Get the free Financial Aid Withholding Authorization - policy umn

Show details

This form authorizes the University of Minnesota to use financial aid to pay outstanding charges on a student's account and outlines the terms of this authorization.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial aid withholding authorization

Edit your financial aid withholding authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial aid withholding authorization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial aid withholding authorization online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit financial aid withholding authorization. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

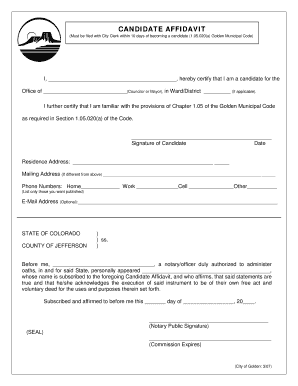

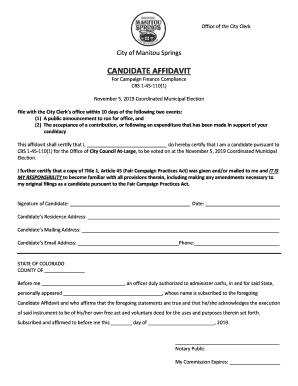

How to fill out financial aid withholding authorization

How to fill out Financial Aid Withholding Authorization

01

Obtain the Financial Aid Withholding Authorization form from your school's financial aid office or website.

02

Fill out your personal information, including your name, student ID, and contact information.

03

Review the sections that explain the purpose of the withholding authorization and any relevant terms and conditions.

04

Indicate the amount of financial aid you wish to withhold, if applicable.

05

Sign and date the form to confirm your understanding and agreement.

06

Submit the completed form to your financial aid office by the specified deadline.

Who needs Financial Aid Withholding Authorization?

01

Students who receive financial aid and want to authorize the withholding of a portion of their funds for specific purposes.

02

Students who are required by their institution to submit this authorization to comply with financial aid regulations.

Fill

form

: Try Risk Free

People Also Ask about

Is a low sai good or bad?

Any SAI of 0 or under is considered really good, and means your eligible for usually the maximum financial aid! Essentially, the lower, the better.

What does it mean when financial aid is authorized?

Employment authorization doesn't make the student eligible for federal student aid funds. Unless an eligible status is also indicated on the employment authorization document or the student can provide other documentation that can be confirmed by the USCIS, the student isn't eligible for federal student aid.

What does a negative authorized financial aid balance mean?

If the amount of financial aid disbursed is greater than your charges, then you will see a negative balance on your account. This means a refund will be paid to the student. Refunds are processed on the first day of class at the earliest. You may use this refund check to buy books or for other expenses.

Do parents who make $120000 still qualify for FAFSA?

There is no income cap for financial aid. It also varies from your school, program, and cola. Just fill it out and most likely you will get some assistance. 122k for a family of 5 is not a lot. If you have any issues filling it out, your school adviser and finance office normally provide assistance with that.

Can I spend my financial aid money on anything?

You can only spend your federal financial aid money on purchases that are necessary for you to continue your studies, ie expenses that are directly related to your education, such as tuition and fees, transportation, books, room and board, supplies and related expenses like child care.

What does authorized financial aid mean?

Authorization and Disbursement After a student is awarded financial aid and accepts the award, you authorize each payment disbursement and disburse the money into the student's account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Aid Withholding Authorization?

Financial Aid Withholding Authorization is a form that allows educational institutions to deduct certain fees or costs from a student's financial aid funds before disbursing the remaining amount to the student.

Who is required to file Financial Aid Withholding Authorization?

Students who wish to have specific fees deducted from their financial aid awards are required to file the Financial Aid Withholding Authorization.

How to fill out Financial Aid Withholding Authorization?

To fill out the Financial Aid Withholding Authorization, students typically need to provide personal information, specify the amount or types of fees they authorize to be withheld, and sign the document.

What is the purpose of Financial Aid Withholding Authorization?

The purpose of Financial Aid Withholding Authorization is to ensure that necessary fees are covered directly from financial aid, allowing students to manage their educational expenses more effectively.

What information must be reported on Financial Aid Withholding Authorization?

The information that must be reported on the Financial Aid Withholding Authorization includes the student's name, ID number, the specific amounts or types of fees to be withheld, and the student's signature.

Fill out your financial aid withholding authorization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Aid Withholding Authorization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.