Get the free California LLC vs. S Corp: A Complete GuideWindes

Show details

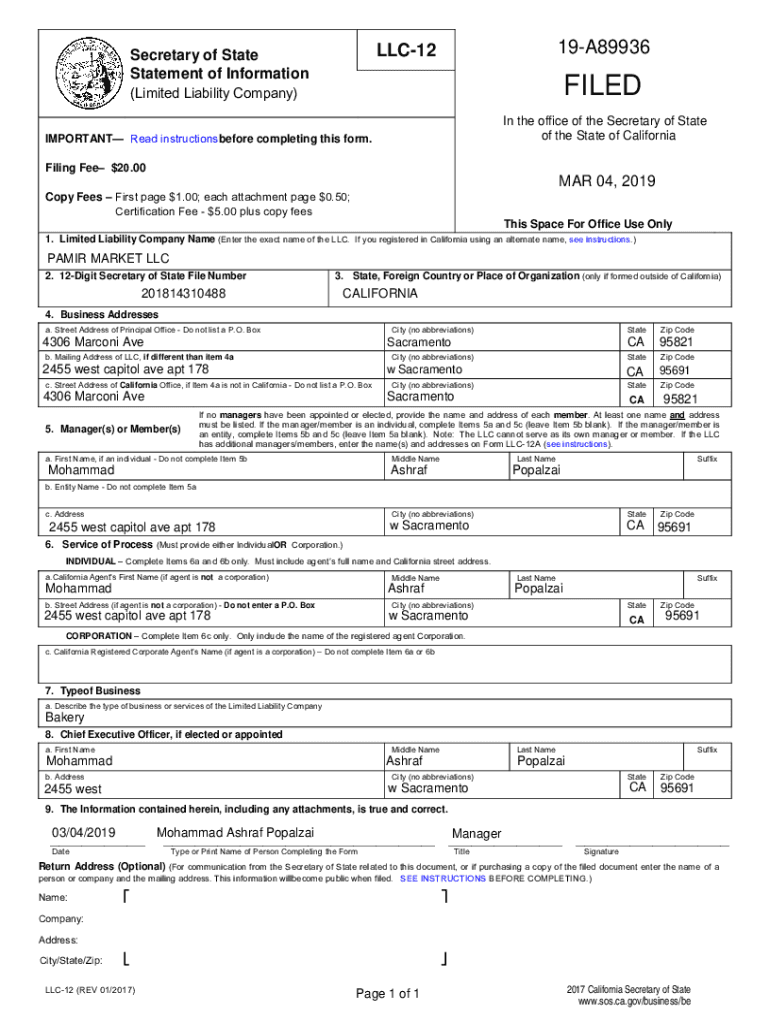

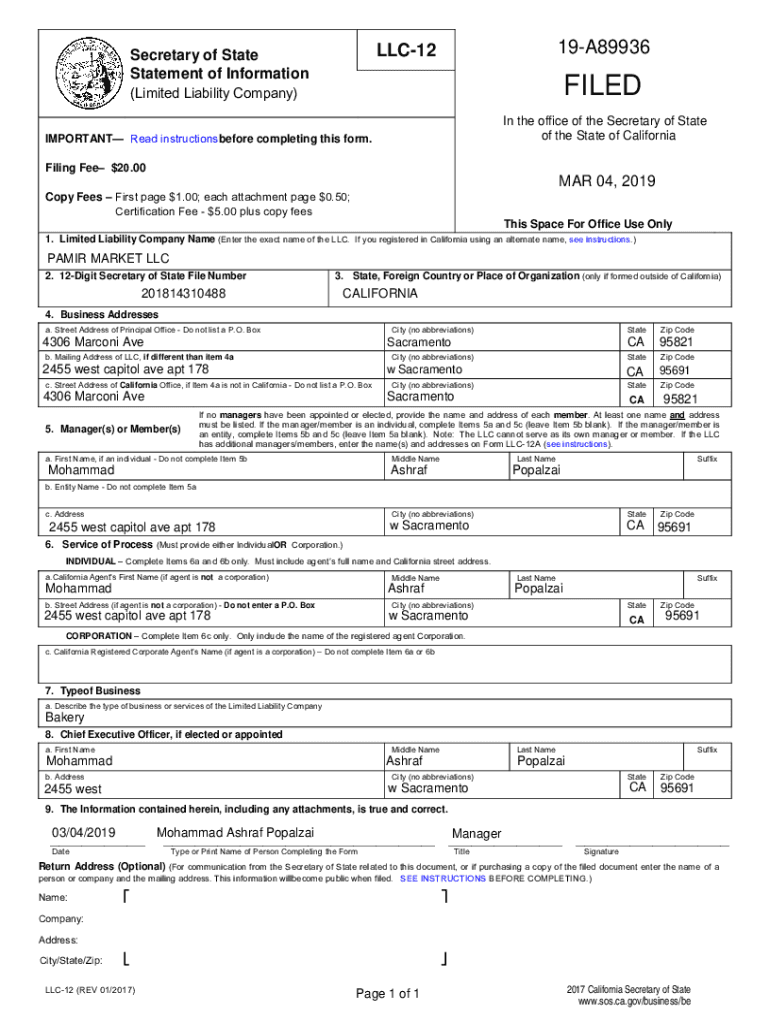

19A89936LLC12Secretary of State Statement of Information (Limited Liability Company×FILEDIMPORTANT Read instructions before completing this form. In the office of the Secretary of State of the State

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign california llc vs s

Edit your california llc vs s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california llc vs s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing california llc vs s online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit california llc vs s. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out california llc vs s

How to fill out california llc vs s

01

To fill out California LLC (Limited Liability Company) vs S Corporation, follow these steps:

02

Determine the type of business structure you want to form. Decide whether a California LLC or S Corporation is more suitable for your needs.

03

Research the requirements and regulations for each type of business structure in California. Familiarize yourself with the legal obligations, tax implications, and other considerations for both options.

04

Choose a unique name for your business. Check the availability of the chosen name with the California Secretary of State to ensure it is not already in use.

05

Prepare the necessary formation documents. For a California LLC, file the Articles of Organization with the California Secretary of State. For an S Corporation, file the Articles of Incorporation.

06

Complete the required information in the formation documents. This includes the business name, registered agent details, business address, member/shareholder information, and other relevant information.

07

Pay the filing fee. The fee may vary depending on the type of business structure and the services you choose.

08

Submit the completed formation documents along with the filing fee to the California Secretary of State by mail or online.

09

Wait for the Secretary of State to process your filing. This can take several weeks, so be patient.

10

Once your California LLC or S Corporation is approved, you may need to fulfill additional requirements such as obtaining an Employer Identification Number (EIN) from the IRS, obtaining any necessary permits or licenses, and complying with ongoing reporting and tax obligations. Consult with professionals or refer to official resources for detailed guidance.

Who needs california llc vs s?

01

California LLC vs S Corporation can be suitable for different types of individuals and businesses. The decision depends on various factors, such as:

02

