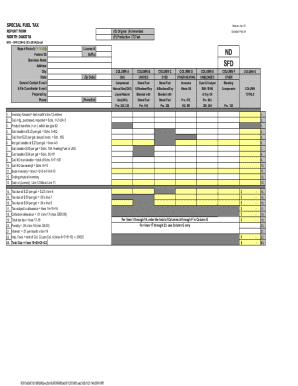

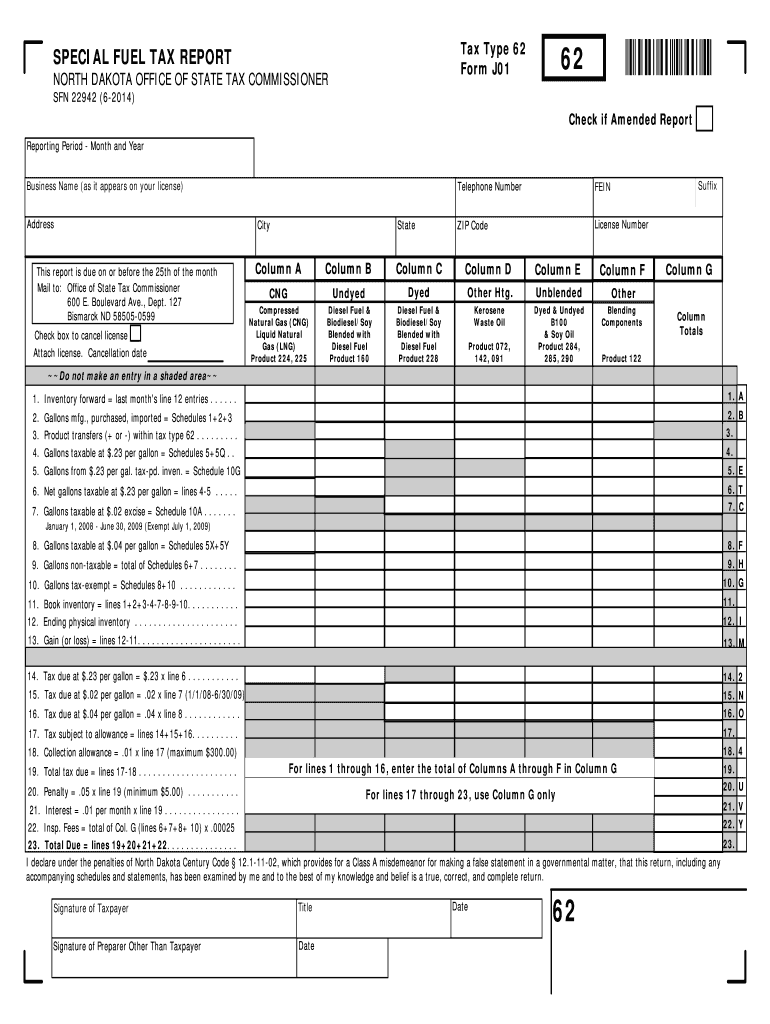

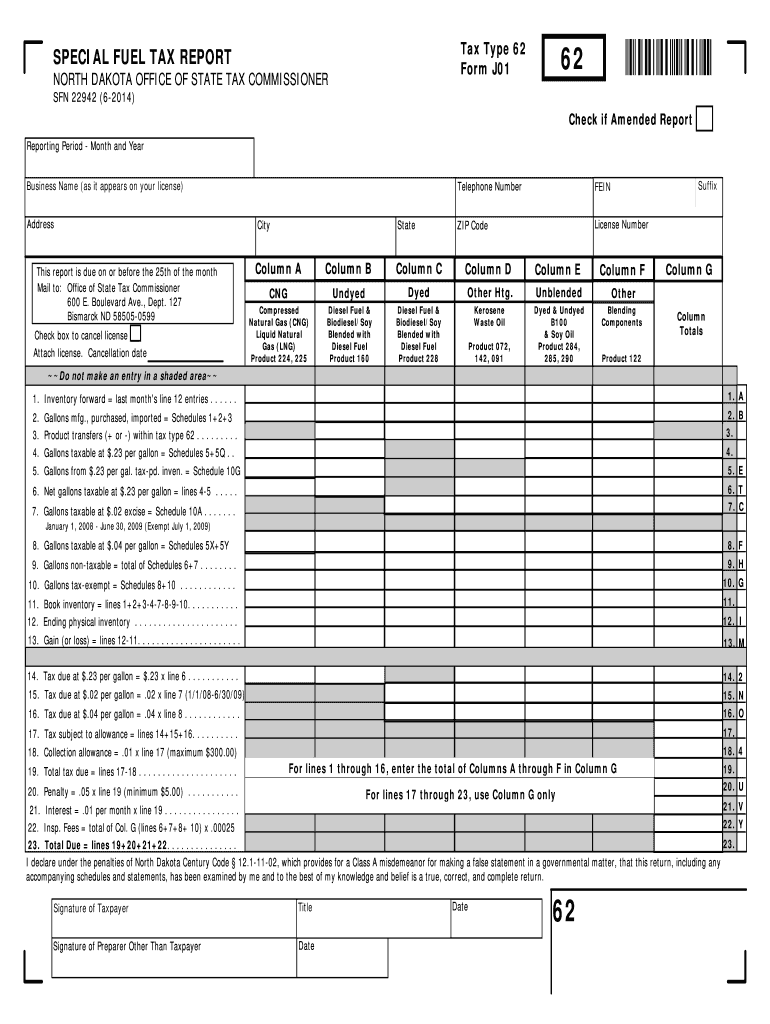

ND SFN 22942 2014 free printable template

Show details

Tax Type 62 Form J01 SPECIAL FUEL TAX REPORT NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER 62 SON 22942 (6-2014) Check if Amended Report Reporting Period Month and Year Business Name (as it appears

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign special fuel tax report

Edit your special fuel tax report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your special fuel tax report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit special fuel tax report online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit special fuel tax report. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ND SFN 22942 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out special fuel tax report

How to fill out ND SFN 22942

01

Begin by downloading the ND SFN 22942 form from the official website.

02

Carefully read the instructions provided at the top of the form.

03

Fill out your personal information in the designated fields, including your name, address, and contact details.

04

Provide specific information regarding the purpose of the form and any relevant details required.

05

Review your entries for accuracy before submitting the form.

06

Sign and date the form where indicated.

Who needs ND SFN 22942?

01

Individuals applying for state services or assistance that require the use of this form.

02

Professionals and organizations involved in processes that necessitate documentation through ND SFN 22942.

Fill

form

: Try Risk Free

People Also Ask about

What is the special fuels tax in North Dakota?

57-43.2-02. Except as otherwise provided in this chapter, an excise tax of twenty-three cents per gallon [3.79 liters] is imposed on the sale or delivery of all special fuel sold or used in this state.

How much federal tax is in a gallon of gasoline?

The federal government levies taxes on gasoline (18.4 cents a gallon) and diesel (24.4 cents a gallon). These tax rates have been unchanged since 1993.

What is the federal fuel tax rate in 2023?

