Get the free Approved FET Exemption Form - archgh

Show details

This form is used to claim exemption from federal excise tax on communication services. It requires the undersigned to certify the purpose of the account and the validity of the exemption claimed.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign approved fet exemption form

Edit your approved fet exemption form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your approved fet exemption form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing approved fet exemption form online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit approved fet exemption form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

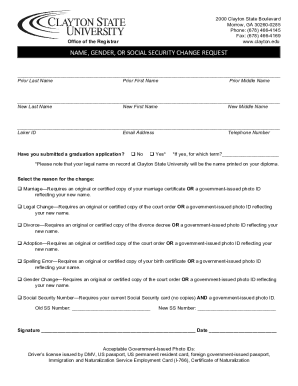

How to fill out approved fet exemption form

How to fill out Approved FET Exemption Form

01

Obtain the Approved FET Exemption Form from the relevant authority or website.

02

Fill in personal details such as name, address, and contact information.

03

Provide details of the organization or institution for which the exemption is being requested.

04

Specify the reasons for applying for the exemption.

05

Attach any required supporting documentation, such as proof of eligibility or affiliation.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form.

08

Submit the form to the designated authority by the specified deadline.

Who needs Approved FET Exemption Form?

01

Organizations or institutions that are eligible for FET exemptions.

02

Individuals applying on behalf of an eligible organization.

03

Educational institutions, charitable organizations, or non-profits seeking exemptions from FET.

Fill

form

: Try Risk Free

People Also Ask about

What is a form 720 used for?

The IRS Form 720 (Quarterly Federal Excise Tax Return) is used to report and pay your federal excise taxes as a business owner. Excise taxes are taxes paid on certain types of goods, services, or activities and they're often included in the price of the product.

Can you be exempt from FET?

The Federal Excise Tax Exemption Program allows eligible entities to purchase taxable goods and services without paying FET. ing to the IRS, this program primarily benefits foreign diplomats, consular missions, and international organizations recognized by the U.S. government.

What is form 637 used for?

Use Form 637, Application for Registration (For Certain Excise Tax Activities), to apply for registration for activities under IRC sections 4101, 4222, 4662 and 4682. Form 637 contains a description of each activity letter. A person can register for more than one activity on Form 637, if applicable.

Who needs to file a federal excise tax return?

Excise taxes are independent of income taxes. Often, the retailer, manufacturer or importer must pay the excise tax to the IRS and file the Form 720. Some excise taxes are collected by a third party. The third party then sends the tax to the IRS and files the Form 720.

What is the exemption form 4029?

Members of recognized religious groups file Form 4029 to apply for exemption from Social Security and Medicare taxes.

How to avoid federal excise tax?

This is done by filing an exemption certificate with the order. (The Exemption Certificate, STD. 802, is available from Department of General Services, Office of Procurement, Material Services Section.)

What is form 673 used for?

Give Form 673 to your U.S. employer to claim an exemption from U.S. income tax withholding on wages earned abroad to the extent of the foreign earned income exclusion and foreign housing exclusion. Your employer will then withhold the correct amount of federal income tax from your pay.

What is revenue code 637 used for?

Incidental Drugs Revenue CodeDescriptionDescription 637 Self-administered drugs Use HCPCS codes that describe the services rendered.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Approved FET Exemption Form?

The Approved FET Exemption Form is a document used to claim exemption from the Federal Excise Tax (FET) for certain products, services, or transactions that are eligible under specific regulations.

Who is required to file Approved FET Exemption Form?

Entities or individuals who engage in transactions that qualify for exemption under the Federal Excise Tax guidelines are required to file the Approved FET Exemption Form.

How to fill out Approved FET Exemption Form?

To fill out the Approved FET Exemption Form, one must provide detailed information including the entity's name, address, tax identification number, description of goods or services, and reasons for claiming exemption.

What is the purpose of Approved FET Exemption Form?

The purpose of the Approved FET Exemption Form is to formally document and support a claim for exemption from the Federal Excise Tax, ensuring compliance with tax regulations.

What information must be reported on Approved FET Exemption Form?

The information that must be reported on the Approved FET Exemption Form includes the applicant's details, a description of the transaction or item for which exemption is sought, and any supporting documentation or justification.

Fill out your approved fet exemption form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Approved Fet Exemption Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.