Get the free mortgage 05m

Show details

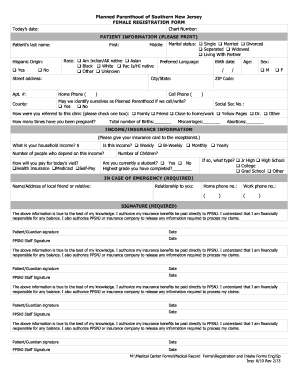

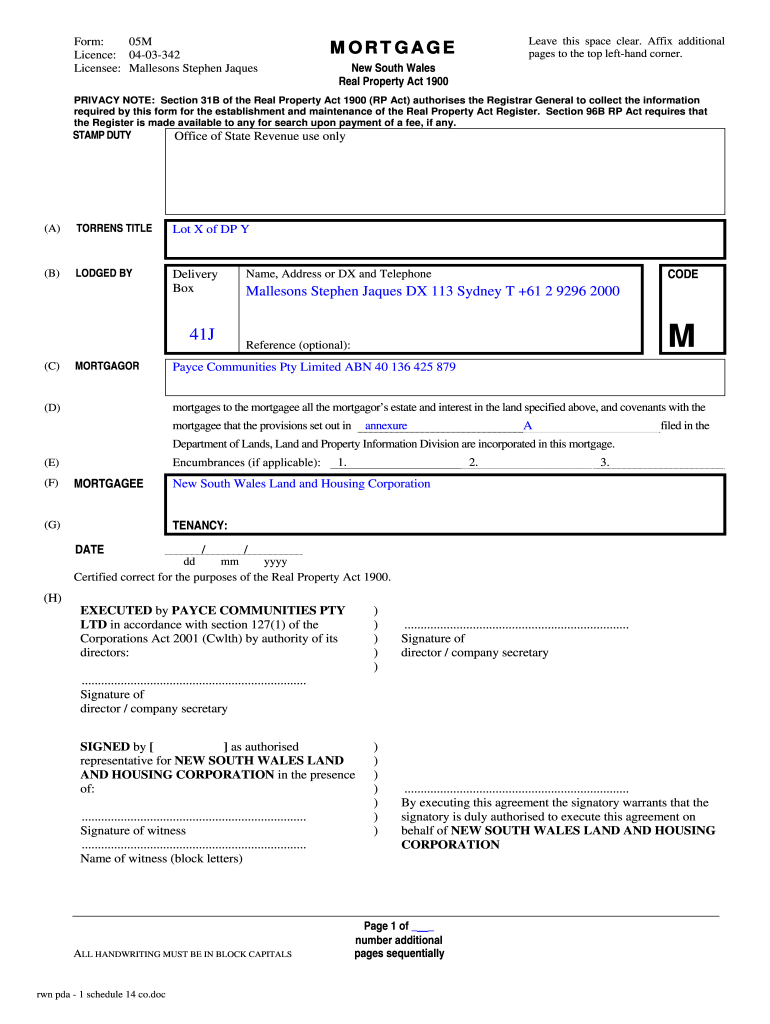

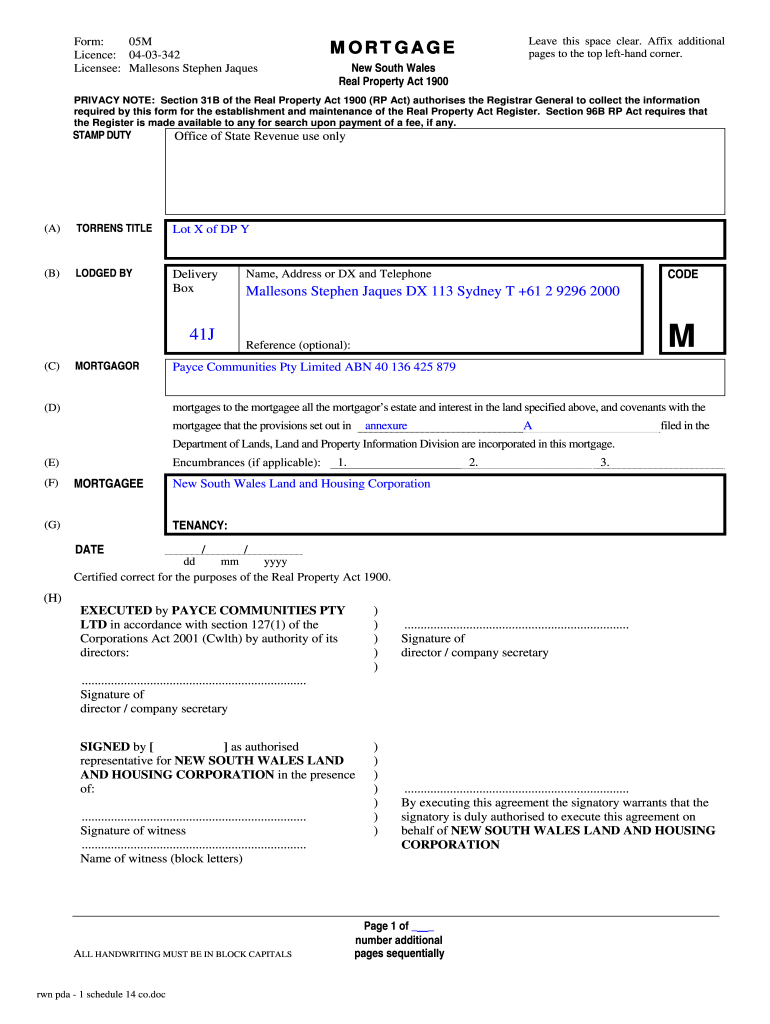

MORTGAGE Form: 05M License: 04-03-342 Licensee: Galleons Stephen Jacques Leave this space clear. Affix additional pages to the top left-hand corner. New South Wales Real Property Act 1900 PRIVACY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage 05m form

Edit your mortgage 05m form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage 05m form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage 05m online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage 05m. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage 05m

How to fill out mortgage 05m?

01

Gather your financial documentation: Start by collecting all the necessary financial documents such as income statements, tax returns, bank statements, and any other relevant financial information.

02

Understand the terms and conditions: Take the time to carefully review the terms and conditions of the mortgage 05m. Ensure you understand the interest rate, repayment schedule, and any penalties or fees associated with the mortgage.

03

Complete the application: Fill out the mortgage 05m application accurately and thoroughly. Provide all the requested information, including personal details, employment history, and financial information. Double-check for any errors before submitting the application.

04

Submit required documents: Attach all the required documents to support your mortgage application. This may include proof of income, tax returns, bank statements, and any other documentation as specified by the lender.

05

Review and sign the agreement: Carefully review the mortgage agreement provided by the lender. Understand the terms and conditions, including the interest rate, repayment terms, and any additional clauses or requirements. If you agree with the terms, sign the agreement.

Who needs mortgage 05m?

01

First-time homebuyers: People looking to purchase their first home may need a mortgage 05m to finance the purchase. It provides an opportunity for individuals to become homeowners, allowing them to spread out the cost of the home over a longer period.

02

