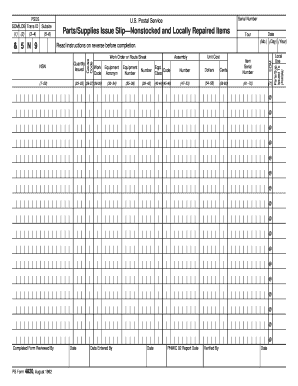

Get the free Form 589

Show details

Form 589 is a request for a reduced withholding amount for nonresident payees in California, subject to the approval of the Franchise Tax Board (FTB). It allows nonresident taxpayers to apply for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 589

Edit your form 589 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

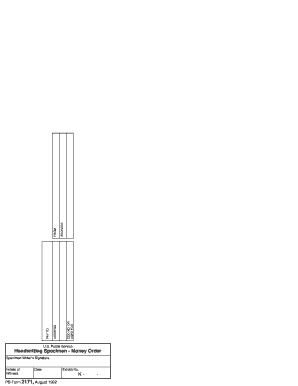

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 589 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 589 online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 589. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 589

How to fill out Form 589

01

Obtain Form 589 from the relevant authority or website.

02

Read the instructions carefully before starting.

03

Fill in personal information, including name, address, and date of birth.

04

Provide relevant details about the purpose of the form.

05

Attach any required documentation as specified in the instructions.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form as directed, either online or by mail.

Who needs Form 589?

01

Individuals applying for a specific benefit or service that requires Form 589.

02

Applicants seeking to verify their eligibility for a program associated with the form.

03

Those required to provide information for legal or administrative purposes as defined by the issuing authority.

Fill

form

: Try Risk Free

People Also Ask about

What documents do I need to send with form I-589?

A decision should be made on your asylum application within 180 days after the date you filed your application unless there are exceptional circumstances. For more information about the step-by-step asylum process, see the Affirmative Asylum Process page. Where Can I Find the Law on Asylum?

Who is eligible for I-589?

To qualify for asylum, you must establish that you are a refugee who is unable or unwilling to return to his or her country of nationality, or last habitual residence if you have no nationality, because of persecution or a well-founded fear of persecution on account of race, religion, nationality, membership in a

What is the I-589 form?

There is no filing fee for a Form I-589 asylum application. If you are required to take a biometrics exam, you will not have to pay for that either. In total, the filing fee for Form I-589 is $0.

How much does it cost to get a form I-589?

Your completed Form I-589. A copy of your passport, if you have one. If possible, include a copy of every page, including the front and back covers. A copy of your Form I-94, if you have one.

What happens after you file form I-589 with USCIS?

We will accept your Form I-589, send it to the EOIR immigration court where your proceedings are pending, and notify you by mail. EOIR will adjudicate your Form I-589. The date USCIS receipted your Form I-589 will serve as the filing date for the purpose of the asylum one-year filing deadline.

How long does it take for form I-589 to be approved?

A decision should be made on your asylum application within 180 days after the date you filed your application unless there are exceptional circumstances. For more information about the step-by-step asylum process, see the Affirmative Asylum Process page. Where Can I Find the Law on Asylum?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 589?

Form 589 is a tax form used in California for reporting personal income tax information for individuals or entities claiming a deduction for a sale or exchange of property.

Who is required to file Form 589?

Individuals or entities that have sold or exchanged property and wish to claim deductions related to that transaction are required to file Form 589.

How to fill out Form 589?

To fill out Form 589, collect all relevant information regarding the transaction, including details about the property sold or exchanged, and complete the form by following the provided instructions, ensuring all applicable sections are filled out accurately.

What is the purpose of Form 589?

The purpose of Form 589 is to allow taxpayers to report specific information about the sale or exchange of property for the purpose of claiming tax deductions.

What information must be reported on Form 589?

Form 589 requires reporting information such as the description of the property, the amount realized from the sale or exchange, and any deductions or adjustments related to the transaction.

Fill out your form 589 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 589 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.