Get the free RP-466-c [Erie]

Show details

Aplicación para la exención de impuestos a la propiedad para bomberos voluntarios y trabajadores de ambulancias en el condado de Erie. Esta solicitud debe ser presentada ante el tasador o el funcionario

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rp-466-c erie

Edit your rp-466-c erie form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rp-466-c erie form via URL. You can also download, print, or export forms to your preferred cloud storage service.

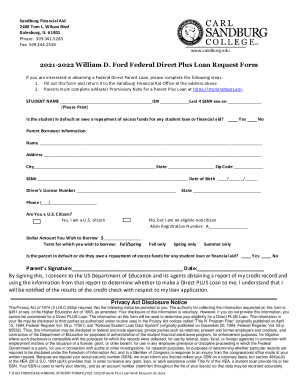

Editing rp-466-c erie online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rp-466-c erie. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rp-466-c erie

How to fill out RP-466-c [Erie]

01

Obtain the RP-466-c form from the appropriate local or state tax office or download it from their website.

02

Carefully read the instructions provided with the form to understand the requirements and sections.

03

Fill in your personal information, including name, address, and property identification details in the designated fields.

04

Provide accurate information regarding the property tax and any exemptions that may apply to your situation.

05

Double-check all entries for accuracy and completeness to avoid any delays in processing.

06

Sign and date the completed form where required.

07

Submit the RP-466-c form according to the submission guidelines provided, either via mail or electronically if available.

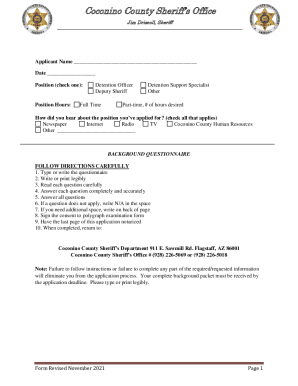

Who needs RP-466-c [Erie]?

01

Property owners in Erie who are applying for property tax exemptions or need to report eligibility for tax-related benefits.

Fill

form

: Try Risk Free

People Also Ask about

Are volunteer payments taxable?

While stipends are not considered wages, they are still taxable income. This means that volunteers must report these payments on their tax returns. It's crucial for volunteers to understand that they may owe taxes on the stipends they receive, so they should plan ingly.

Do volunteer firefighters have to pay taxes?

State or local tax benefits In some cases, volunteer firefighters receive benefits in the form of state or local tax credits or rebates. If these benefits are offered in return for services performed, their value represents income to the worker for Federal tax purposes and should be included in taxable wages.

Are volunteer firefighters considered government employees?

Generally, volunteer firefighters are employees of the fire department or district where they provide services.

Are volunteer first responders eligible for the tax credit in NY?

The volunteer firefighters' and ambulance workers' credit is available to full-year New York State residents who are active volunteer firefighters or volunteer ambulance workers for the entire tax year for which the credit is claimed. The credit is $200 for each active volunteer firefighter or ambulance worker.

Is a fire department tax exempt?

A misconception among some Fire Corps programs is that they are automatically considered tax exempt because the national office is a nonprofit entity. However, this is not the case. Individual Fire Corps programs are only classified as tax exempt if they fall under the department and share their tax exemption.

Are there any benefits to being a volunteer firefighter?

Volunteers enjoy a sense of accomplishment, achievement, and pride in the work they do. In addition, volunteers get to learn new skills, make new friends, be a part of a team, give back to their community, and make a real difference. Some states, localities, and departments offer tangible benefits to their volunteers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

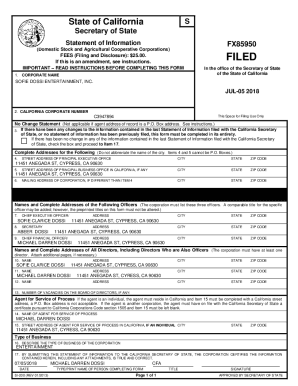

What is RP-466-c [Erie]?

RP-466-c [Erie] is a property tax exemption application used in Erie County for property owners to apply for partial tax exemptions.

Who is required to file RP-466-c [Erie]?

Property owners in Erie County who are seeking a property tax exemption based on specific criteria must file RP-466-c [Erie].

How to fill out RP-466-c [Erie]?

To fill out RP-466-c [Erie], property owners need to provide personal information, details about the property, and the reasons for the exemption, following the guidelines provided on the form.

What is the purpose of RP-466-c [Erie]?

The purpose of RP-466-c [Erie] is to allow property owners to apply for tax exemptions that reduce their property tax burden, thereby promoting affordable housing and property development.

What information must be reported on RP-466-c [Erie]?

Information required on RP-466-c [Erie] includes the property owner's name, property address, tax identification number, description of the property, and any other information needed to assess eligibility for the exemption.

Fill out your rp-466-c erie online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rp-466-C Erie is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.