Get the free Here?s a gift that keeps on giving

Show details

FREE CAS E Here's a gift that keeps on giving With no stress for you or your cattle Horn fly season will be here again before you know it. Make sure you're ready. Begun delivers a precise dose of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign heres a gift that

Edit your heres a gift that form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your heres a gift that form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing heres a gift that online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit heres a gift that. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out heres a gift that

How to fill out "Here's a Gift That":

01

Start by selecting a suitable gift for the recipient. Consider their interests, hobbies, and preferences to ensure that the gift is meaningful and personalized.

02

Wrap the gift neatly using appropriate wrapping paper and adorn it with a bow or ribbon for an extra touch of presentation.

03

Attach a card or write a heartfelt note to accompany the gift. Express your feelings and wishes for the recipient, making it a heartfelt gesture.

04

Present the gift in a thoughtful way. Be considerate of the recipient's preferences – whether they would prefer a surprise or a pre-planned gift-giving moment.

05

If possible, deliver the gift in person to witness their reaction and share in the joy of the moment. Alternatively, ensure that the gift is well-packaged and shipped promptly if you are unable to deliver it personally.

Who needs "Here's a Gift That":

01

Anyone looking to show appreciation or affection towards a loved one, family member, or friend. "Here's a Gift That" is a suitable option for various occasions such as birthdays, anniversaries, holidays, or even to simply bring a smile to someone's face.

02

Individuals who want to make a positive impact or surprise someone special with a thoughtful gesture. "Here's a Gift That" can be a way to strengthen relationships, express gratitude, or celebrate milestones.

03

Corporate professionals seeking meaningful gifts for clients, colleagues, or employees. "Here's a Gift That" allows for customization and personalization to make a lasting impression and foster strong professional relationships.

In conclusion, filling out "Here's a Gift That" involves selecting a suitable gift, wrapping it thoughtfully, adding a heartfelt note, and presenting it in a way that suits the recipient. Anyone looking to express their appreciation or affection can benefit from this gesture, whether it be for personal or professional relationships.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit heres a gift that from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your heres a gift that into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send heres a gift that to be eSigned by others?

Once your heres a gift that is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get heres a gift that?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the heres a gift that in a matter of seconds. Open it right away and start customizing it using advanced editing features.

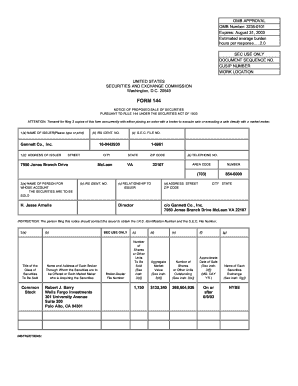

What is heres a gift that?

A gift tax return is a form that must be filed with the IRS when someone gives a gift of a certain value to another person.

Who is required to file heres a gift that?

The donor of the gift is typically responsible for filing the gift tax return.

How to fill out heres a gift that?

To fill out a gift tax return, the donor must provide information about the gift, the recipient, and the value of the gift.

What is the purpose of heres a gift that?

The purpose of a gift tax return is to report gifts that exceed the annual exclusion amount and to determine if any gift tax is due.

What information must be reported on heres a gift that?

Information about the gift, the recipient, and the value of the gift must be reported on a gift tax return.

Fill out your heres a gift that online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Heres A Gift That is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.