AU DH1054B 2015 free printable template

Show details

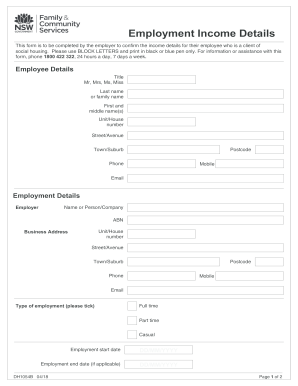

Employment Income Details This form is to be completed by the employer to confirm the income details for their employee who is a client of Social Housing. Please use BLOCK LETTERS and print in black

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AU DH1054B

Edit your AU DH1054B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU DH1054B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU DH1054B online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit AU DH1054B. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU DH1054B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU DH1054B

How to fill out AU DH1054B

01

Obtain the AU DH1054B form from the official website or local government office.

02

Read the instructions carefully to understand the required information.

03

Fill in personal details in the designated sections, such as name, address, and contact information.

04

Provide the necessary identification documentation as specified on the form.

05

Include any additional information that may be required, such as financial details or employment history.

06

Review the form for accuracy and completeness before submission.

07

Submit the completed form according to the instructions provided, either online or in person.

Who needs AU DH1054B?

01

Individuals applying for specific benefits or programs administered by the Australian government.

02

Residents who need to verify their identity for official purposes.

03

Persons seeking assistance or support services that require formal documentation.

Fill

form

: Try Risk Free

People Also Ask about

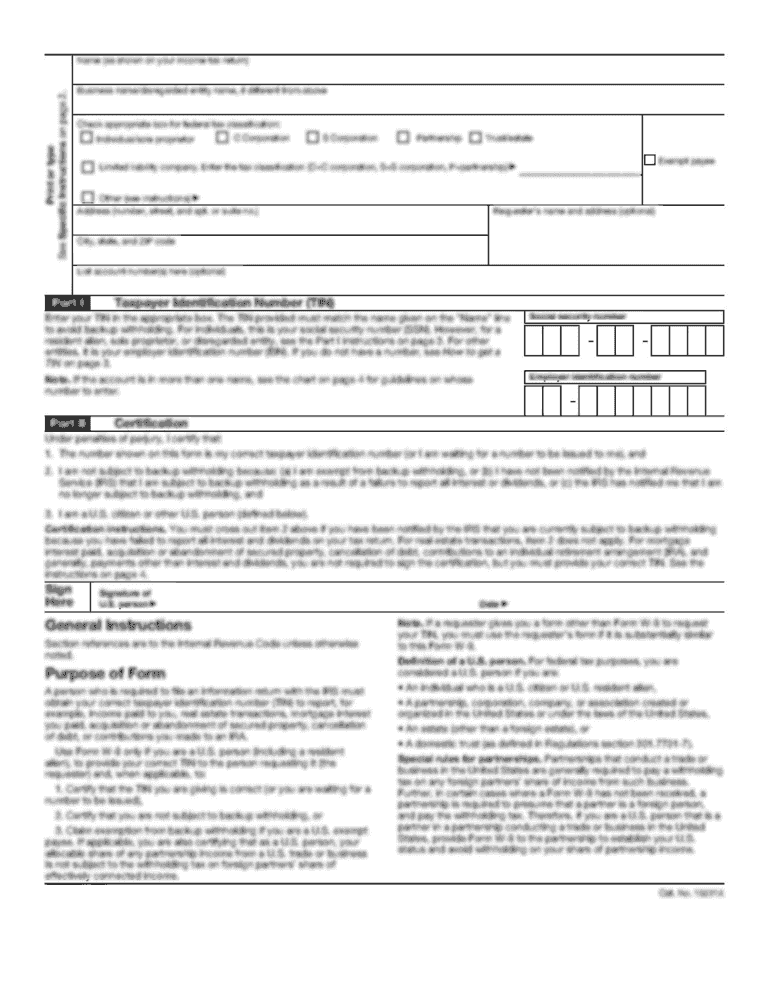

How do you get your W-2 if you don't have it?

If you're unable to get your Form W-2 from your employer, contact the Internal Revenue Service at 800-TAX-1040. The IRS will contact your employer or payer and request the missing form.

What if I don't have a W-2 because I didn't work?

If you cannot get a copy of your W-2 or 1099, you can still file taxes by filling out Form 4852, “Substitute for Form W-2, Wage and Tax Statement.” This form requests information about your wages and taxes that were withheld. It may be helpful to have documentation, such as a final pay stub, available to complete it.

What is meant by proof of employment?

Proof of employment means a letter from approved agency, or copy of pay stub, or 1099 Form, or W-2.

How can I prove I have no w2?

6 Types of Employment and Income Verification Documents Form I-9. Employment Verification Letter. Unemployment Verification Form. State-specific income verification form. Loss of Income Form. Paystub.

Is a pay stub proof of employment?

Recent pay stubs can prove that you're currently employed and report how much money you're making every pay period.

What can I do if I don't have a W-2?

If you're unable to get your Form W-2 from your employer, contact the Internal Revenue Service at 800-TAX-1040. The IRS will contact your employer or payer and request the missing form.

How do you verify proof of employment?

The number is 1-800-EMP-AUTH (1-800-367-2884).Information that can be provided includes: Dates of employment, Title (job classification), Employment history (all position, dates and salary since date of hire), Gross salary for the past two years, Year to date salary, and. Annual salary.

How can I get my W-2 without a W-2?

Otherwise, you'll need to contact your employer or SSA for a copy. The quickest way to obtain a copy of your current year Form W-2 is through your employer. Your employer first submits Form W-2 to SSA; after SSA processes it, they transmit the federal tax information to the IRS.

Is it illegal to file taxes without a W-2?

Technically, you could still file your taxes legally without the W-2 form — as long as you're filing electronically. However, if you're going to do so correctly, there's a bunch of information from your W-2 you'll need nonetheless, such as: Any separate local income taxes withheld.

What is a proof of employment?

Pay stubs and W-2 forms are commonly used as proof of employment. Your employer may write a verification letter or use an automated verification service to confirm your job title, employment history, and salary information.

What do you do if you don't have a W-2?

If you're unable to get your Form W-2 from your employer, contact the Internal Revenue Service at 800-TAX-1040. The IRS will contact your employer or payer and request the missing form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in AU DH1054B without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing AU DH1054B and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I edit AU DH1054B on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing AU DH1054B right away.

How do I edit AU DH1054B on an iOS device?

You certainly can. You can quickly edit, distribute, and sign AU DH1054B on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is AU DH1054B?

AU DH1054B is a form used by Australian businesses to report specific tax information to the Australian Taxation Office (ATO).

Who is required to file AU DH1054B?

Businesses and entities that have certain tax obligations in Australia are required to file AU DH1054B, typically those involved in taxable activities or with taxable income.

How to fill out AU DH1054B?

To fill out AU DH1054B, gather the necessary financial and tax information, complete all required fields on the form, ensure accuracy of the data, and submit it to the ATO by the specified deadline.

What is the purpose of AU DH1054B?

The purpose of AU DH1054B is to collect tax-related information from businesses for compliance purposes, enabling the ATO to assess and verify tax obligations.

What information must be reported on AU DH1054B?

The information that must be reported on AU DH1054B includes income details, deductions claimed, and other relevant financial data required by the ATO for tax assessment.

Fill out your AU DH1054B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU dh1054b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.