Get the free IT-243 - tax ny

Show details

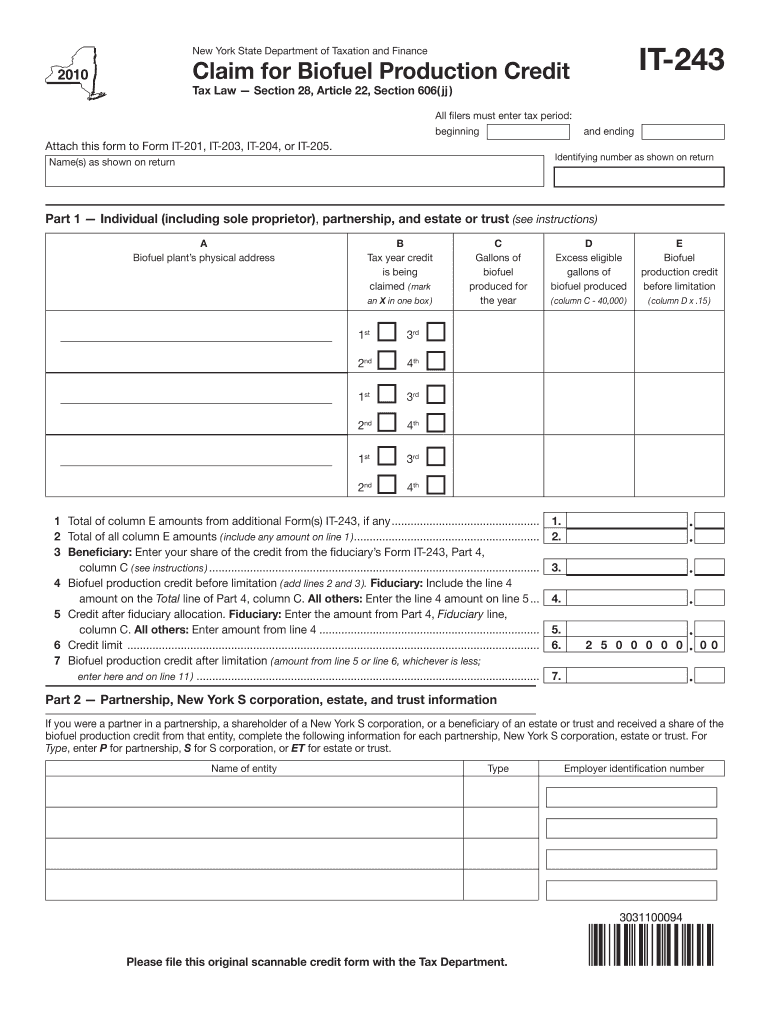

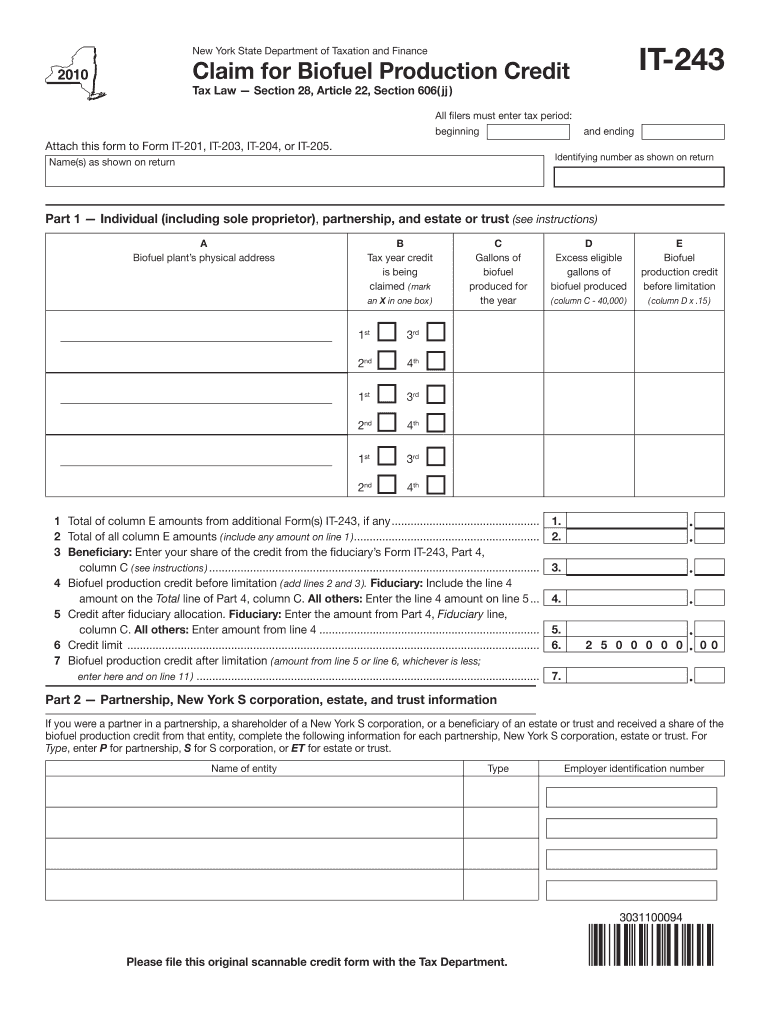

Este formulario se utiliza para reclamar el crédito de producción de biocombustibles según la Ley Fiscal de Nueva York. Los solicitantes deben proporcionar información sobre la producción de

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-243 - tax ny

Edit your it-243 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-243 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it-243 - tax ny online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit it-243 - tax ny. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-243 - tax ny

How to fill out IT-243

01

Obtain the IT-243 form from the official tax website or your local tax office.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Complete the income section by reporting all applicable sources of income.

04

Fill out the deductions section if eligible, providing necessary documentation to support your claims.

05

Review the tax credits available and determine if you qualify for any.

06

Calculate your total tax liability and any refund or amount owed.

07

Sign and date the form before submitting it to the appropriate tax authority.

Who needs IT-243?

01

Individuals who have earned income in the specified tax year.

02

Taxpayers who are claiming specific deductions or credits associated with the IT-243.

03

Residents of the state or jurisdiction where the IT-243 is required for tax filing.

Fill

form

: Try Risk Free

People Also Ask about

Is English 2 a sophomore class?

Course Description: Students explore rhetorical appeals and techniques through the study of essays, short fiction, speeches, and novels. They learn argument, persuasion, and perspective through writing essays, literary analysis, and a research paper, and develop advanced writing skills through peer review and revision.

What is English 2 in college?

