Get the free W-2 REPLACEMENT / CORRECTION REQUEST FORM - sftreasurer

Show details

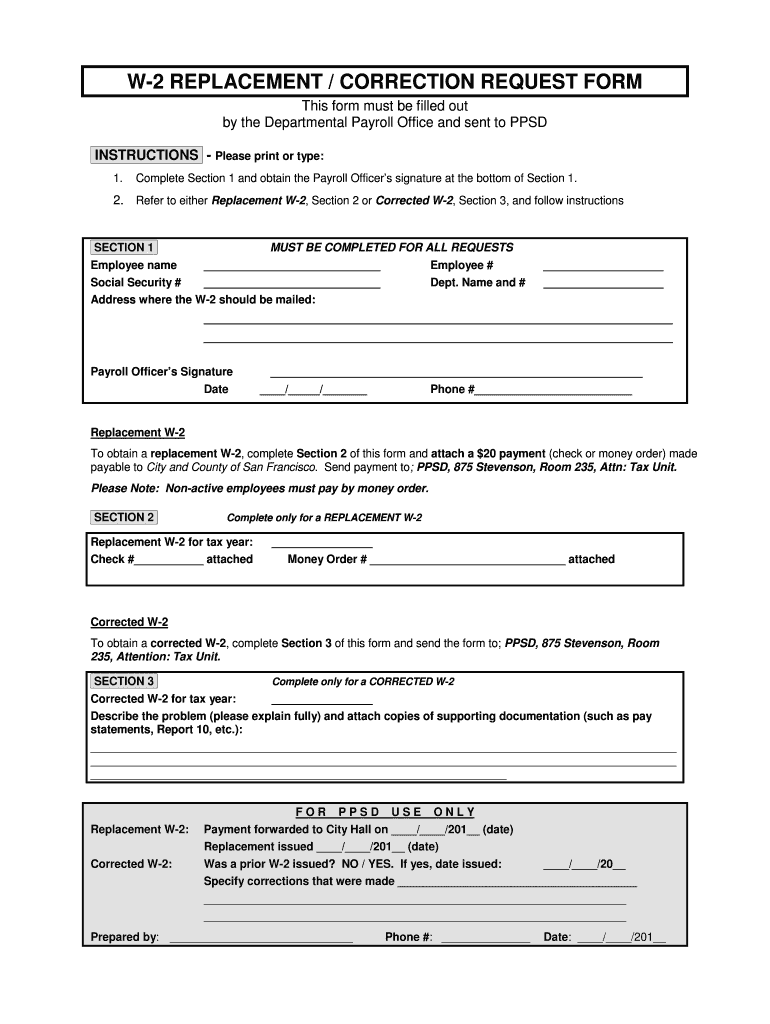

This form is used to request a replacement or correction of a W-2. It must be filled out by the Departmental Payroll Office and includes sections for employee information, payment for replacement,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign w-2 replacement correction request

Edit your w-2 replacement correction request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w-2 replacement correction request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit w-2 replacement correction request online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit w-2 replacement correction request. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out w-2 replacement correction request

How to fill out W-2 REPLACEMENT / CORRECTION REQUEST FORM

01

Obtain the W-2 Replacement / Correction Request Form from the IRS website or your employer.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Specify the tax year for which you are requesting a replacement or correction.

04

Indicate whether you need a replacement due to loss or non-receipt, or if you need a correction for an inaccurate W-2.

05

Provide details about the original W-2, including the employer's name, EIN, and any other relevant details.

06

Sign and date the form to verify that the information is correct.

07

Submit the completed form to the appropriate address as indicated in the instructions.

Who needs W-2 REPLACEMENT / CORRECTION REQUEST FORM?

01

Employees who did not receive their W-2 form.

02

Employees who received an incorrect W-2 and need it corrected.

03

Individuals who need a duplicate W-2 for tax filing purposes.

Fill

form

: Try Risk Free

People Also Ask about

What form is used to replace W-2?

If you cannot get a W-2 from your employer, you can file Form 4852 Substitute for Form W-2, Wage and Tax Statement. TaxAct does not provide Form 4852, so you'll need to print a hard copy of your return, attach Form 4852, and mail it to the IRS.

How to request a corrected W-2?

If you find errors on your W-2, contact your employer's payroll or human resources department, tell them about the problem, and ask them to issue you a corrected W-2. Your employer should correct errors on Form W-2 and send a W-2C, Corrected Wage and Tax Statement form as quickly as possible.

How do I get a replacement copy of my W-2?

In the event you lose your Form W–2, or require a duplicate copy you can download a copy from Cal Employee Connect under the "W-2" tab. You also can request one from the State Controller's Office. To do so you must obtain a Standard Form 436: Request for Duplicate Wage and Tax Statement: As a fill and print PDF form.

How do I write a W-2 correction letter to my employee?

To create a corrected W-2 after filing, use Form W-2c, Corrected Wage and Tax Statement. Employers use Form W-2c to correct errors on Forms W-2 filed with the Social Security Administration. Sometimes, you might send Form W-2c to your employee but not the SSA (explained below).

What happens if your employer messes up your W-2?

Answer: If by the end of February, your Form W-2, Wage and Tax Statement has not been corrected by your employer after you attempted to have your employer or payer issue a corrected form, you can request that an IRS representative initiate a Form W-2 complaint.

How to request a corrected W-2?

Call the IRS toll free at 800-829-1040 or make an appointment to visit an IRS taxpayer assistance center (TAC). The IRS will send your employer a letter requesting that they furnish you a corrected Form W-2 within ten days.

How to make sure your W-2 is correct?

Contact Your Employer: Reach out to your employer or the payroll department as soon as possible. Inform them of the specific error and request a corrected W-2, known as a W-2c. Wait for the Corrected W-2: Your employer should issue a corrected W-2 to you. This form will clearly indicate that it is a correction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is W-2 REPLACEMENT / CORRECTION REQUEST FORM?

The W-2 Replacement/Correction Request Form is a document used by employees to request a replacement or correction of an incorrect W-2 form that has been issued by their employer.

Who is required to file W-2 REPLACEMENT / CORRECTION REQUEST FORM?

Employees who receive an incorrect W-2 form or who need a duplicate of a W-2 form for tax purposes are required to file the W-2 Replacement/Correction Request Form.

How to fill out W-2 REPLACEMENT / CORRECTION REQUEST FORM?

To fill out the W-2 Replacement/Correction Request Form, provide your personal information such as name, address, Social Security number, and the details of the incorrect W-2, including tax year and the reason for the request.

What is the purpose of W-2 REPLACEMENT / CORRECTION REQUEST FORM?

The purpose of the W-2 Replacement/Correction Request Form is to correct any errors on the original W-2 form or to obtain a duplicate copy for filing taxes accurately.

What information must be reported on W-2 REPLACEMENT / CORRECTION REQUEST FORM?

The information that must be reported includes the employee's personal details, the incorrect W-2 details (such as the employer's name, tax year, etc.), and the reason for the correction or replacement request.

Fill out your w-2 replacement correction request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

W-2 Replacement Correction Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.