- Legal structure preference: Some individuals or business owners may prefer the simplicity and flexibility of a California LLC, while others may find the corporate structure of an S Corporation more appealing.

03

- Tax considerations: S Corporations offer certain tax advantages, such as the ability to avoid double taxation. If tax benefits are a priority, an S Corporation structure may be beneficial.

04

- Size and ownership: S Corporations have restrictions on the number and type of shareholders, while California LLCs have more flexibility in terms of ownership and membership.

05

- Liability protection: Both California LLCs and S Corporations provide liability protection for their owners, shielding personal assets from business debts and liabilities.

06

- Future plans: Consider your long-term goals and plans for growth. If you anticipate seeking venture capital or going public in the future, an S Corporation structure may be more suitable.

07

Ultimately, it is advisable to consult with legal and financial professionals to determine the most appropriate business structure for your specific needs and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the california llc vs s electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your california llc vs s in minutes.

How do I edit california llc vs s on an Android device?

The pdfFiller app for Android allows you to edit PDF files like california llc vs s. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I fill out california llc vs s on an Android device?

Complete california llc vs s and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is california llc vs s?

California LLC Vs S Corporation is a comparison between two different types of business entities that can be formed in California.

Who is required to file california llc vs s?

Any individual or entity looking to start a business in California may consider filing either a California LLC or an S Corporation.

How to fill out california llc vs s?

To fill out the forms for a California LLC or an S Corporation, you will need to provide basic information about the business, such as the company name, address, registered agent, and the names of the owners or shareholders.

What is the purpose of california llc vs s?

The purpose of forming a California LLC or an S Corporation is to protect the owners' personal assets from business liabilities and to establish a legal entity for tax and operational purposes.

What information must be reported on california llc vs s?

The information that must be reported on the forms for a California LLC or an S Corporation includes details about the company's ownership structure, business activities, and tax election.

Fill out your california llc vs s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Llc Vs S is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.