Get the free Application for a VAT refund. OB 068 - 2Z*22FOL ENG

Show details

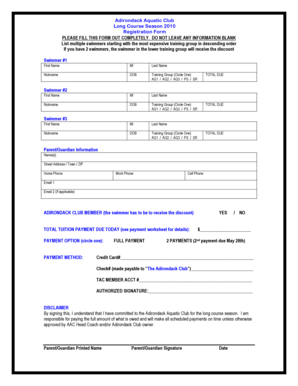

Belastingdienst Application For VAT refund For entrepreneurs based in Bulgaria, Cyprus, Greece, Hungary or Sweden Why this form? If you are an entrepreneur who is based in Bulgaria, Cyprus, Greece,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for a vat

Edit your application for a vat form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for a vat form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for a vat online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for a vat. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for a vat

How to fill out an application for a VAT:

01

Gather the necessary information: Before starting the application process, make sure you have all the required information at hand. This may include your business details such as legal name, address, tax identification number, and contact information.

02

Determine the appropriate application form: Depending on your location and the specific regulations in your country, there may be different application forms for VAT registration. Research and identify the correct form that applies to your situation.

03

Complete the application form: Fill in the application form accurately and completely. Provide all the required information, ensuring that you double-check your entries for errors or omissions. Any incorrect or missing information may delay the processing of your application.

04

Attach supporting documents: The VAT application may require certain supporting documents to be submitted alongside the form. These documents may include copies of your business license, proof of address, identification documents, and any other relevant paperwork. Make sure to include all requested documents as specified in the application guidelines.

05

Review and sign the application: Before submitting your application, review all the information you have provided to ensure its accuracy. Once you are satisfied, sign the application form where required.

06

Submit the application: Depending on the process established by the tax authorities in your country, you may be required to submit the application form and supporting documents physically or electronically. Follow the instructions provided by the relevant tax authority to ensure your application is submitted correctly.

07

Monitor the progress: After submitting your application, keep an eye on the progress and check for any communication from the tax authorities. They may request additional information or clarification, so it is important to respond promptly and provide any required documentation they ask for.

Who needs an application for a VAT:

01

Businesses selling taxable goods or services: Companies involved in the sale of goods or services that are subject to value-added tax (VAT) regulations typically need to apply for a VAT registration.

02

Startups and newly established businesses: When starting a new business or company, it is important to determine whether VAT registration is necessary based on the jurisdiction and applicable thresholds. If your business is expected to exceed the VAT registration threshold, you will likely need to submit an application.

03

Companies engaging in international trade: Businesses involved in importing or exporting goods or services may be required to register for VAT, especially when conducting trade with other countries within the European Union (EU) or jurisdictions with similar tax regulations.

04

Freelancers and self-employed individuals: Depending on the country and the applicable regulations, freelancers and self-employed individuals may also need to apply for a VAT registration if their annual turnover exceeds the specified threshold.

05

Non-profit organizations: In some regions, non-profit organizations may need to register for VAT if they engage in commercial activities or receive income subject to VAT.

Remember, the specific requirements for VAT registration may vary depending on the country and its tax regulations. It is always recommended to consult with a professional tax advisor or the relevant tax authority to ensure compliance with local laws and procedures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit application for a vat online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your application for a vat to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out the application for a vat form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign application for a vat and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit application for a vat on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share application for a vat on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is application for a vat?

The application for a VAT, or value-added tax, is a form used to register for VAT and obtain a VAT identification number.

Who is required to file application for a vat?

Any business or individual that meets the threshold for VAT registration is required to file an application for a VAT.

How to fill out application for a vat?

To fill out the application for a VAT, one must provide information about the business, such as its name, address, and type of business activity.

What is the purpose of application for a vat?

The purpose of the application for a VAT is to register for VAT and obtain a VAT identification number to collect and remit VAT on taxable supplies.

What information must be reported on application for a vat?

The information that must be reported on the application for a VAT includes details about the business, such as its legal structure, turnover, and taxable supplies.

Fill out your application for a vat online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For A Vat is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.