Get the free IT-135 - tax ny

Show details

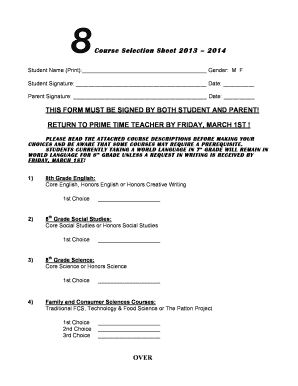

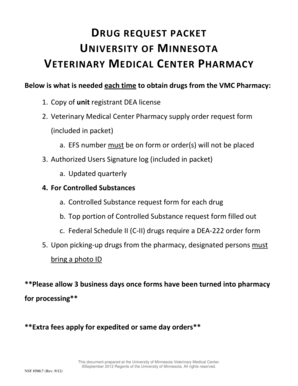

This form is used to report sales or use tax liability on purchases of items or services costing $25,000 or more and must be attached to the appropriate income tax return forms.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-135 - tax ny

Edit your it-135 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-135 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it-135 - tax ny online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit it-135 - tax ny. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-135 - tax ny

How to fill out IT-135

01

Gather all necessary documents related to your tax information.

02

Download the IT-135 form from the official tax website or obtain a physical copy.

03

Start by filling out your personal information at the top of the form, including your name, address, and Social Security number.

04

Complete the section regarding your income by providing details of any wages, salary, or other earnings.

05

Input any deductions or credits you may be eligible for in the appropriate sections.

06

Carefully review your entries to ensure accuracy and completeness.

07

Sign and date the form at the bottom once you have finished filling it out.

08

Submit the form according to the instructions, either electronically or via mail.

Who needs IT-135?

01

Individuals who are residents of the state and need to report their income tax.

02

People claiming specific tax deductions or credits outlined in the IT-135 instructions.

03

Any taxpayer who meets the filing requirements as set by the state's tax authority.

Fill

form

: Try Risk Free

People Also Ask about

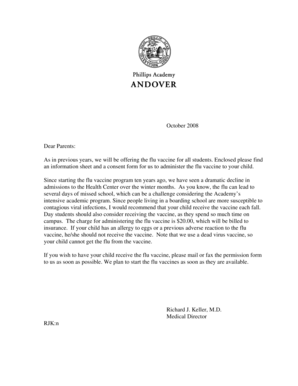

What level of English is advanced?

FAQs about English language levels Proficiency LevelCEFR Intermediate B1 Upper-Intermediate B2 Advanced C1 Mastery C22 more rows

What grade is level 1 English?

Functional Skills English Level 1 is equivalent to a GCSE English grade 1 to 3 (D to G). It's an alternative qualification to GCSE English for adults and GCSE pupils who learn better with practical, real-life examples. Did you find GCSE English difficult and confusing?

Is English composition the same as English 101?

Many U.S. colleges and universities require introductory writing courses like English 101. A curriculum staple, English 101 — sometimes called writing 101, English composition, or a number of similar names — helps students polish crucial skills like analysis and argumentation.

What is English 114 in college?

English 114: Writing Seminars teach students to compose well-reasoned and nuanced academic arguments through their engagement with a variety of perspectives in cross- disciplinary readings and multimodal texts.

What is English 135?

ENG-135: Business and Technical Writing and Research.

Is English 1 advanced?

Honors English 1 is designed for advanced students in 9th grade (14+) and above seeking an introductory high school English class that will acquaint you with the arts of examining and writing about literature analytically, writing soundly and creatively, reading introspectively, and hammering down grammar and

What is advanced English 1?

Advanced English 1 (Meets A-G requirements) Advanced English 1 is fast paced course with increased expectations for reading and writing. There is an increased emphasis on critical thinking in this course, and students are expected to participate in Socratic Seminars on a regular basis.

Is English 1 a high school class?

These include narrative, descriptive, and persuasive writing, literary analysis, basic essay writing, and research and presentation skills. High School English 1 is an introductory writing and composition course for the high school years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IT-135?

IT-135 is a tax form used for reporting certain income and deductions for state tax purposes.

Who is required to file IT-135?

Individuals who have specific types of income or are claiming certain deductions as outlined by state tax regulations are required to file IT-135.

How to fill out IT-135?

To fill out IT-135, you must gather your financial information, follow the instructions provided on the form, and complete each section accurately.

What is the purpose of IT-135?

The purpose of IT-135 is to allow taxpayers to report specific income and deductions, ensuring compliance with state tax laws.

What information must be reported on IT-135?

IT-135 requires information such as income, deductions, and any applicable credits, as well as personal identification details.

Fill out your it-135 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-135 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.