In 2023, the state plans to phase the tax back in by $0.05/gal per month until the full $0.25/gal gasoline tax is restored by May 1, 2023. Federal excise tax rates remain at $0.183/gal for gasoline and $0.243/gal for diesel fuel.

What is the excise tax in North Dakota?

The North Dakota excise tax for motor vehicles is 5%. Excise tax is paid to the Motor Vehicles Division of the Department of Transportation when you register your vehicle.

Who has the highest gas tax in the United States?

Fact: In 2023, state gas tax rates averaged 30 cents per gallon. Rates were lowest in Alaska (9 cents) and Hawaii (16 cents), and highest in Pennsylvania (58 cents) and California (63 cents).

What percentage of a gallon of gas is federal tax?

The United States federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in special fuel tax report?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your special fuel tax report to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I edit special fuel tax report on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing special fuel tax report right away.

How do I fill out special fuel tax report on an Android device?

Use the pdfFiller mobile app to complete your special fuel tax report on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is ND SFN 22942?

ND SFN 22942 is a tax form used in North Dakota for reporting specific financial information, including details about income and deductions.

Who is required to file ND SFN 22942?

Individuals and entities engaged in certain business activities or receiving specific types of income in North Dakota are required to file ND SFN 22942.

How to fill out ND SFN 22942?

To fill out ND SFN 22942, provide accurate information regarding your finances, including income, deductions, and other relevant details as instructed in the form guidelines.

What is the purpose of ND SFN 22942?

The purpose of ND SFN 22942 is to ensure compliance with state tax laws by collecting essential financial information from taxpayers.

What information must be reported on ND SFN 22942?

The ND SFN 22942 requires reporting of income details, deductions, credits, and any other pertinent financial information as specified in the form.

Fill out your special fuel tax report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Special Fuel Tax Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.