions, and handling any legal and financial matters.

04

Understand the tax implications: Familiarize yourself with the tax laws and regulations specific to trusts and estates in the year 2014. This will help you accurately report any income, deductions, and credits related to the trust.

05

Prepare the necessary tax forms: Use the appropriate tax forms for reporting the estate and trust's taxable income. In 2014, this may include Form 1041 for federal income tax returns and any state-specific forms required.

06

Determine beneficiaries: Identify the beneficiaries entitled to receive assets from the estate and trust. This could be family members, charities, or any other designated individuals or organizations mentioned in the estate planning documents.

07

Distribute assets: Follow the instructions outlined in the trust to distribute the assets to the beneficiaries. This may involve selling property, transferring ownership of financial accounts, or distributing personal belongings.

Who needs 2014 estate and trust?

01

Individuals with substantial assets: Those who have accumulated considerable wealth may require an estate and trust to ensure their assets are protected, managed, and distributed according to their wishes after their passing.

02

Guardians of minors: If the estate includes assets that are meant to be managed on behalf of minors, establishing a trust can provide a designated trustee with authority to handle those assets until the minors reach adulthood.

03

Individuals with complex family dynamics: For those who have complex family situations or specific desires about how their assets should be distributed, a trust can help establish clear instructions that minimize conflicts and ensure beneficiaries are taken care of.

In summary, filling out the 2014 estate and trust requires gathering necessary documents, assessing assets, appointing a trustee, understanding tax implications, preparing tax forms, determining beneficiaries, and distributing assets. It is beneficial for individuals with substantial assets, guardians of minors, and individuals with complex family dynamics.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2014 estate and trust in Gmail?

2014 estate and trust and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit 2014 estate and trust from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including 2014 estate and trust. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I fill out the 2014 estate and trust form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign 2014 estate and trust and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is estate and trust income?

Estate and trust income refers to income generated from assets held in an estate or trust.

Who is required to file estate and trust income?

Trustees or executors of estates, as well as beneficiaries of trusts are required to file estate and trust income.

How to fill out estate and trust income?

Estate and trust income is typically filled out using IRS Form 1041 for estates and trusts.

What is the purpose of estate and trust income?

The purpose of filing estate and trust income is to report the income generated by the assets held in the estate or trust to the IRS.

What information must be reported on estate and trust income?

Information such as income, deductions, distributions, and beneficiaries must be reported on estate and trust income.

Fill out your 2014 estate and trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2014 Estate And Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.