Get the free 2014 FSA claim form - iaumc

Show details

Flex Plan Reimbursement Form TH 1454 30 Street, Unit 105 West Des Moines, IA 50266 Phone 515-224-9400 or 800-300-9691 Fax 515-224-9256 www.kabelbiz.com Company Name (Employer) Employee Name Date Social

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2014 fsa claim form

Edit your 2014 fsa claim form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2014 fsa claim form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2014 fsa claim form online

Follow the steps down below to take advantage of the professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2014 fsa claim form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2014 fsa claim form

01

To fill out the 2014 fsa claim form, start by obtaining the form itself. You can typically find this form online on the official website of the organization responsible for administering FSAs (Flexible Spending Accounts), such as your employer or a benefits provider.

02

Carefully read through the instructions provided with the form. These instructions will guide you on how to accurately and correctly complete the form. Make sure you understand the requirements and any supporting documents you may need to include.

03

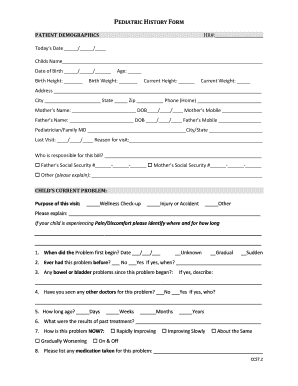

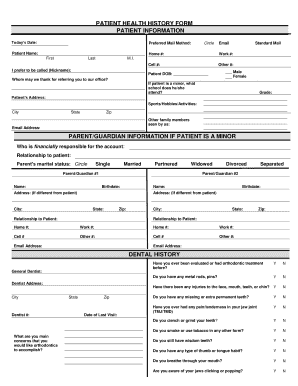

Begin by providing your personal information in the designated sections of the form. This may include your name, address, social security number, and other relevant details.

04

Indicate the period for which you are submitting the claim. In the case of the 2014 fsa claim form, this would typically cover expenses incurred between January 1, 2014, and December 31, 2014.

05

Provide detailed information about the expenses you are claiming. This may include medical and dental expenses, prescription medications, vision care, and eligible over-the-counter items. Depending on the specific form, you may need to indicate whether the expense was for yourself, your spouse, or a dependent.

06

Include supporting documentation for each expense. This can include receipts, invoices, and statements that verify the amount spent and the nature of the expenses. It is essential to keep a copy of these documents for your records.

07

Calculate the total amount of expenses you are claiming. Some forms may provide specific sections for you to enter each category of expense separately, while others may ask for a lump sum total. Make sure to double-check your calculations for accuracy.

08

Review the completed form thoroughly to ensure all information is accurate and complete. Incorrect or missing information can lead to delays in processing or possible denial of your claim.

09

Sign and date the form as required. Some forms may require additional signatures, such as from a healthcare provider or spouse. Follow the instructions provided on the form.

10

Keep a copy of the completed form and any supporting documents for your records. It is a good practice to retain these records for a few years in case of any audit or inquiries related to your claim.

Who needs the 2014 fsa claim form?

The 2014 fsa claim form is needed by individuals who have a Flexible Spending Account (FSA) and incurred eligible expenses during the claim period specified on the form. These individuals may include employees who have enrolled in an employer-sponsored FSA or those who have their own individual FSA through a benefits provider. It is important to check with your employer or benefits provider to determine if the 2014 fsa claim form is the appropriate form for your FSA and if it is still valid for claims processing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fsa claim form?

The FSA claim form is a form used to request reimbursement for eligible expenses paid for with a Flexible Spending Account (FSA).

Who is required to file fsa claim form?

Employees who have a Flexible Spending Account (FSA) and wish to be reimbursed for eligible expenses must file an FSA claim form.

How to fill out fsa claim form?

To fill out an FSA claim form, you must provide information about the eligible expenses incurred, including the date, amount, and purpose of the expense.

What is the purpose of fsa claim form?

The purpose of the FSA claim form is to request reimbursement for eligible expenses paid for with a Flexible Spending Account (FSA).

What information must be reported on fsa claim form?

The FSA claim form must include details such as the date of the expense, the amount paid, the purpose of the expense, and any supporting documentation where required.

How can I modify 2014 fsa claim form without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including 2014 fsa claim form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an eSignature for the 2014 fsa claim form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your 2014 fsa claim form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I fill out 2014 fsa claim form on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your 2014 fsa claim form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your 2014 fsa claim form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2014 Fsa Claim Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.