Homeowners looking to refinance: Current homeowners may consider mortgage 05m if they want to refinance their existing mortgage. Refinancing can help with reducing monthly payments, obtaining a lower interest rate, or accessing additional funds for home improvements.

03

Real estate investors: Investors who want to purchase properties as an investment may also require mortgage 05m. They can use the mortgage to leverage their capital and expand their real estate portfolio, potentially generating rental income or capital appreciation.

Overall, anyone who wishes to purchase a property but lacks the necessary funds to do so outright may need mortgage 05m. It is essential to carefully consider your financial situation and conduct thorough research before proceeding with a mortgage application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit mortgage 05m online?

With pdfFiller, it's easy to make changes. Open your mortgage 05m in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out the mortgage 05m form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign mortgage 05m and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I fill out mortgage 05m on an Android device?

Use the pdfFiller mobile app and complete your mortgage 05m and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is mortgage 05m?

Mortgage 05m refers to a specific form or document used for reporting mortgage information to the relevant authority.

Who is required to file mortgage 05m?

Any individual or entity that has a mortgage on a property or is involved in mortgage transactions may be required to file mortgage 05m.

How to fill out mortgage 05m?

Mortgage 05m can typically be filled out online or on paper by providing details about the mortgage, the property, and other relevant information.

What is the purpose of mortgage 05m?

The purpose of mortgage 05m is to provide transparency and record-keeping for mortgage transactions, ensuring compliance with regulations and tax requirements.

What information must be reported on mortgage 05m?

Information such as the mortgage amount, interest rate, property address, borrower details, and other relevant financial data may need to be reported on mortgage 05m.

Fill out your mortgage 05m online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage 05m is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.