Get the free Existing Single Family Deferral Application

Show details

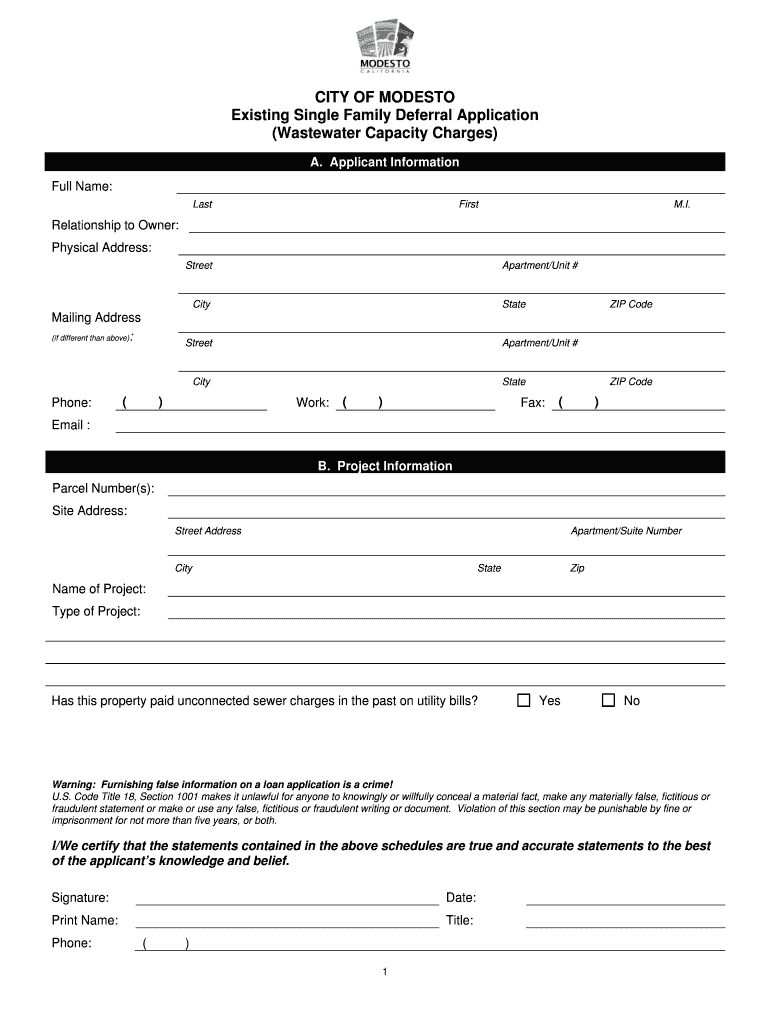

This application is for single-family homeowners in the City of Modesto to request deferral of wastewater capacity charges. It includes sections for applicant information, project details, and certification

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign existing single family deferral

Edit your existing single family deferral form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your existing single family deferral form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing existing single family deferral online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit existing single family deferral. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out existing single family deferral

How to fill out Existing Single Family Deferral Application

01

Download the Existing Single Family Deferral Application form from the official website.

02

Read the instructions carefully to ensure you understand the requirements.

03

Fill in your personal information: name, address, and contact details.

04

Provide details about your property, including the property address and parcel number.

05

Indicate any income-related information as required in the application.

06

Attach any necessary documentation, such as proof of income or ownership.

07

Review your application for accuracy and completeness.

08

Sign and date the application.

09

Submit the completed form as directed, either via mail or online.

Who needs Existing Single Family Deferral Application?

01

Individuals or families seeking financial assistance or deferral of payments on property taxes for their single-family residence.

02

Homeowners experiencing financial hardship that impacts their ability to pay taxes on their property.

Fill

form

: Try Risk Free

People Also Ask about

How many times can you defer a mortgage payment?

Financial hardship can make it difficult to pay back loans. Deferment is an option that allows you to temporarily pause your loan payments with the lender's approval.

What is a payment deferral agreement?

The payment deferral home retention workout option enables mortgage servicers to assist eligible homeowners who have resolved a temporary hardship and have resumed their monthly contractual payments but cannot afford either a mortgage reinstatement or repayment plan to bring the mortgage loan current.

What is a request payment deferral?

A deferred payment is one that is delayed, either completely or in part, in order to give the person or business making the payment more time to meet their financial obligations. In accounting terms, any merchant allowing customers to set up a deferred payment agreement will be dealing with accrued revenue.

Is deferred payment good or bad?

A Deferment Fee is a charge applied by shipping companies or customs agencies to extend the payment period for duties and taxes on imported goods. This fee allows importers to manage cash flow more effectively by delaying the immediate financial burden of large tax payments.

What does request deferral mean?

Deferring a payment may help alleviate financial pressure when you're in a pinch. And while the act of deferring payments alone won't hurt your credit, how you handle your credit account prior to and following deferment can impact your credit in the long run.

What does payment deferral mean?

A deferred payment is one that is delayed, either completely or in part, in order to give the person or business making the payment more time to meet their financial obligations. In accounting terms, any merchant allowing customers to set up a deferred payment agreement will be dealing with accrued revenue.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Existing Single Family Deferral Application?

The Existing Single Family Deferral Application is a form used by homeowners to apply for a deferral of property taxes on their primary residence, typically aimed at helping those who meet certain financial criteria.

Who is required to file Existing Single Family Deferral Application?

Homeowners who wish to defer their property taxes due to financial hardship, typically meeting specific income and age criteria, are required to file the Existing Single Family Deferral Application.

How to fill out Existing Single Family Deferral Application?

To fill out the Existing Single Family Deferral Application, homeowners should provide their personal information, income details, property information, and any required documentation that demonstrates their eligibility for tax deferral.

What is the purpose of Existing Single Family Deferral Application?

The purpose of the Existing Single Family Deferral Application is to assist eligible homeowners in delaying the payment of property taxes, thereby alleviating financial burdens and enabling them to remain in their homes.

What information must be reported on Existing Single Family Deferral Application?

Information that must be reported on the Existing Single Family Deferral Application includes the homeowner's name, address, income level, age, property details, and any supporting documentation that proves eligibility.

Fill out your existing single family deferral online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Existing Single Family Deferral is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.