What English Majors Say. “I think some people may think it's super easy, like it's English. While I loved my degree, I would say it was equally challenging and stimulating throughout my entire time at UF. It's a lot of rigorous reading and a lot of critical thinking that goes into it.

What is english 242?

This course introduces the student to fiction from the 20th and 21st centuries, with an emphasis on the relation between art and life.

How do you write 243 in English?

243 in English Words We generally write numbers in words using the English alphabet. So, we can spell 243 in English words as “Two hundred forty-three”.

Is the English major a hard major?

AS English II is one of two English course options offered to sophomores. Although it's labeled as advanced, it does not have a grade bump like some other AS classes. With a grade bump, a B is considered a 4.0 for weighted GPA and an A is considered a 5.0.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IT-243?

IT-243 is a tax form used by certain taxpayers in the United States to report their tax liabilities and claims for refund.

Who is required to file IT-243?

Businesses and individuals who meet specific criteria, such as having earned income from certain sources or receiving tax credits, are required to file IT-243.

How to fill out IT-243?

To fill out IT-243, taxpayers need to provide their personal information, income details, and any applicable deductions or credits in the designated sections of the form.

What is the purpose of IT-243?

The purpose of IT-243 is to ensure accurate reporting of income and tax liabilities, as well as to facilitate the claiming of eligible tax credits.

What information must be reported on IT-243?

The information required on IT-243 includes taxpayer identification details, income from various sources, deductions, credits claimed, and any amounts owed or due for refunds.

Fill out your it-243 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-243 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.